Insight of the Month: How Brand Partnerships Became Awin’s Fastest-Growing Partner Type

Written by Alfie Staples on 7 minute read

Our latest Insight of the Month feature is dedicated to the crowds of advertisers becoming publishers to unlock high-margin revenue.

If it were ever difficult to sum up affiliate marketing’s qualities as a connective force and the ability of vastly different businesses to use the channel to collaborate and drive each other’s goals, brand partnerships have made it much easier.

An increasing number of advertisers are now turning into publishers to create fresh streams of income. And if you’re interested in starting a brand partnership journey yourself, our latest Insight of the Month explains all.

Affiliate marketing’s role in brand partnerships

In an affiliate context, brand partnerships typically involve a brand partner ‘host’ promoting an advertiser in exchange for a commission.

That promotion usually involves the advertiser offering a 'reward’ of sorts to the brand partner’s customers. Rewards vary according to the sector, but they largely belong to two categories:

- Gift: A trial of a service at ‘65% off’ or free. Simply Cook’s free recipe box (when the customer pays postage) and Beer52’s free case of craft beer were two of the highest-performing brand partner offers on Awin last year.

- Reward: A monetary saving, loyalty points, or cashback as a reward for shopping with a brand partner. On Awin, Belgian mobile network Mobile Vikings has enjoyed great success by offering extra loyalty points for purchases at electrical leader Vanden Borre.

It makes for a positive value exchange, as each time that reward is redeemed, the brand partner is paid a cost per acquisition (CPA), the advertiser gains a customer, while customers themselves get extra value for money.

How fast are brand partnerships growing?

