Mounting economic pressure means less sales but boosts to AOV

Written by Alfie Staples on 5 minute read

Dwindling consumer confidence will lead to shifting shopping habits that place sustainability and value-for-money front of mind this peak trading quarter.

After the biggest pandemic in over a century, the Ukraine-Russia conflict, rising energy and fuel prices, and supply chain difficulties have resulted in some of the highest inflation hikes in recent times.

This coupled with an all-time low in consumer confidence is leading to a number of changes in consumer behavior as they lean on their lockdown learnings and make savings by spending more time at home, scaling down and buying cheaper alternative products, and making sustainable substitutions over all-out sacrifices.

Lower sales, but spending more?

At first sight, this might seem a paradox. Given the current pressures on consumer spending, we expect sales volumes would generally be down. But we might also expect the same of average order values (AOV) too. But, partly because of inflation growth, we actually expect AOVs to increase over Q4.

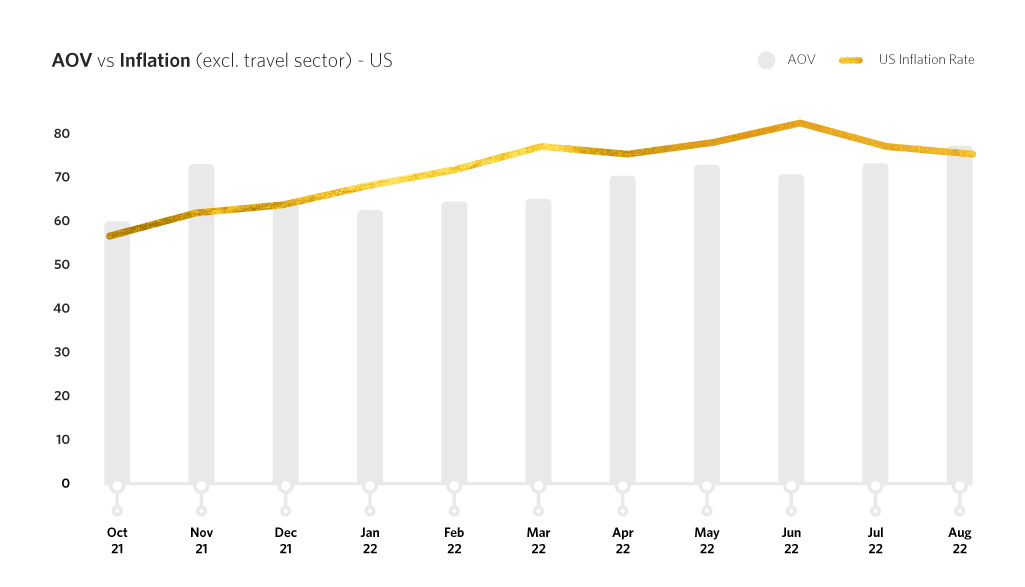

As the above graph shows, rising inflation across the US correlates directly to bigger shopping cart value. But is this just a story of advertisers selling less and consumers spending more?

