ISBA, the trade body representing UK advertisers, wanted to find out exactly where the billions of pounds of ad spend that brands pour into the programmatic supply chain every year actually went.

They put their best men and women on the job. Data scientists and auditing experts tailing the spend of 15 major brands through the byzantine avenues of the industry to 12 publisher websites for over a year - from ad servers and DMPs, through open marketplaces and ad exchanges, authentication, verification and various analytics platforms, to SSPs and finally, the publishers themselves.

Yet, to no avail. Despite their best efforts, the case could not be definitively closed. Of the 267m impressions tracked only 12%, 31m could be objectively matched at a base level from advertiser to publisher.

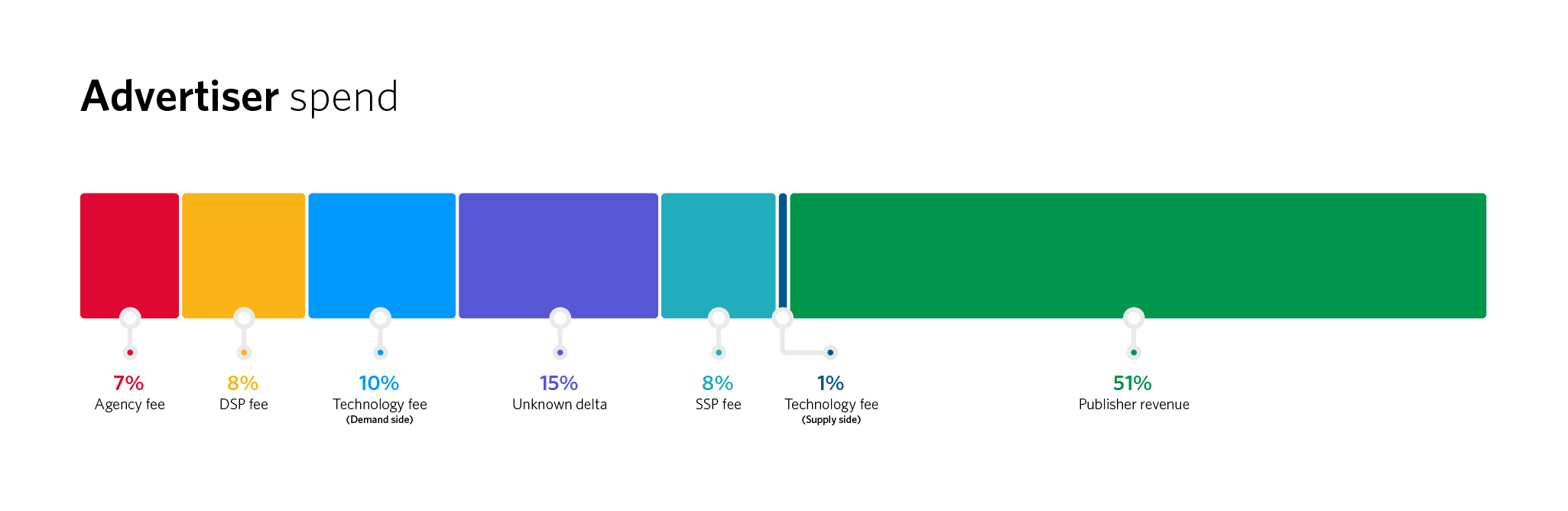

Fifteen percent of advertiser spend remained entirely undetermined. The experts simply christened it the ‘Unknown Delta.’

Fifteen percent is arguably a minor amount in the grand scheme of things. Except for the fact that the scheme is so grand.

The latest IAB ad spend figures for the UK revealed display’s share to be around $7.6b in 2019. Around 90% of that activity is run programmatically, amounting to $6.8b. Fifteen percent of that sum comes in at a sizable $1.03b.

That’s $1.03b of advertising spend that simply couldn’t be accounted for.