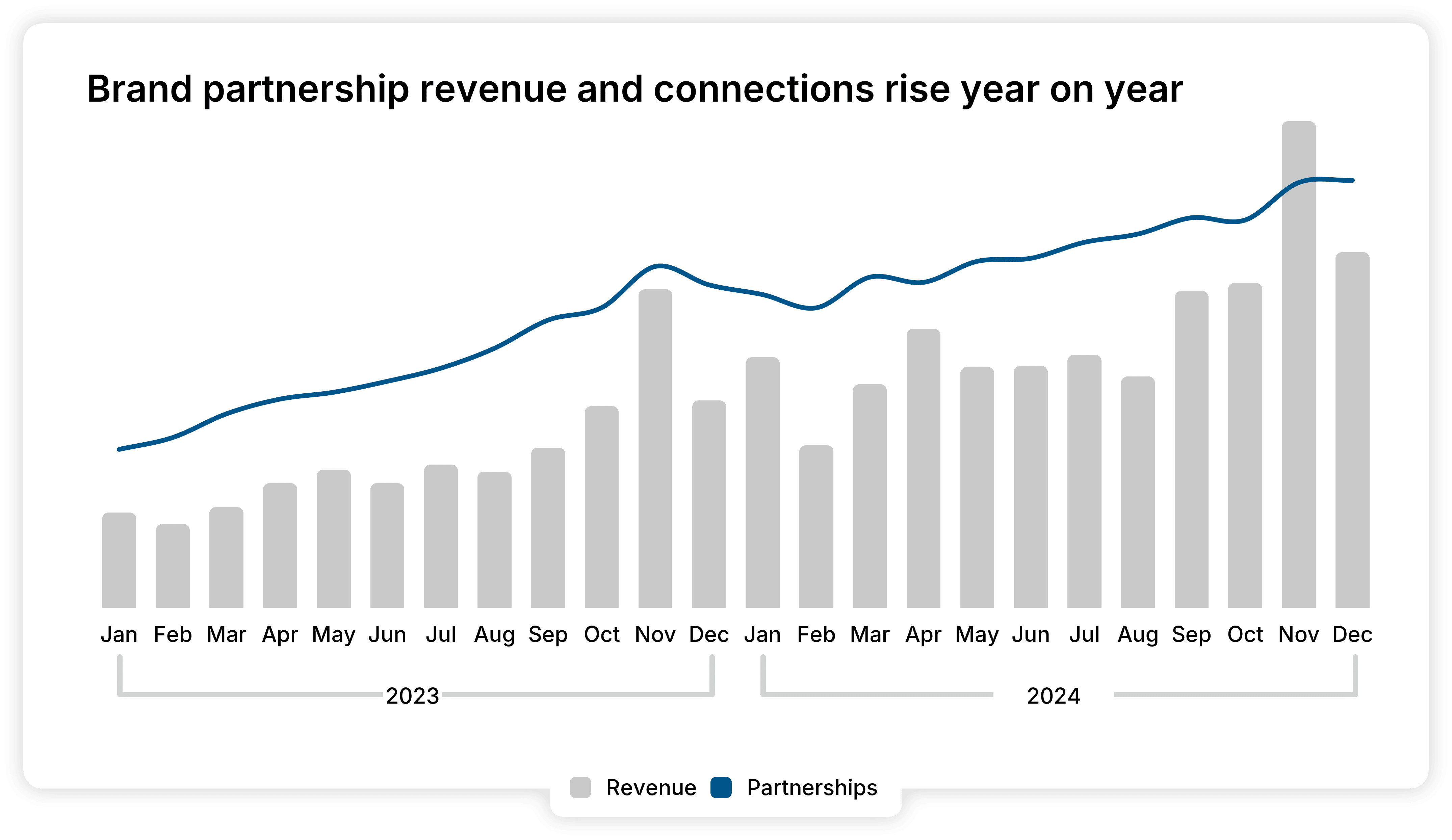

If you caught our ‘Brand Partnerships: Wrapped’ for 2024, you’ll have seen that last year, Awin enabled 4,500 advertisers to connect with over 400 brand hosts to drive €90 million in revenue.

These lofty figures helped to make brand partnerships the fastest-growing partner type on Awin globally in 2024, courtesy of a +93% year-on-year rise in sales.

Brand partnerships have grown at a consistently high rate in recent months, but they certainly come into their own over Black Friday, evidenced by the +30% jump in monthly revenue from October to November last year. Could this be a sign of brand partners protecting their margin by using advertiser rewards, rather than discounts, to incentivise purchases?

Why are brand partnerships growing so quickly?

Nike and Apple, Starbucks and Spotify, Tesla and Ikea – and that’s just from 2024. Brand collaborations are in vogue and the adapted idea of using audience overlaps to drive mutual goals is very much prevalent in the affiliate channel.

Then there’s the M-factor: “margins”. Many retailers are looking for new ways to drive revenue amid rising inflation and profitability concerns. At Awin, it’s not uncommon for brand partner hosts to earn in excess of €300,000 in commission per year. Retail margins typically range between 20% - 60%, but if we take a conservative estimate of 20%, that €300,000 is worth the equivalent of an extra €1.5 million in sales.

There’s a solid deal for advertisers, too. Brand partnerships are arguably one of the most suitable and cost-effective acquisition methods for subscription businesses, whose most valuable customers could arrive from a free trial distributed via one of their partners.

Advertisers also get access to high-quality customers on order confirmation pages, in-app reward hubs, and newsletters — places where they aren’t necessarily looking for the lowest price.

In which sub-sectors are brand partnerships most popular?

Active brand partnerships on Awin are up 39% year on year thanks to an influx of new players, but it certainly has its champions.