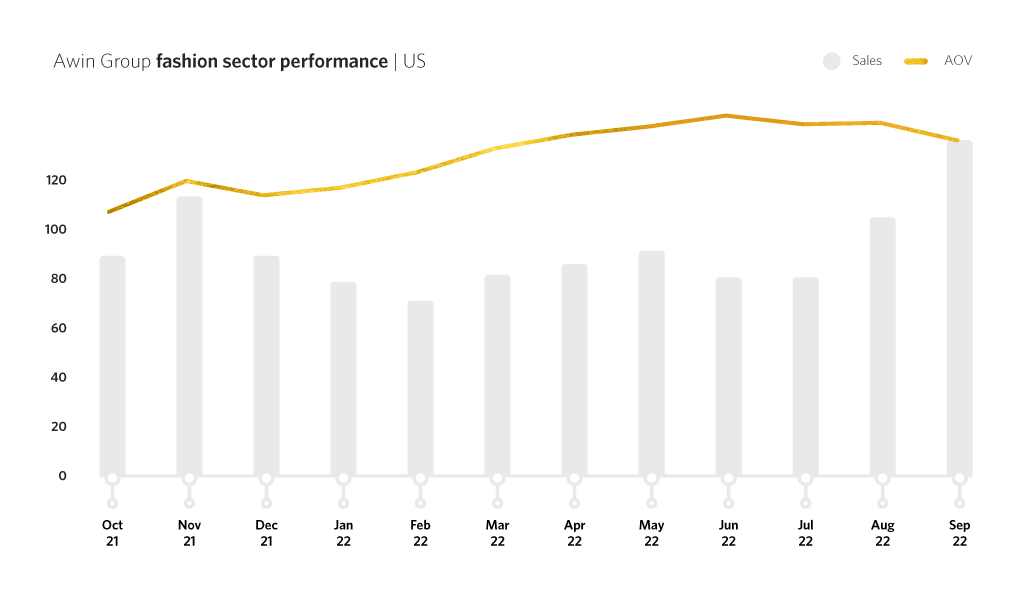

The fashion sector tells an interesting tale as we see sales decrease steadily, in line with rising inflation across 2022 and with an average quarterly decrease of -4% from Q2 to Q3. However, AOV continues to grow, with an average quarterly increase of 17% and with further growth forecasted for the rest of the year.

What does this mean?

In light of inflation, we’re seeing shopping habits shift and consumers split into two camps: those willing to spend less for low-cost alternatives in higher volumes; and those willing to spend more but less often for sustainable, longer-lasting products.

A recent report by FirstInsights indicates across all demographics consumers are willing to pay 10% more for sustainable products, seemingly taking inspiration from eco-savvy Gen Z. Although younger shoppers will naturally be on the hunt for savings, such as via TikTok tutorials on the best budget makeup, we still expect to see basket values increase gradually as consumers become more conscientious of the products they buy, spending more for durability and sustainability.

However, as the season of deals and discount approaches, we predict a slight +1% uptick in sales volume for the fashion sector. This signals the temporary return of those discerning consumers to the (digital) aisles as they try make a little go a long way with Cyber Week savings.

Who is still spending?

As we enter peak trading, it’s worth considering which demographic is ‘least’ affected by the current economy.

Consumer confidence has dwindled to an all time low, but PwC’s Consumer Sentiment Survey in the UK offers a little hope for brands with under-25s remaining net positive at the time of research. Unsurprisingly, under-25s are more likely to live with parents and have less responsibility for household bills, and therefore more sheltered from a large part of the current economic crisis. With those living at home having generally having less expenses, these younger shoppers may still find space in their digital wallets for more lifestyle consumption like going out, food delivery and impulse fashion purchases. Gen Z could be both the target and saviour of retailer campaigns this winter and help boost average shopping cart sizes across many sectors.

How can brands continue to sell value to consumers?

When examining how consumers will spend their cash, we see two main factors determining which sectors see a spike in AOV: sustainability and the World Cup.

For the first, brands can appeal to shoppers’ desire to be more sustainable by communicating their own ecofriendly practices throughout Cyber Week marketing campaigns.

While smaller merchants may struggle to feel they make a ‘big enough’ eco impact, through the affiliate and partner marketing channel they can create online partnerships that help fulfil their eco-conscious customers’ expectations. For example, brands on Awin and ShareASale can now partner with Ecosia, the world’s leading not-for-profit search engine that plants a tree for every sale made through its Freetree browser extension.

When it comes to crafting ethically-minded marketing campaigns this Cyber Week, advertisers that tell an authentic and compelling narrative about their genuine efforts can establish longer-term relationships with this audience. By contrast, any disingenuous attempt to greenwash risk coming under fire as the public become more wary of such cynical marketing efforts.

As for the impact of the World Cup, coinciding with the biggest shopping events of the year means cost-conscious consumers will be on the lookout for the best deals on food, alcohol, sportswear, merchandise and home entertainment even more than usual.

Brands can capitalize on the fandom from Cyber Week through the holidays by starting campaigns even earlier than 2021. Read our full analysis here in our first prediction World Cup to drive longest Cyber shopping campaigns ever.

Check out our partner recommendations for the peak season

Access the Awin Report 2022 to learn more about the 100 most innovative #Power100 partners on our global platform to help you make the most of this Q4.