Tapping into a post-pandemic Telco network

Written by Tavy Stubbs on 6 minute read

Measuring the impact of Covid-19 on the performance channel and telecoms sector.

The telecoms sector has always provided consumers with the opportunity to stay "connected". Covid-19 intensified this reliance, with video calls and Zoom quizzes being the primary social output for most of us got throughout 2020. Now, with social distancing and stay-at-home mandates becoming an ever distant memory, we evaluate how have buying behaviours changed in the telecoms space during Covid-19 and whether we can expect any of these changes to be long lasting.

Broadband need for speed

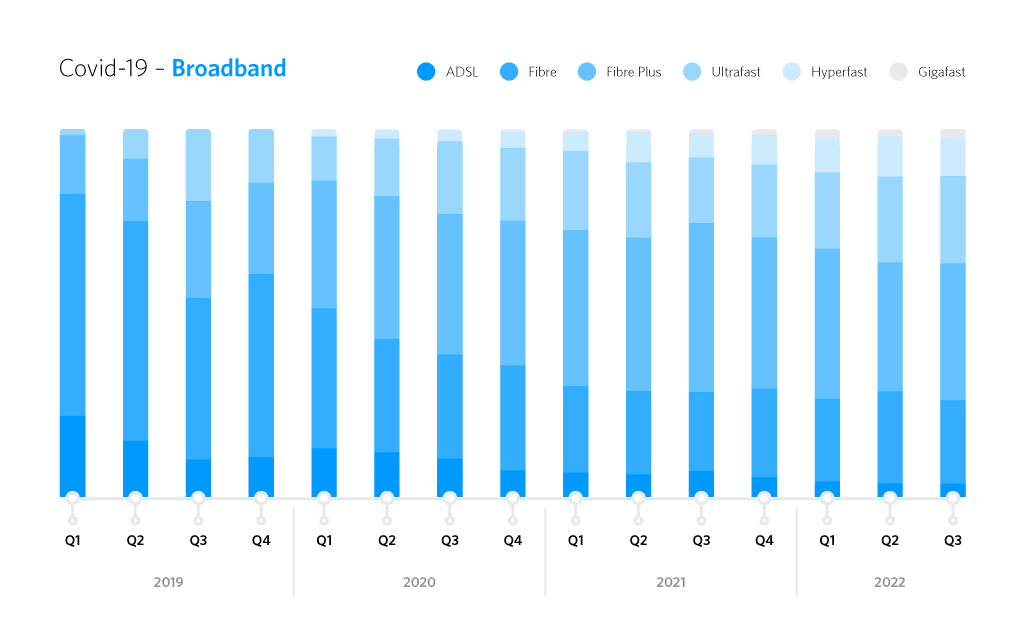

During the pandemic, Ofcom found that on average in the UK, people were spending more than a quarter of their waking day connected, and that the amount of broadband data used doubled. Similarly, Awin data saw an increasing demand for speed with the percentage of the market purchasing broadband over 100Mb increasing by over 76% MoM after the work from home mandate. Sales over 100Mb went from 11% in 2019 to an average of 35% in 2022 year to date, this lines up with increased requirements within the home with smart gadgets and home working becoming more prevalent, as well as the pledge from the UK government to provide gigabit services across the UK by 2025. In May of 2022, Ofcom announced that 67% of homes could now get Gigabit services, meaning that the affiliate space has a way to go before this is reflected in the sales mix.

We are expecting this trend to continue over time, and not to slow down despite the fact that some are returning to the office more regularly. The need for speed is here to stay, and more and more providers are starting to enter the space with their Fibre-to-the-Premise/Home (FTTP/H).