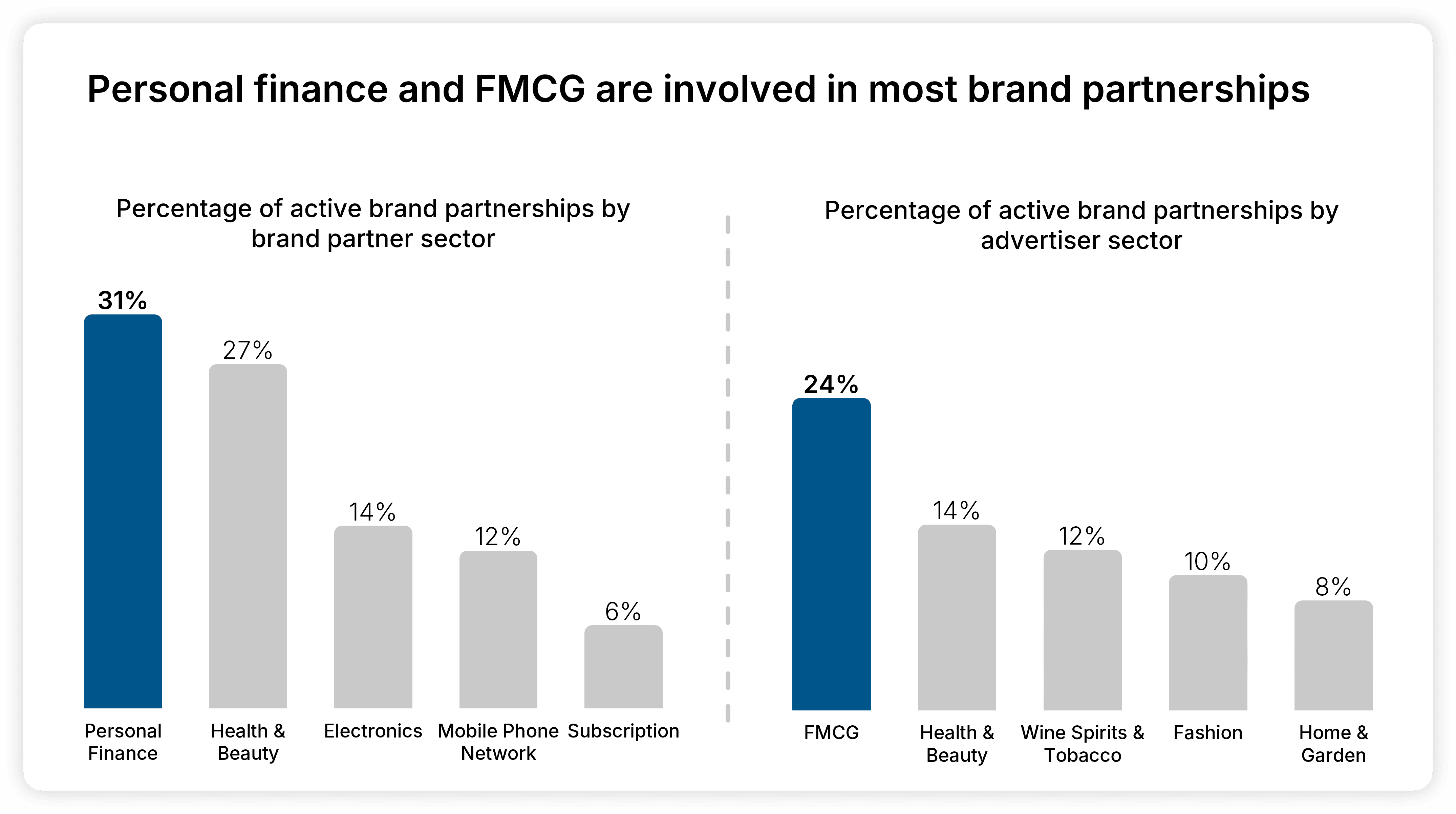

Personal finance businesses are the most common brand partner hosts, making up nearly a third of that contingent (31%) thanks to the influence of high performers like Revolut and its in-app customer rewards.

Leading things on the other side of the partnership is FMCG (fast-moving consumer goods), accounting for almost a quarter of advertisers (24%), including recipe kit subscriptions like Gousto and SimplyCook, which offer strong introductory offers for new customers.

No stranger to the concept of gifting, Health & Beauty has strong representation on both sides. The same can be said for subscription-based companies from the showings of Mobile Phone Networks (12% of brand partner hosts) and Wine, Spirits & Tobacco (12% of advertisers), which routinely use free gifts as an acquisition tool.

Are brand partnerships making their way into other sub-sectors?

Looking at growth outside of the top-five advertisers, we’re definitely seeing more sub-sectors realising the value of brand partnerships by distributing rewards and gifts, including:

- Sportswear (+22% YoY)

- Books & Subscriptions (+38%)

- Furniture & Soft Furnishings (+24%)

These all saw noticeable increases in advertisers in 2024, growing just as fast as the more dominant players:

- Health & Beauty (+26%)

- Home & Garden (+24%)

- FMCG (+23%)

