Insight of the Month: The Early Impact of Google’s Site Reputation Abuse Update

Written by Robert Davinson on 9 minute read

We share an exclusive before-and-after account of the clampdown on sites deemed to have fallen foul of Google’s spam guidelines.

Months have passed since Google’s controversial site reputation abuse policy came into force. With the dust settling, we’ve explored how the actions undertaken on May 5 have reshaped the affiliate landscape.

The search giant’s now-recitable declaration of its targets sparked one of the biggest talking points in affiliate marketing this year. Promising manual action as a precursor to algorithmic changes, Google aimed to address ‘spam’ by penalizing sites deemed to be hosting content with the intention of manipulating search rankings.

As a reminder, it defined site reputation as: “... when third-party pages are published with little or no first-party oversight or involvement, where the purpose is to manipulate search rankings by taking advantage of the first-party site's ranking signals.”

Google pledged to de-rank or remove “sponsored, advertising, partner, or other third-party pages” produced without involvement or independent of the host site from its search results.

One example was particularly glaring: “... A news site hosting coupons provided by a third-party with little to no oversight or involvement from the hosting site, and where the main purpose is to manipulate search rankings.”

SEO experts swiftly pointed out the most likely targets, namely mass media publishers running their own coupon pages and editorial partners with white-label coupon directories powered by a third party, but not all discount-driven properties met the same fate. Google’s criteria theoretically safeguarded the rankings of ‘traditional’ coupon sites designed solely for the purpose of sharing various discount codes and offers.

The next few weeks brought unsettling reports of substantial revenue losses, de-ranked sites, and the large-scale deletion of problematic pages, which were somewhat offset by a boost in traffic for those deemed to align with Google’s vision.

Taking a closer look at two different affiliate cohorts

Awin’s status as one of the world’s largest affiliate platforms gives us a unique perspective on this topic. We count 100s, if not 1000s of affiliates like these partners among our base.

So, with that in mind we sought to better understand how these affiliates were being affected by the change, and a few questions immediately emerged:

- Had the negatively impacted publishers shown any sign of recovery since the penalty?

- Did the changes accelerate or reverse any long-standing changes in affiliate performance?

- Would improved conversion rates validate Google’s intention of directing more traffic to those they deemed to be higher-quality sites?

To provide a more comprehensive overview that didn’t isolate any one affiliate partner’s experience, we created two sets of cohorts to compare performance before and after the Google change.

The first, which we’ll refer to as ‘Mass’ in the analysis, was made up of Mass Media House partners. These are news and media websites which have adopted the tactic Google’s change is designed to penalize.

The second, which we’ll refer to as ‘Coupon’, are more traditional coupon and discount code websites which were widely expected to rise in the SERPs following the change.

Both sets of cohorts ran into the 100s in terms of the number of affiliates we included in the analysis, and both also featured a mix of affiliates from different countries across the world.

