Affiliate trends from Cyber Weekend 2024

Written by Alfie Staples on 10 minute read

We’ve crunched the numbers from another epic online shopping bonanza with Awin tracking over $700m in sales revenue over the Cyber Weekend.

Expectations for Q4’s traditional peak were cautiously optimistic in the lead up to Black Friday this year. Despite challenging economic conditions and rising credit card debt in many global markets, the forecast was that shoppers would continue to take advantage of the deals and discounts on offer.

True enough, the results Awin tracked over the weekend were broadly positive. Although the heady days of double-digit growth overall during the Cyber Weekend have long since settled down, some shopping trends really did take off.

1. Shoppers show patience and wait for Cyber deals

Much has been made in the past of Black Friday’s expansion from being a 24-hour focal point of discounting to a month-long period of promotions. Burnt by the mayhem of in-store fights for flat screen TVs and overloaded ecommerce sites unable to deal with sudden traffic surges, many brands have in recent years deliberately moderated those choke points by staggering promotions over the whole of November.

Shoppers this year didn’t appear to bite on those early promotions though. November saw performance decline overall with traffic down almost 3%, sales down 8% and affiliate commissions declining 3%.

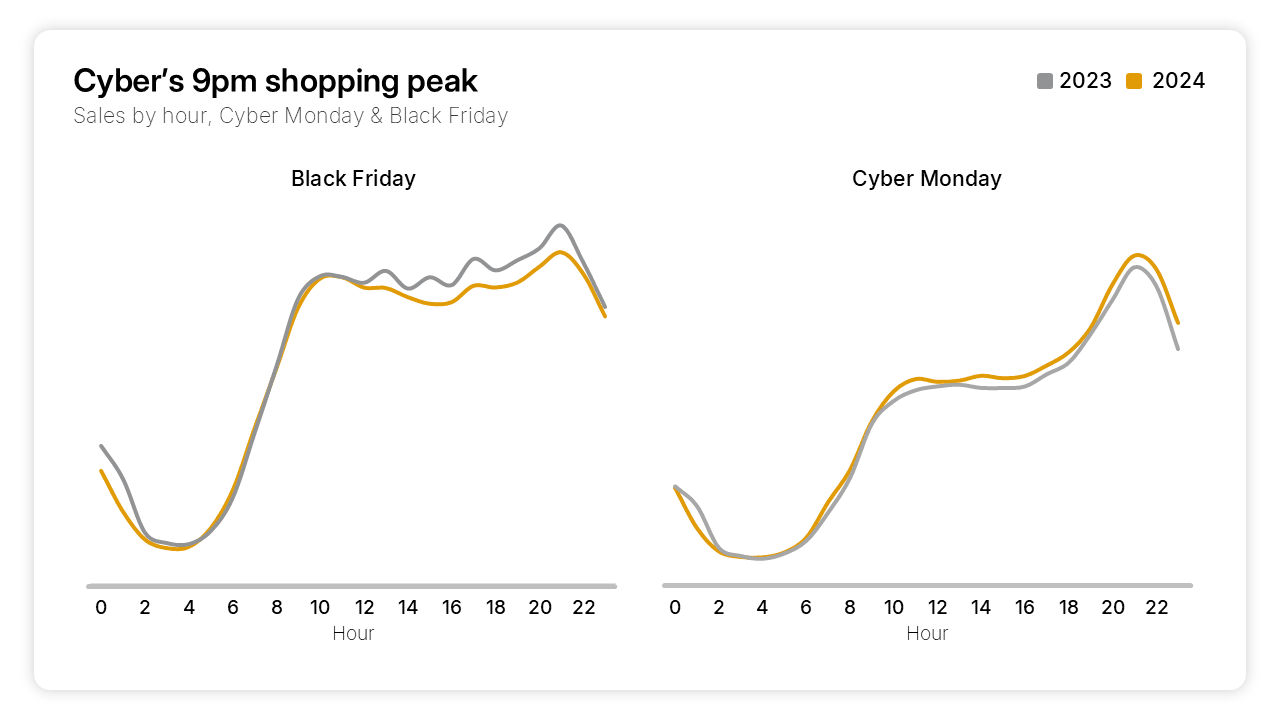

Instead, activity ramped up sizably over Black Friday and in particular the latter stages of the Cyber Weekend. Cyber Monday saw traffic jump almost 10% and sales up more than 3% with affiliate commissions mirroring this same increase. In fact, looking at the sales by hour across both Black Friday and Cyber Monday illustrates how the shopping peak reaches its apex late in the day. 9pm appearing to be the shopping hour of choice.