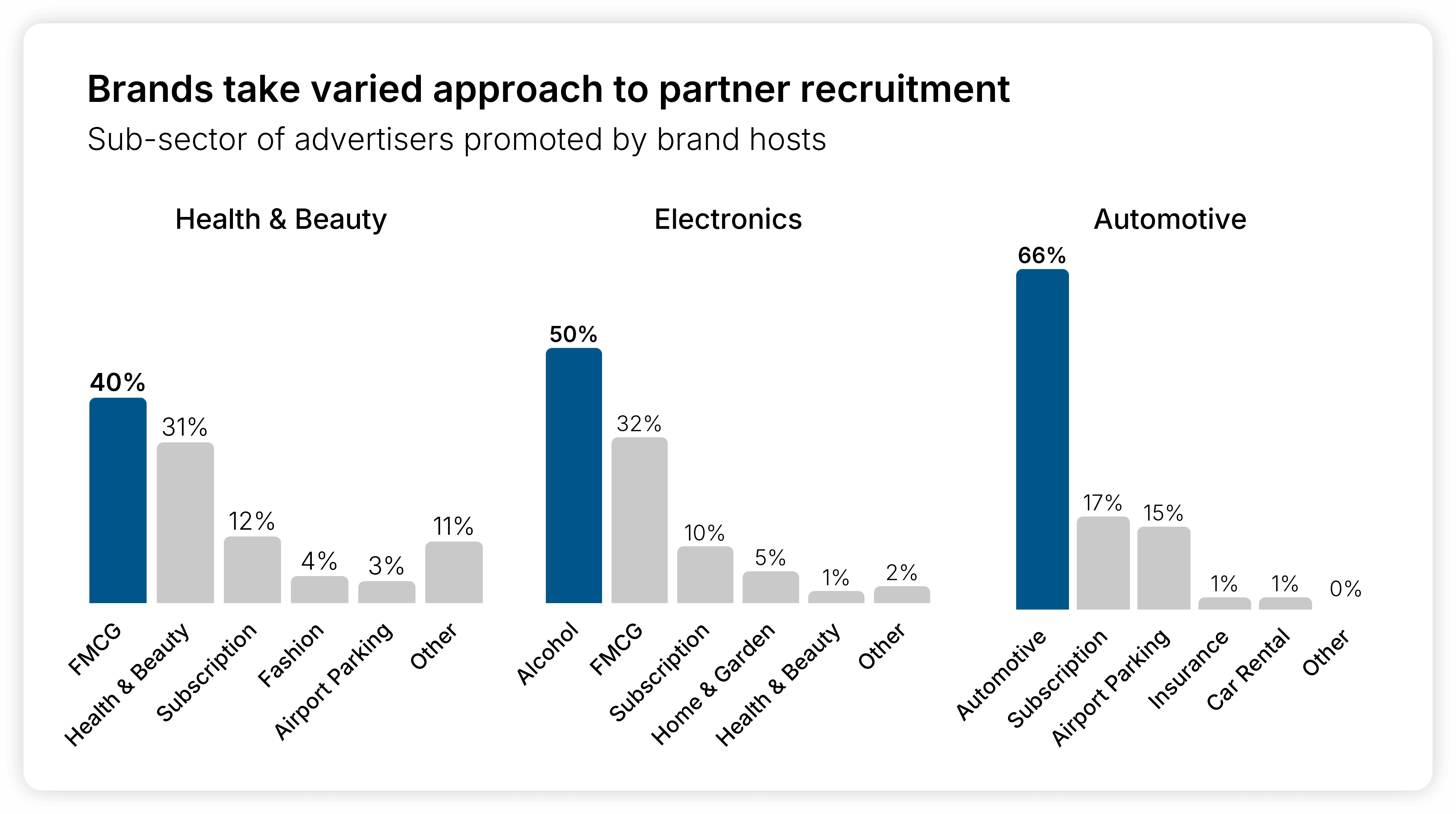

While choice is rarely bad for the consumer, it isn’t always utilised by the brand partner host. In automotive, for example, a potential lack of audience overlaps means 66% of brand partner rewards are from the automotive industry itself, with Subscription taking second spot on just 17%.

It’s a different picture in sub-sectors like Electrical, where a variety of products necessitates a more even promotion between Alcohol (50%), FMCG (32%), and Subscription advertisers (10%).

Don’t forget, just like any other form of advertising, the best brand partnerships are typically driven by relevance. This space is full of interesting stories, like tech provider BrandSwap creating a widget to help electrical leader Currys promote meal kit subscriptions to customers purchasing cooking appliances, and laundry products to recent buyers of washing machines.

If you need more advice on how to find brand partnership opportunities, be sure to check out Awin’s ‘Ultimate Guide to Brand Partnerships’.

In which regions are brand partnerships growing fastest?

Going solely on its financial contribution, brand partnerships are worthy of phenomenon status – just not yet a global one.

The UK has led the movement in Europe and recently celebrated hitting 100,000 brand partnership sales in November 2024 – the first market to do so.

Benelux (Netherlands and Belgium) is another growth driver and even beats the UK for brand partnerships as a percentage of total affiliate sales, reaching 4.7% in Q4 2024 vs the UK’s 1.3%.

Judging by the success of partners like ING Global (banking) and Mobile Vikings (mobile network), Benelux is a fascinating example of how loyalty programmes with closed user groups have allowed advertisers to tap into valuable audiences.

Meanwhile in the UK, there have been several stories of household names using brand partnerships to drive performance without resorting to discounts. One of our favourites involves Secret Sales using Tyviso offering brand partner rewards in exchange for purchases. Among the customers that opted into rewards, Secret Sales reported a +66% uplift in their conversion rate and a +14% increase in average order value.

Brand partnerships account for a lower proportion of affiliate contributions in DACH and France, but year-on-year sales rose strongly across both regions in Q4 2024 (+77% for DACH, +55% for France).

The US is also planted in the opportunity phase despite brand partnership sales in 2024 tracking largely above 2023 levels, but watch this space. Considering its alignment with current retail challenges, and growing interest in different sub-sectors, we’re eager to see whether brand partnerships become a more global concern in the coming months.

Start your brand partnerships journey today: Brand Partnerships - Achieve Success through Collaboration | Awin]