A serious sales drop for mass media affiliates despite stable traffic

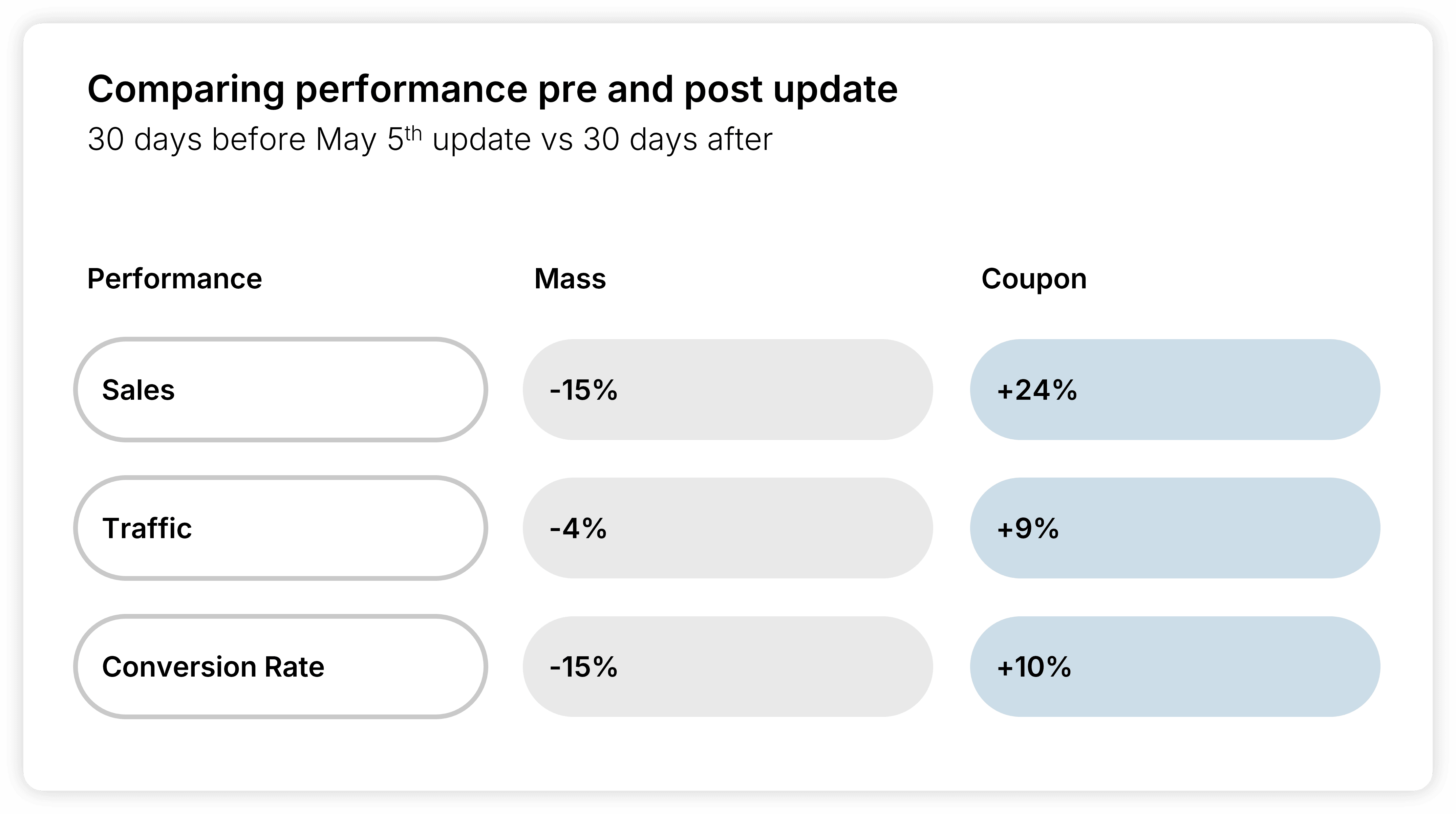

First, we looked at some baseline performance results. Comparing performance from 30 days before the update vs. 30 days after, we can immediately see a hugely contrasting impact on sales for mass media publishers (-15%) and standard coupon sites (+24%).

Traffic for mass media is only down 4%, which could indicate the success of webmasters following Forbes' lead by preventing problematic areas of their sites from being indexed by Google after learning of the expected changes. This might also explain their much deeper drop in sales as a key revenue-driving element was removed.

Traffic for coupon sites went the opposite way, increasing 9% after the changes. There was always a chance that any new visitors landing on these sites might have felt less familiar here than at some of the more famous news and media titles that previously dominated the top rankings for specific coupon-based searches. Conversion rates for standard coupon sites defied this logic by increasing 10% though.

However, the 15% drop in mass media conversion rate - again, potentially explained by coupon directories on their pages being de-indexed or removed - equates to a net negative in one of the areas Google’s policy aimed to have improved. We’ll take a closer look at evolving conversion rates shortly.

The changing complexion of traffic and affiliate touchpoints

Awin’s Funnel Report, which Awin Advanced advertisers can use to understand affiliate contributions beyond the last touch, illustrates how these publishers’ roles in the customer journey may have changed post May 5.

The report reveals where shoppers have interacted with an affiliate in a journey that culminates in a sale. These touchpoints are then labeled as one of four categories:

- Upper: The first touchpoint in a multi-touchpoint conversion journey

- Mid: Any touchpoint that isn’t the first or last touchpoint in a multi-touchpoint conversion journey