2. Advertisers compete fiercely for affiliate exposure over Cyber Weekend with tenancy spend up

Tied to the previous point it was notable that ad spend, and specifically tenancy spend, really concentrated around the Cyber Weekend itself and wasn’t as spread across the month.

Tenancy spend has been on the increase in the channel in the last few years more generally. A consequence perhaps of the ongoing diversification of the channel as more upper-funnel ad models emerge and the ability to effectively measure and reward on a last-click basis is diminished.

The Cyber Weekend is a prime example of where tenancy spend tends to spike. Competition for valuable exposure intensifies and tenancies often offer a means of securing these vital slots far in advance of the event.

So, it was interesting to note the differences in growth of commission overall (including tenancies) vs without. Overall commission, including tenancies, saw a 16% rise for the Cyber Weekend. Excluding tenancies, pure-play CPA commission by contrast grew by just over 6%.

Despite many brands running their promotions and Black Friday campaigns throughout November, it did appear that many of them saved their biggest exposure for the main event days. Overall commission spend (including tenancies) was down for the month of November by almost 4%.

Advertisers may have timed their marketing efforts wisely this year with the sudden ramp up in exposure over the Cyber Weekend doing its work and convincing shoppers to buy.

3. AOVs climb again throughout November despite falling inflation

With inflation hitting hard over the last couple of years average order values have naturally followed this trend. Last year saw US shoppers spending $15 more on average than they did in 2022.

2024 has seen inflation generally fall across most economies, yet the AOVs Awin tracked across its global platform continued to rise. Black Friday witnessed almost a 5% rise in AOVs while the month of November was even higher, up 11% for the month compared to 2023.

This despite the fact that overall, sales were marginally down over the Cyber Weekend (-0.6%) and more significantly (-8%) for November as a whole. Clearly, those shoppers that were enticed to buy were spending more on their purchases.

4. Health & Beauty’s Cyber success falls short in 2024 as shoppers opt for Fashion & Sportswear

Looking at sector performance over the weekend the big story was of Health & Beauty’s relative decline. A longtime favoured sector for shoppers, Health & Beauty brands and retailers saw lots of browsing but not as many sales this year. Traffic was up more than 5% on Black Friday and more than 13% on Cyber Monday. Yet sales, revenue and commission all saw declines on 2023’s figures.

Instead, Fashion stole the spotlight as advertisers saw big growth in revenue. Up over 30% on Black Friday and by almost 26% over the whole weekend. And their affiliate partners also shared in some of the glory with commissions in the sector also growing by 26% over the Cyber Weekend.

Following in Fashion’s footsteps, the Sportswear & Fitness sector saw similarly positive growth too. Sales in the sector were up more than 25% on Cyber Monday with revenue clocking more than a 12% rise.

And for those of a more practical mindset, Home & Garden shoppers were also out in force. Sales and commissions were up almost 20% over the weekend with revenue growing by more than 25%.

5. Comparison sites to the fore as Black Friday decision fatigue sets in

A huge spike in traffic from comparison sites over Black Friday (up 62%) suggested a lot of shoppers were gravitating towards these sites as a means of simplifying their research. With many choosing to do their shopping at the last possible moment, it seems that comparison sites were the resource of choice for ensuring they could find just the right deal. Sales from this affiliate type were up 43% with revenue up almost 15%.

Loyalty partners also performed well. Sales were up almost 12% on Black Friday with revenue up by almost 20%.

By contrast discount code partners appeared to be neglected by shoppers this year. Traffic was down more than 10%, sales by over 3% and revenue by almost 8%. And despite a number of brands offering some hugely attractive cashback rates this year, overall sales on these sites declined slightly by 3%, though those that did buy were spending more with revenue up by almost 4%.

6. Brand partnership sales grow by a third with Europe leading the way

One of the recent success stories to have emerged from the channel in recent years has been that of brand partnerships. Piggybacking off the retail media wave, the chance for brands to co-promote fellow non-competitors, reach new customers and even monetise their own sites has been eagerly adopted by some.

Pioneered by Awin’s own award-winning industry leader and beginning to get real traction within the wider market now, this year saw global sales using the ad model grow by almost 33%.

The UK has been the pace-setter in the space and continues to grow rapidly with sales jumping almost 29%. With easy-to-use solutions like Tyviso making brand partnerships a plug-and-play tactic to deploy for brands, it’s easy to see why it’s attracting more demand.

The UK isn’t the only region where the tactic is taking off though. Germany and France both saw brand partnership sales grow by more than 110%, and in Benelux where there was growth of more than 34% the tactic now accounts for more than 5% of all affiliate transactions (the highest share of any market globally).