Of course, we’ve been here before. This is not the first study of its kind. In 2014, the World Federation of Advertisers’ Waterfall Study scrutinized the same field with similar results. So did the Association of National Advertisers in the US in 2017 with its aptly titled research, ‘Programmatic: Seeing Through the Financial Fog.’

It was around that same time that Marc Pritchard, CMO at one of the world’s biggest advertisers Procter & Gamble, derided the state of this digital advertising supply chain, denouncing it as “murky at best, fraudulent at worst.”

But, despite a lot of industry hand wringing, it seems not much has dramatically changed.

The 51% of that ad spend that publishers received was admittedly a significant improvement on the income generated by The Guardian newspaper in 2016, when it found it received just 37 cents for every $1.25 a brand invested in buying its ad inventory programmatically.

However, as PwC’s Sam Tomlinson, who led the ISBA investigation, was quick to emphasize, “it’s important to realize that this study represents the most premium parts of programmatic: the highest profile advertisers, publishers, agencies and ad tech.” This excluded the so-called ‘long tail’ aspect of the marketplace that would presumably only serve to further reinforce the report’s findings.

In the current circumstances that seems a worrying caveat.

Most advertisers around the world are examining their marketing budgets with a view to pausing or at least cutting back spend as the fallout from the lockdown brings uncertainty to businesses in practically every sector.

Knowing that 15% of your ad investment is disappearing into an ‘Unknown Delta’ with no evidence of its effectiveness or value seems a fairly reasonable excuse for pulling back when you could be prioritizing things like retaining employees, paying your rent or simply remaining solvent.

From a publisher perspective, the report’s findings are no less worrying. In recent weeks we’ve witnessed news of major online publications like Buzzfeed, Vice and The Economist all having to downsize their staff.

The combination of this ad tech tax with keyword blocking of highly-trafficked articles on coronavirus, and general cuts to ad investment, has done nothing to help the publishing industry’s already declining incomes.

That fact undoubtedly explains why such media publishers have increasingly turned to the affiliate industry in recent years to diversify and boost their ailing advertising revenues.

Its perception as an overly-simplistic, blunt tool for online marketing is being reconsidered in place of a realization that it offers the kind of transparency and control that both advertisers and publishers are pining for.

Publishers can take heart from knowing that 100% of what an advertiser invests in partnering with them will be received by them.

Networks like Awin’s provide transparency around when payments can be expected, average EPC rates, and ‘traffic light’ systems that highlight those brands with the best credit status from whom they can anticipate being paid quicker, along with a host of other solutions to help with cashflow visibility.

Advertisers can invest with conviction in the channel knowing that they retain absolute authority over which affiliate sites they work with and how they work with them. At the heart of the channel sits its performance model, whereby brands can control the types of activity their partners generate for them through the commission they choose to reward them with.

Want to shift volume on a product line that you need to sell quickly? Looking to acquire new customers from the millions of first-time online shoppers in lockdown? Seeking to raise awareness of your new brand with a younger social-based audience? All of these objectives can be built into the very fabric of an affiliate program.

Many in the affiliate industry might look enviously at the scale of investment in programmatic, even with all its incumbent issues. The annual IAB study quantifying the size of our channel recently suggested that in 2019 brands invested around $625m. That’s 40% less than the $1.03b being squandered in the Unknown Delta alone last year.

However, sometimes it pays to be small... to get your house completely in order before scaling to the kind of size that programmatic has done. Ensuring that the affiliate industry is doing everything it can to retain the characteristics of transparency and control that it currently offers, improving standardization of terminology and reporting metrics in the manner in which projects like the Publisher Board are currently doing, will go a long way in making our future a sustainable one.

With the right kind of cross-industry collaboration that such aims represent, the long-term growth of the affiliate channel seems, to borrow a famous detective’s parlance, elementary.

For more information on COVID-19, please visit our information hub where we bring you the latest news from Awin, as well as links to network insights and useful pointers, alongside wider updates.