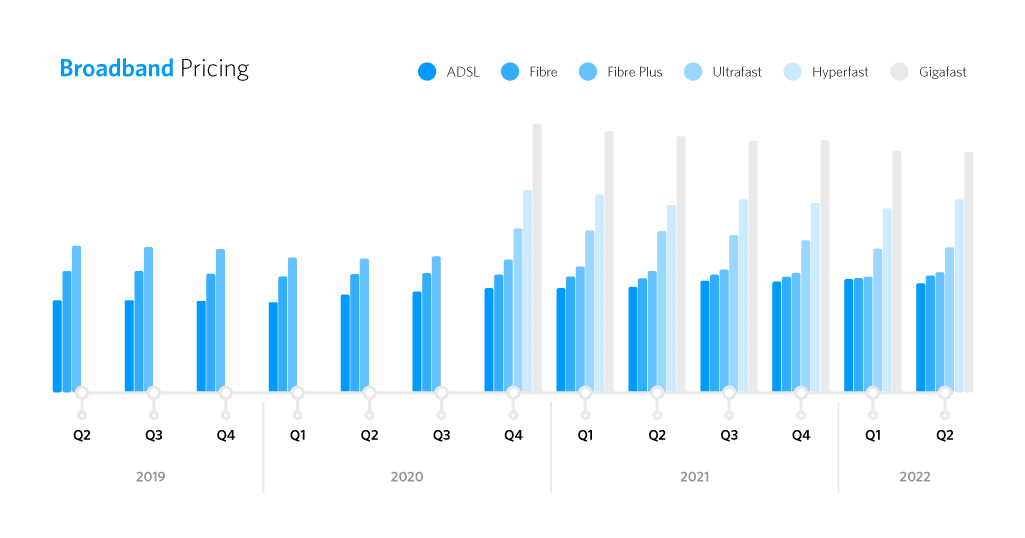

It’s not just speed which has been impacted during the pandemic, we’ve also seen a shift in the way providers are pricing their products. We have seen a -£1.18 drop in price for speeds over 100Mbs, and pricing hasn’t reached pre-Covid levels since.

Interestingly, products under 50Mb have seen a price increase since 2019 on average, with 2021 being the biggest upwards shifts. However, the faster the product the more radical the price drop we have seen. The monthly cost of products between 100Mb – 249Mb has dropped to just £31 per month, a YoY drop of -£3 per month on average.

Mobile unbundling dials up

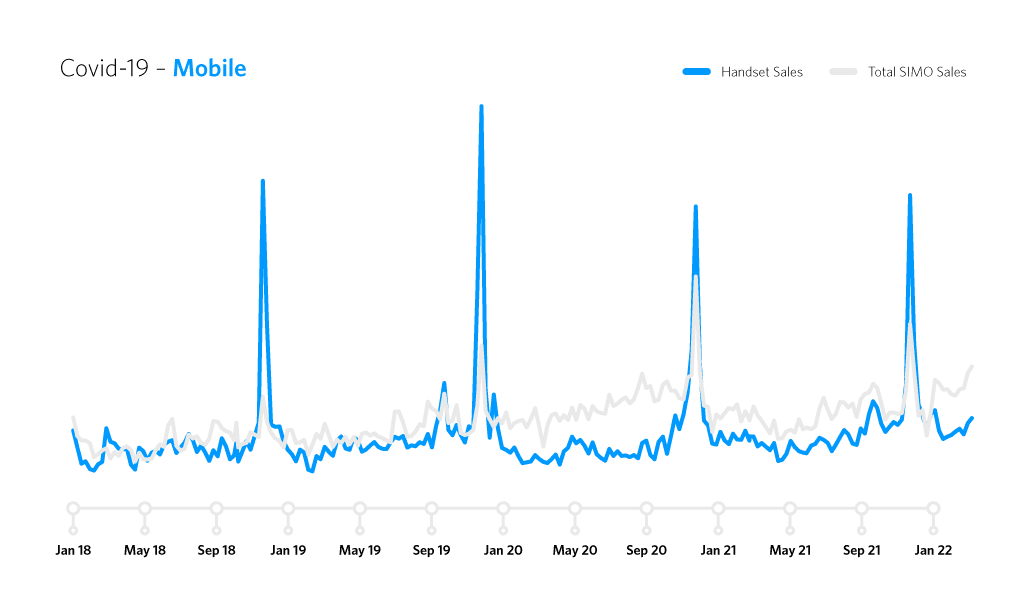

The pandemic sparked unprecedented changes to consumer behaviour and caused economic uncertainty across the globe. The negative impacts of which are evident when considering handset sales volume since 2020, with perhaps consumers thinking they should keep hold of their older model whilst they may have been facing financial struggles, or doubts over their future earning capacity.