- Lower: The last touchpoint in a multi-touchpoint conversion journey

- Solo: The only touchpoint in a conversion journey

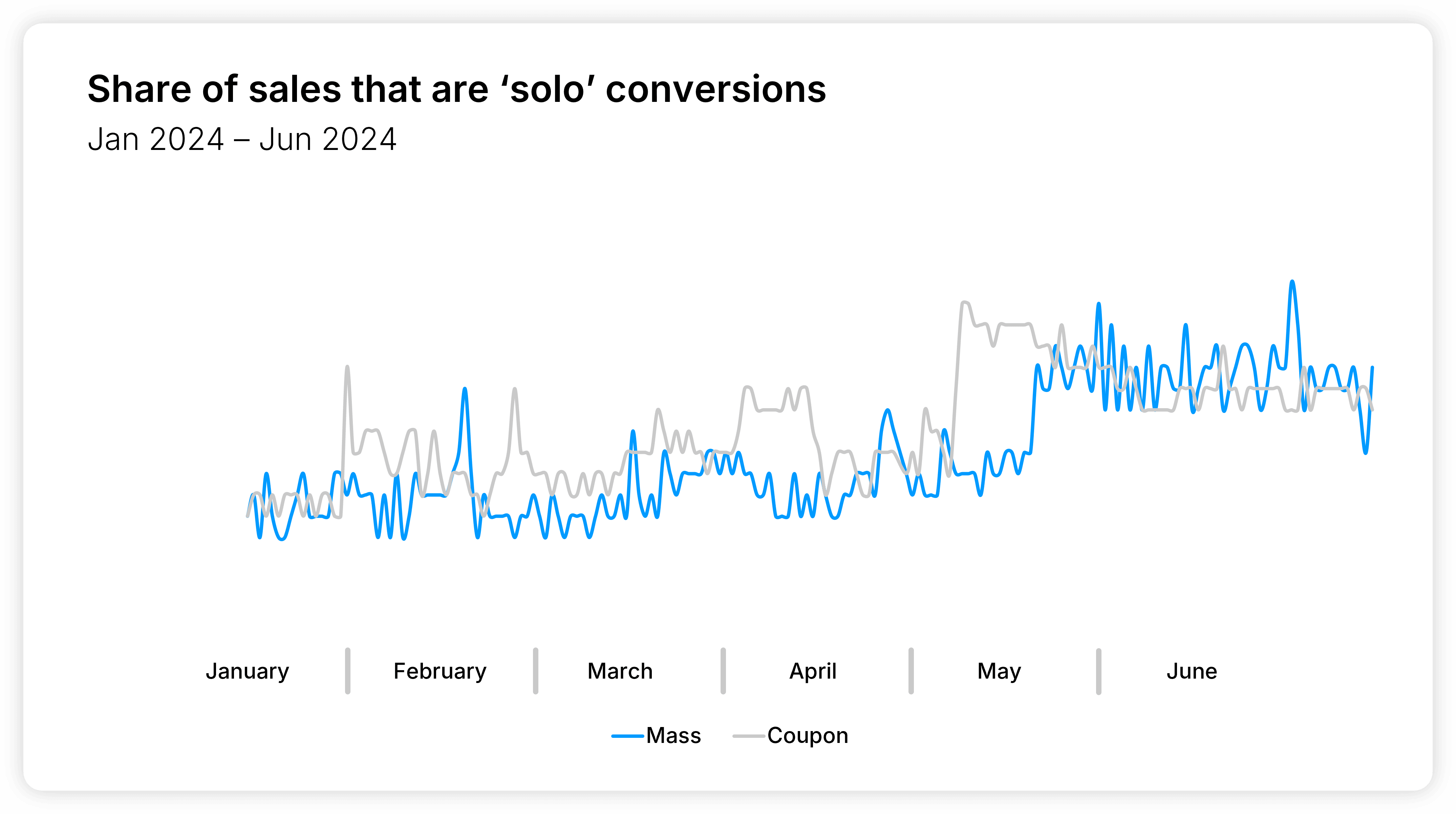

Interestingly, Mass Media publishers saw their solo contributions increase following Google's changes. Instances where these publishers were the only touchpoint in a customer journey rose to 18% on May 7 and went on to hit 21% later in the month despite hovering around the 12-14% mark in April.

We might speculate here that their drop in the search rankings might also mean a decline in more fair-weather traffic; less shoppers who are prone to bouncing around to other websites looking for the best possible discount or deal for the product they’re aiming to buy.

Instead, there is perhaps a higher concentration of traffic which is more brand loyal to their publications and therefore happy to trust the discount featured and convert there and then.

To support that interpretation, mid-funnel contributions dropped 9%. Again, perhaps there is a correlation here with those more ‘flitty’ shoppers now being redirected elsewhere to compare coupons across other websites ranking higher within Google.

Changes inspire turnaround for coupon sites

With mass media and coupon sites now finding themselves in two very different camps, we wanted to see whether Google’s action had accelerated any long-standing trends.