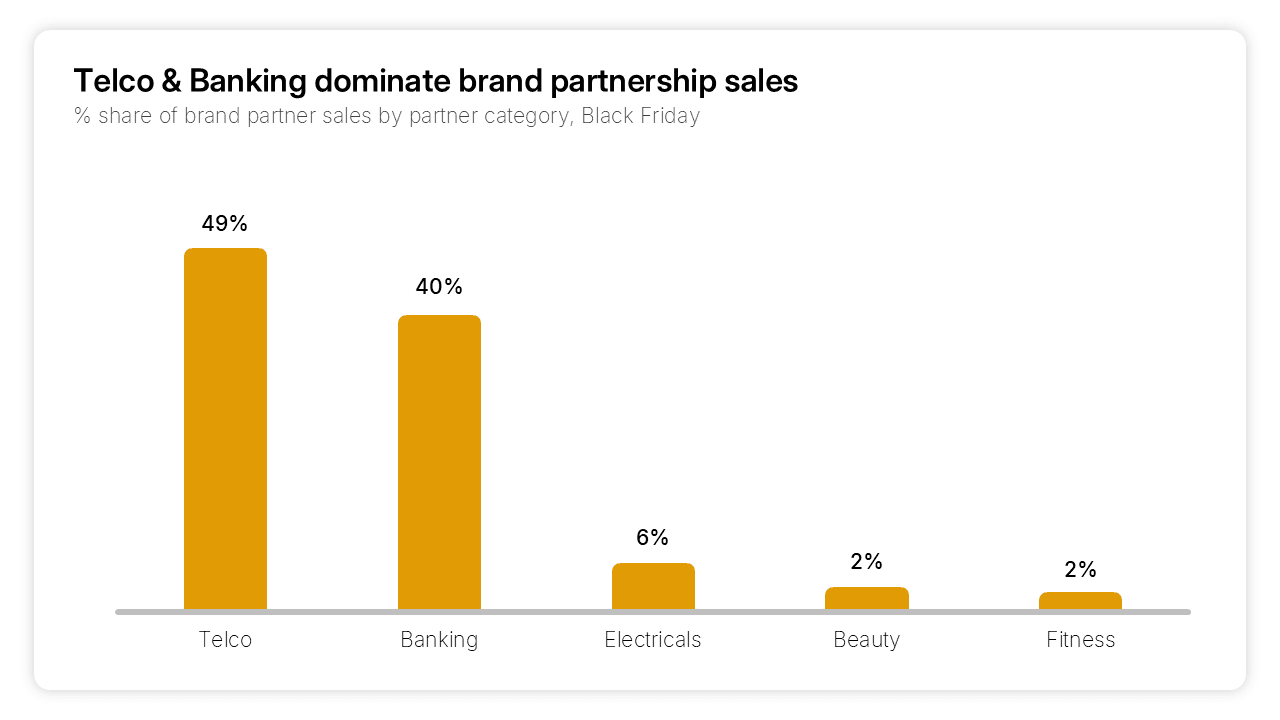

Looking beyond the regional lens and honing in on which sectors are thriving in the brand partnership space, Telecoms and Banking currently dominate the space as promoters of other brands. Combined, the two sectors accounted for almost 90% of brand partnership sales over the Black Friday period with Electricals, Beauty and Fitness bringing up the rear.

However, there’s a lot more variety when it comes to the sectors that are being promoted via brand partnerships. Sportswear accounted for 28% of Black Friday sales but was closely followed by Health & Beauty (26%), Department Stores (17%) and FMCG brands (13%).

However, there’s a lot more variety when it comes to the sectors that are being promoted via brand partnerships. Sportswear accounted for 28% of Black Friday sales but was closely followed by Health & Beauty (26%), Department Stores (17%) and FMCG brands (13%).

7. App tracking upgrades bear fruit for some over Cyber period

App tracking is a central pillar of Awin’s newly-launched Conversion Protection Initiative (CPI) which aims to improve tracking standards for all. It was therefore a topic which was front of mind for many brands and their affiliate partners as the peak period approached.

Overall, app sales were up around 1% across the entire platform over the Cyber Weekend on 2023’s figures, with smartphones once again dominating share of sales as the device of choice for shoppers. Shoppers’ preference for buying on mobile devices is now well-established with all markets recording more than half of all sales on mobile for the first time last year.

With app user experiences generally cleaner, smoother and more efficient the shift to app-based shopping is something that will only continue to grow. So, having affiliate app tracking in place is a must.

For the affiliate partner Zilch, who are in a unique position to see clearly the discrepancies in tracking where this isn’t in place thanks to their credit card data, improvements in app tracking with Samsung led to an astronomical increase in tracked sales.