However we’ve also attributed this year on year decrease to the flattening out of handset generational jumps. iPhone and Galaxy releases no longer produce as much of a halo as reflected in previous years. A combination of increased reliability and reduced innovation has broken the ‘1 year upgrade cycle’ of previous years.

Data shows us that the SIMO market has had the reverse fortunes to that of the handset market, further highlighting the unbundling of ‘Service’ and ‘Technology’.

12/24 month sim-only contracts have seen fairly consistent growth since 2015, with the longer contracts slowly catching up with the 30D market which typically has seen larger volumes. This is thanks largely in part to the ‘Text-To-Switch’ change in Ofcom rules coming in halfway through 2019 which triggered an increase in customers opting for longer term contracts over the more flexible alternative.

Another year that jumps out is 2020, for 30D market share in particular, where the largest spike came during Oct-Dec and, in particular, around the Black Friday period; this was a time 4-tier statuses, a second lockdown and Christmas being cancelled, all of which contributed to extremely uncertain times. Consumer behaviour reflected this in the increase of customers taking out 30D Sims, a much more flexible option rather than the increased commitment of a 12/24M contract.

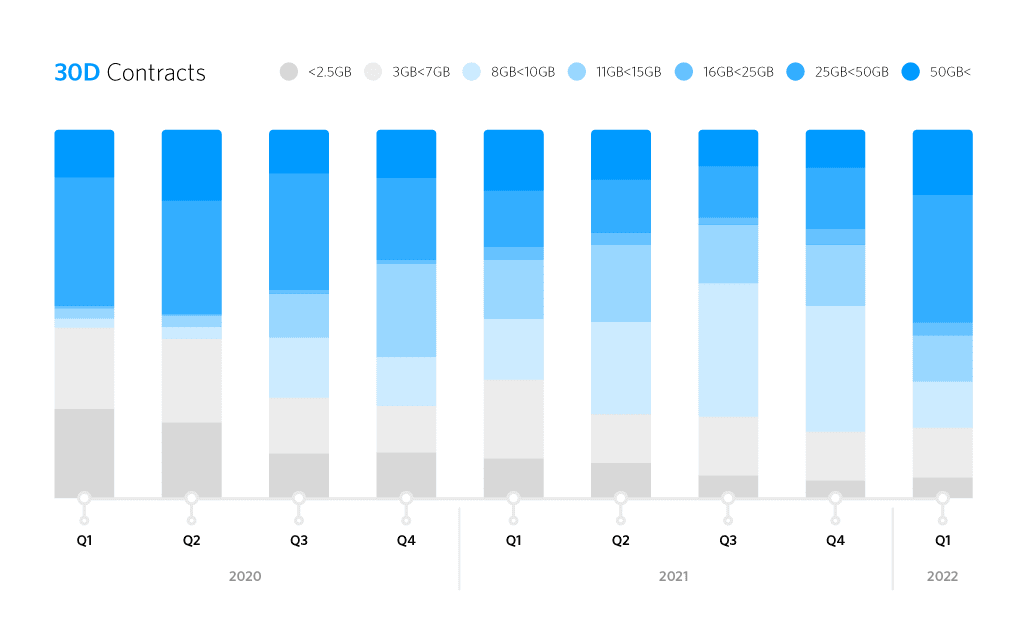

Data, data everywhere

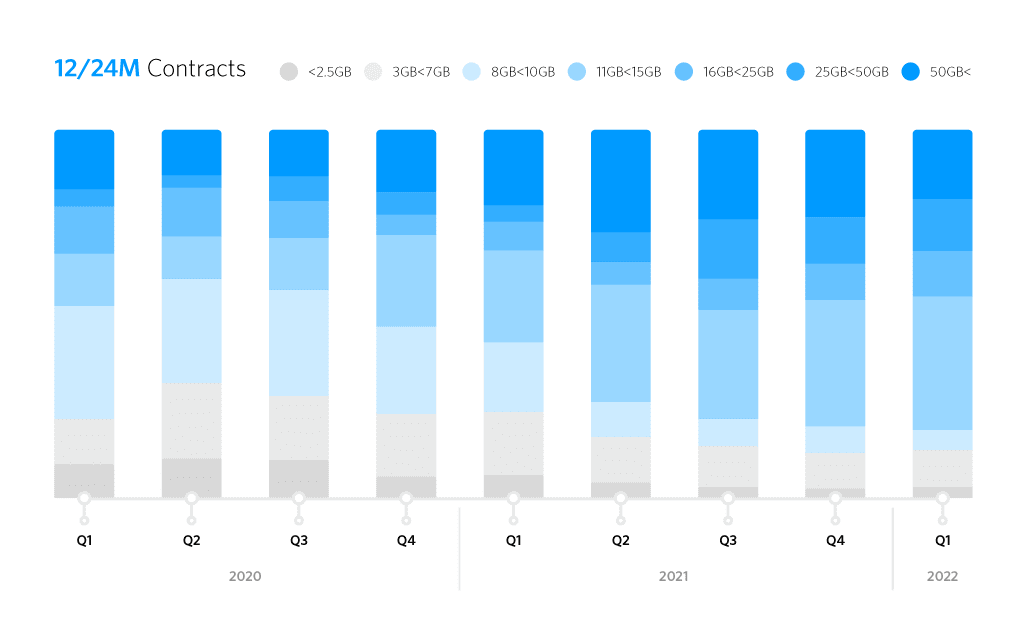

In terms of data usage, at the beginning of 2020 we saw a heavily polarised product mix (with the majority of sales falling either below 7Gb or above 25Gb). However since then we’ve seen a significant swing from both ends of the spectrum towards the centre, with plans between 8GB-15GB consistently making up over 50% of overall sales volume towards the end of 2021. The 8GB-10GB data range, once the realm of the ‘12M MNO contract’ has since shifted to the 30 Day MVNO market.