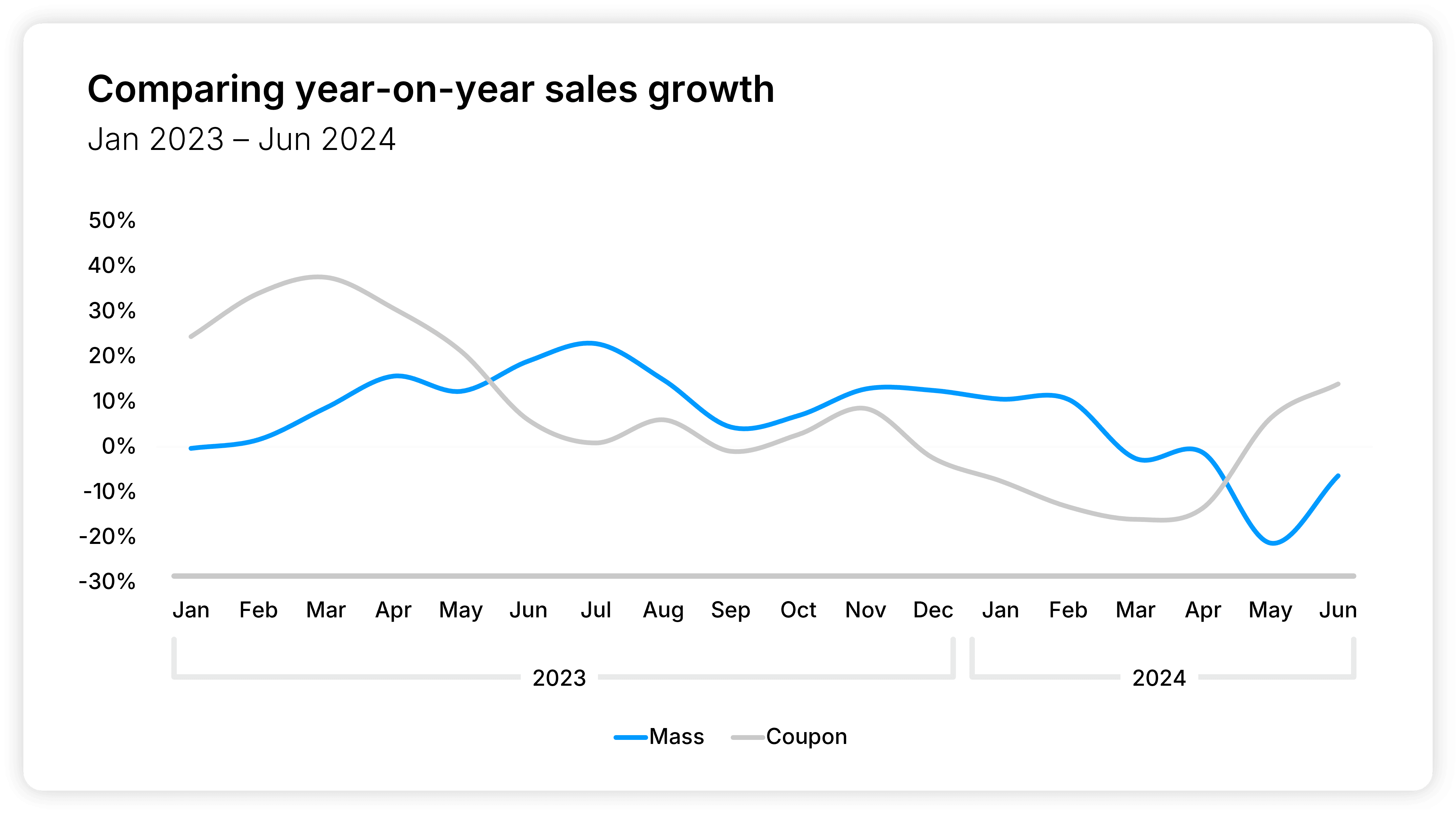

In the coupon cohort’s case, the change appears to have reversed many months of decline. These sites experienced a significant drop in sales from a high in March 2023 (+38% YoY) to March 2024 (-16% YoY), before Google’s actions led to dramatic improvements in April (-14% YoY), May (+5% YoY), and June (+14% YoY).

Mass media sites had seen their own decline in sales but at a much slower pace. A strong summer 2023 brought healthy figures in July (+23% YoY), followed by a drop in September (+4% YoY) and then months of stagnation. Sales were down just -1% YoY in April but dropped suddenly to -21% in May after Google’s actions. Sales growth recovered slightly in June, but still represented a decline of -6% on the previous year’s figures.

Regional nuances, conversion rate contrasts and discount fatigue?