As Sarah Holland, Senior Sales and Partnerships Manager stated, “At Zilch, we are delighted with Awin’s efforts to continually improve tracking. Together, we recently implemented app-to-app tracking with Samsung, achieving a 42% YoY increase in tracking over the Black Friday weekend. Overall tracking accuracy has now reached an impressive 98%. We look forward to seeing more and more brands improve their tracking and capture spend accurately!”

8. Travel sector thrives with tech partners while APAC brands jump on the tech bandwagon

Much has been made of the travel sector’s rebound this year. Travellers have flocked back en masse with holiday bookings once again very much on consumers’ radars despite the challenging economic times. With demand already in place, many travel brands face the challenge of serving this appetite adequately. Travel is one of the more complex and protracted booking journeys given its high purchase value and research required before committing to a booking

This is where affiliate tech partners can bring real value. Quick and simple to deploy via Awin, online advertisers can easily improve their own customer experiences by choosing from an array of different solutions. Customer service chatbots, product bundling, basket abandonment… the choice is wide.

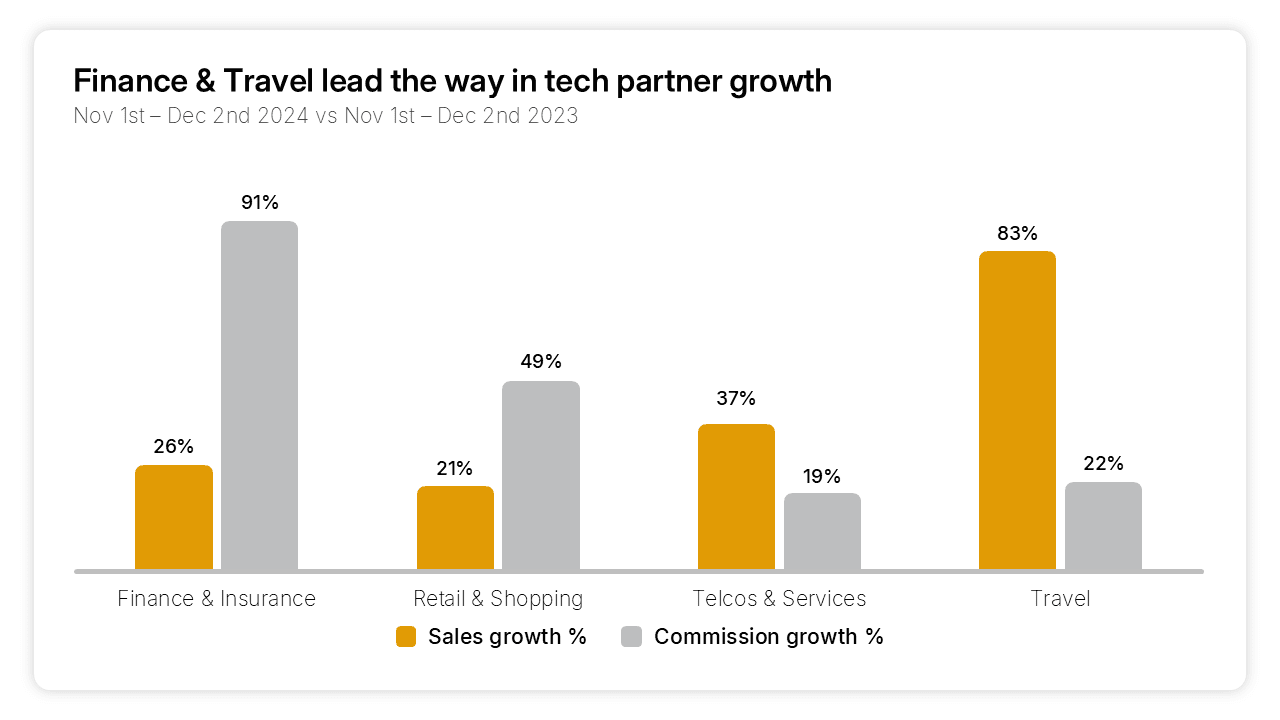

Sure enough, travel sector sales over the period generated by tech partners grew by more than 80% this year with ad spend growing by 22%.

Travel was not alone in increasing its spend in the space. Whilst the retail sector remains where most tech partner activity occurs, the Finance sector also got in on the act. Sales in that sector were up 26% while commissions grew by more than 90%.

The UK and US remain the market leaders for tech partner adoption and investment in absolute terms (the US more than doubled its spend with tech partners this year) but there were some notable jumps in other markets too over the Cyber Weekend. Brazil also doubled its investment in the space while advertisers in the APAC region invested 8 times more in this space than in 2023.

To review more of Awin’s performance data over the Q4 period yourself, take a peek at our interactive report. Filter to your market or sector to get a more custom view of how shopping trends are evolving on a daily basis.