That said, this distinction between the two different SIM markets is not quite as binary, as moving from the 2nd half of 2021 into 2022, we’ve seen the higher end data tiers in both markets becoming increasingly more popular. Suggesting consumers are being increasingly won over by the larger data plans in both categories. The decline in the handset market is another important factor that helps contribute to this trend; as we’ve previously seen more customers have delayed their handset upgrade, and it stands to reason that we’d see some of this extra spend coming through on the more premium plans on the SIMO side.

What does this mean for the telco sector?

The telecoms industry and infrastructure has long been pivotal to our societies, but in the face of the Covid-19 pandemic, it also became even more central to our social lives, and became a lifeline to the outside world, with Tiger King themed quizzes and online grocery shopping becoming all to familiar to many of us. The changes in behaviour mandated by the pandemic led to some changes in the needs people had of their telecoms products.

Faster broadband; we saw the need for speed increase, specifically around April 2020 when people on slower speeds became painfully aware of the unreliability of their service while working from home. We saw providers shift their pricing to reflect this drive for speedier lines, with prices dropping more steeply, the faster the connection was.

In mobile, we saw people switching away from contract handset purchases, opting instead to stick with their current models and moving onto longer term contracts, such as 12 and 24 months. In terms of data usage, we saw people swing from the extreme ends, i.e. 1GB/2GB and unlimited to the centre of the spectrum, with an overall shift to greater data usage as lockdowns began to ease.