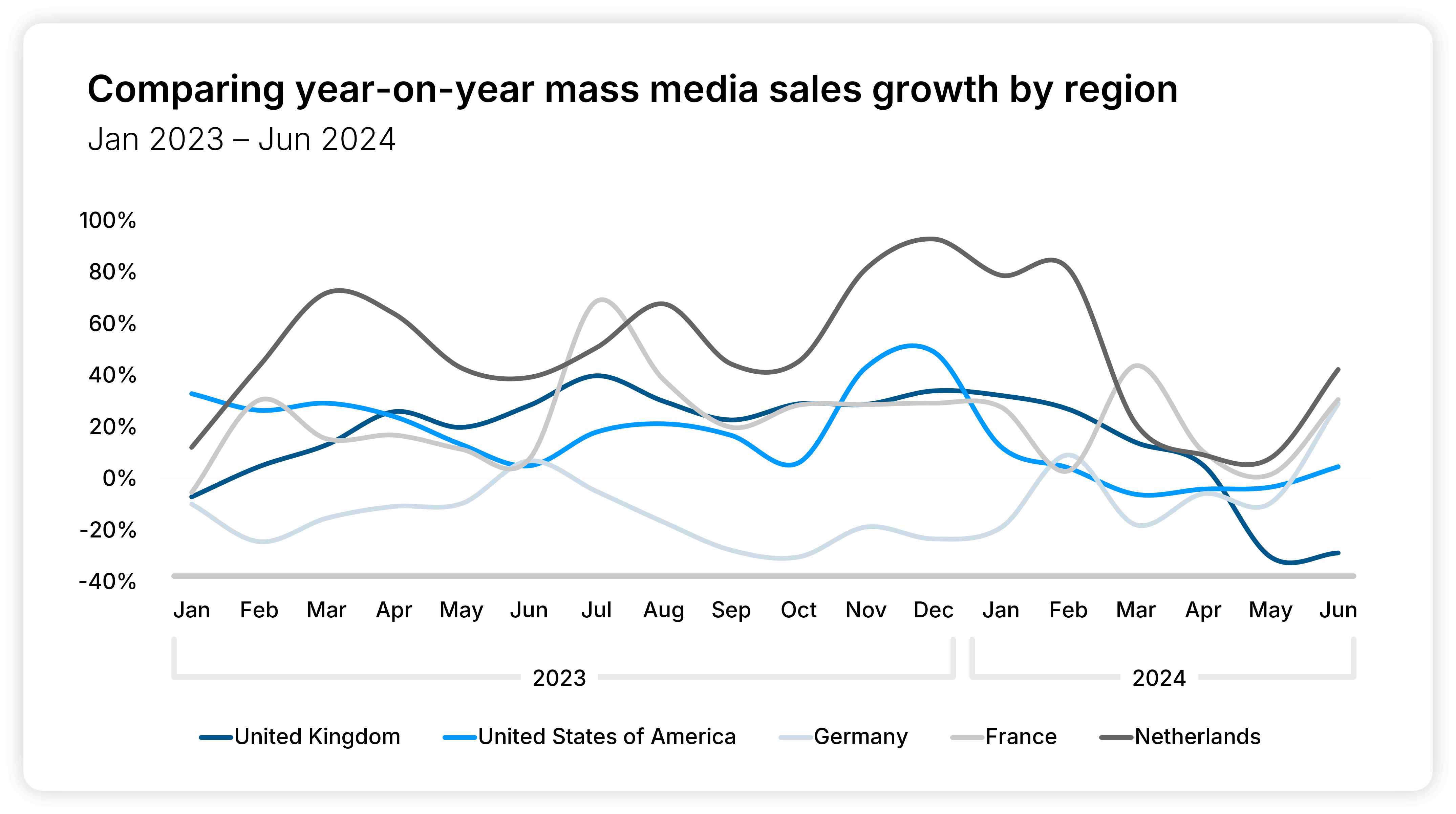

Looking at the regional impact of Google’s changes, UK mass media publishers saw by far the biggest drop in sales, going from +5% YoY in April to -30% in May. Our analysis showed a much less pronounced decline in France (+11% vs +2%), while the US, Germany, and the Netherlands were relatively untouched.

It’s fascinating to consider whether Google’s actions (to reiterate: manual rather than algorithmic) speak to an organization picking and choosing its targets to avoid reprisal. Google may consider itself to have more leeway in a post-Brexit UK than it does in any market protected by the EU, whose commission has famously handed the search giant multiple record-breaking fines for everything from unfairly promoting its shopping price comparison service ($2.5 billion, 2017) to imposing unlawful restrictions on Android users ($4.5 billion, 2018), both with the aim of consolidating its dominant position.

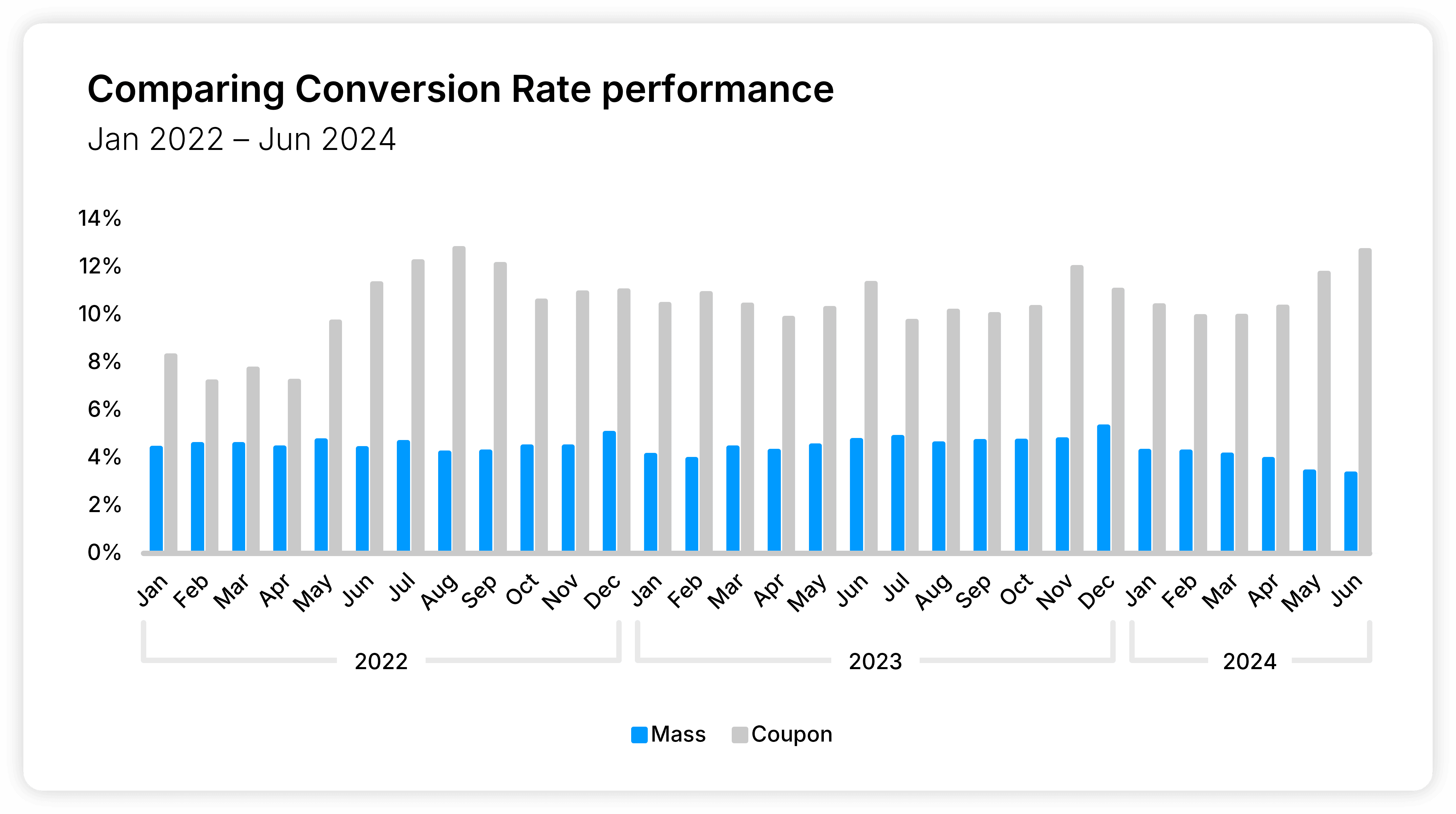

However, if Google ever needs justification for its approach to improving the quality of search results, it should look straight to conversion rates (CVR).

Since April 2022, standard coupon sites have maintained a healthy CVR of 9-12%, far above mass media’s much lower albeit more consistent 3-4% over the same period. The former has even bucked industry-wide declines by increasing its CVR by +53% between January 2022 - June 2024 in the face of a shaky economic climate. Conversely, mass media’s CVR has dropped 25% during the same period.

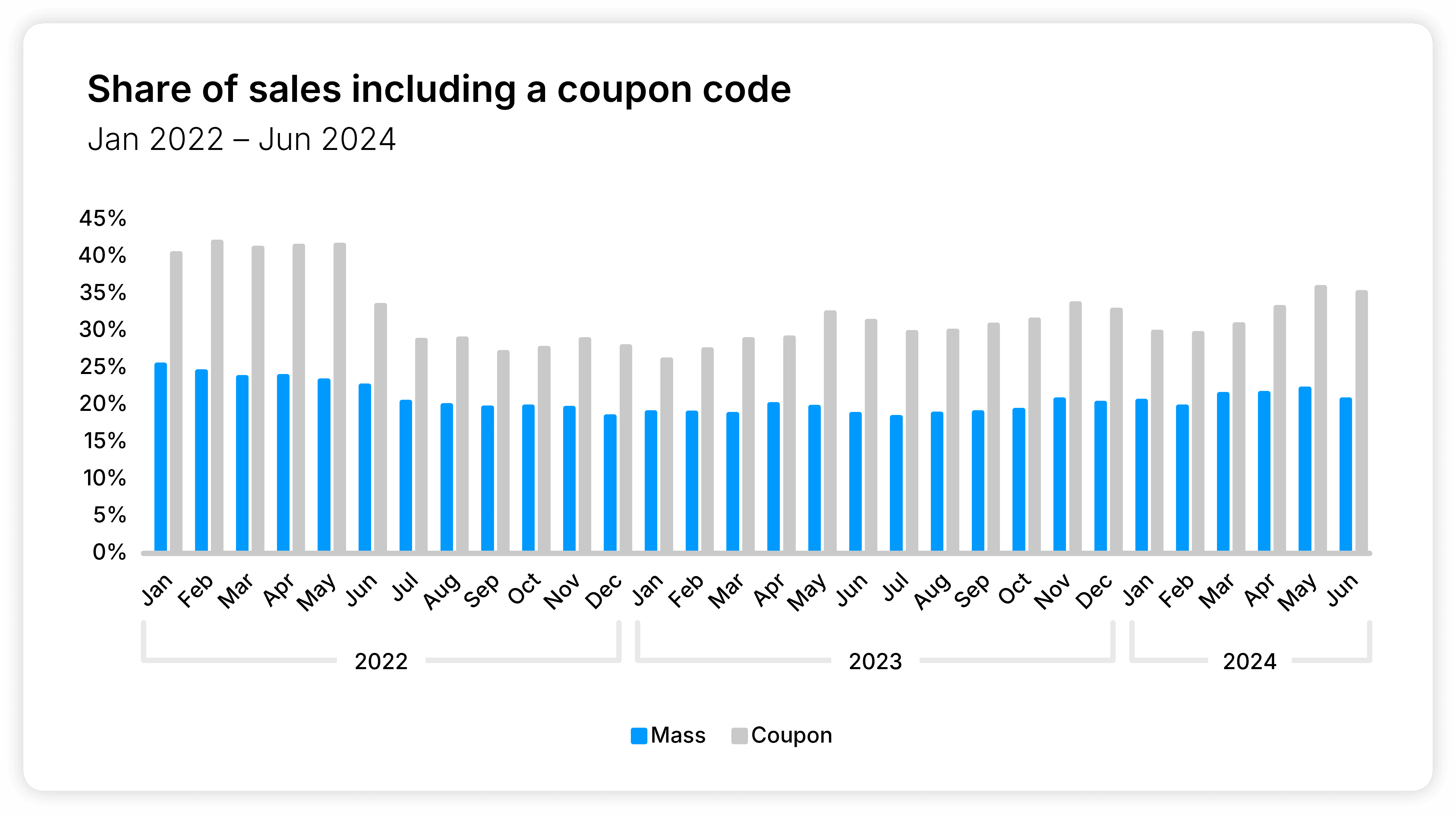

One consumer behavior that may have filtered down from the wider ecommerce landscape is discount fatigue. Between January 2022 and June 2024, mass media’s percentage of sales involving a coupon dropped from 25% to 18%. Patently working with less revenue diversification, coupon affiliates went from 40% to 35% in the same period. Seasonality is a factor, though, as we can see from the relatively high percentage of coupon-driven transactions for standard coupon sites between September and December 2023.

Shielded publisher types still vulnerable to change

Google has made abundantly clear how relying on search engine rankings can make or break entire businesses overnight. However, that’s not to say other publishers aren’t susceptible to alarming peaks and troughs in their performance.

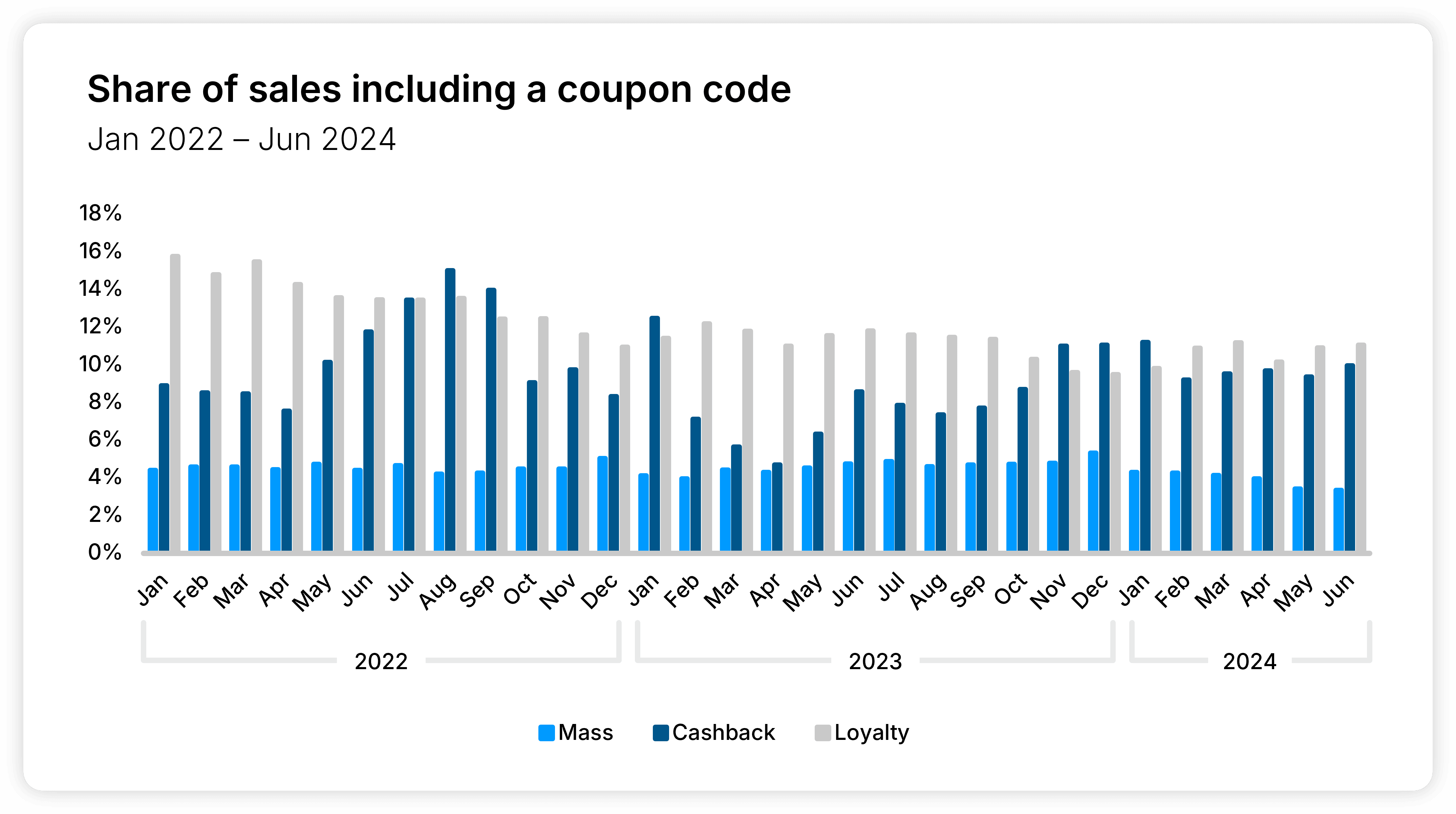

Looking at the conversion rate of mass media vs loyalty and cashback, two publishers that would consider themselves relatively more insulated from Google’s actions because of their models, we can see a high degree of volatility in the latter.

Cashback’s impressive annual peak of 15% CVR in August 2022 shrinks to 9% a mere two months later. It plummets to 6% in May 2023 before bouncing back to 11% at the start of 2024. Loyalty shows greater stability, however, its overall decline in CVR has been far more dramatic than mass media’s, dropping 30% between January 2022 - June 2024 compared to 25%.

The importance of affiliate diversification

If there’s any lesson to be learnt from the experience of the last few months, it’s that diversifying income streams is more important than ever for affiliates. Particularly if your website is reliant on Google for traffic.

Fair or not, Google’s changes and the experience of mass media house affiliates these last few months will no doubt spur many of them on to look at new ways of generating income from advertisers.

And with Awin building a variety of tools that aim to better support that diversification, affiliate marketing can continue to thrive despite these challenges.

To discover what tools Awin customers can use today to support their business goals, bookmark our Product Release page, updated every season with a slew of new features designed to help you grow your own way with affiliate marketing.