Between the sheets: 1166% YoY sales increase for DTC erotic brands

Written by Johanita Dogbey on 3 minute read

The erotic sub-sector witnessed peak performance growth for online DTC brands during the pandemic.

Key takeaways

- 1,166% YoY increase in direct to consumer erotic product sales

- £290k spent on erotic products by consumers via the affiliate channel

- £21 increase in average order value for erotic products

- £7 return on investment for every £1 invested into affiliate activity

- 233k customer visits (clicks) to erotic brands, with 2% conversion rate

- 58% of erotic product sales from Content & Blogger affiliates

Let's talk about sales baby. The coronavirus pandemic helped to accelerate the digital growth of numerous retail categories, but none more so than the erotic sector. With extended periods of isolation and imposed lockdowns often separating sexual partners for weeks on end, shoppers turned to sex toys and other erotica to fulfil sexual pleasures. And with brands offering sex dolls, dildos and other erotic products direct to your door, it’s not surprising to see the growth in direct-to-consumer (DTC) erotic brands - despite the risk of an awkward encounter with the postman.

Research by Allied Market Research estimates that the global erotic sector will be worth an expected £32 million by 2028, growing at an annual rate of +5.8%. As a result, an increasing number of brands are looking to broaden their customer reach via online digital channels.

The lust sales landscape

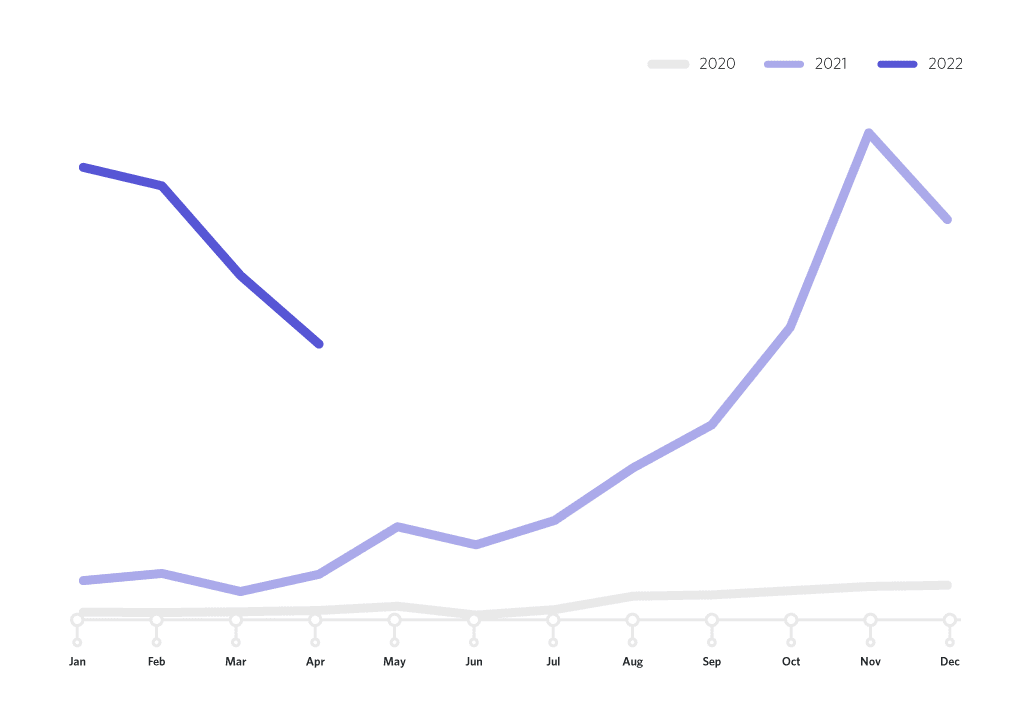

Data tracked onto the Awin network shows that online erotic product sales increased by +1,166% last year, with customers spending over £291k with online DTC erotic brands. Despite the astronomical growth of 2021, performance between January and April 2022 has also seen a continued increase, up +958% on the same period last year. Online sales for erotic brands and products peaked in November 2021, aligning with Black Friday as the key online trading period for retailers, with a +1,585% YoY increase vs. November 2020.

AOV peaks at £69 per transaction

Unsurprisingly, the growth in sales also coincides with an increase in the average spend per transaction. In 2020, the average order value (AOV) for erotic products was £44, increasing to £65 by the end of 2021. Since then, AOV has increased further with the average spend per transaction now at £69. With customers now shopping more frequently for erotic products online, and spending more per transaction, demand for sex toy products could be a continuing trend in the coming years.

Content outperforms traditional affiliate types

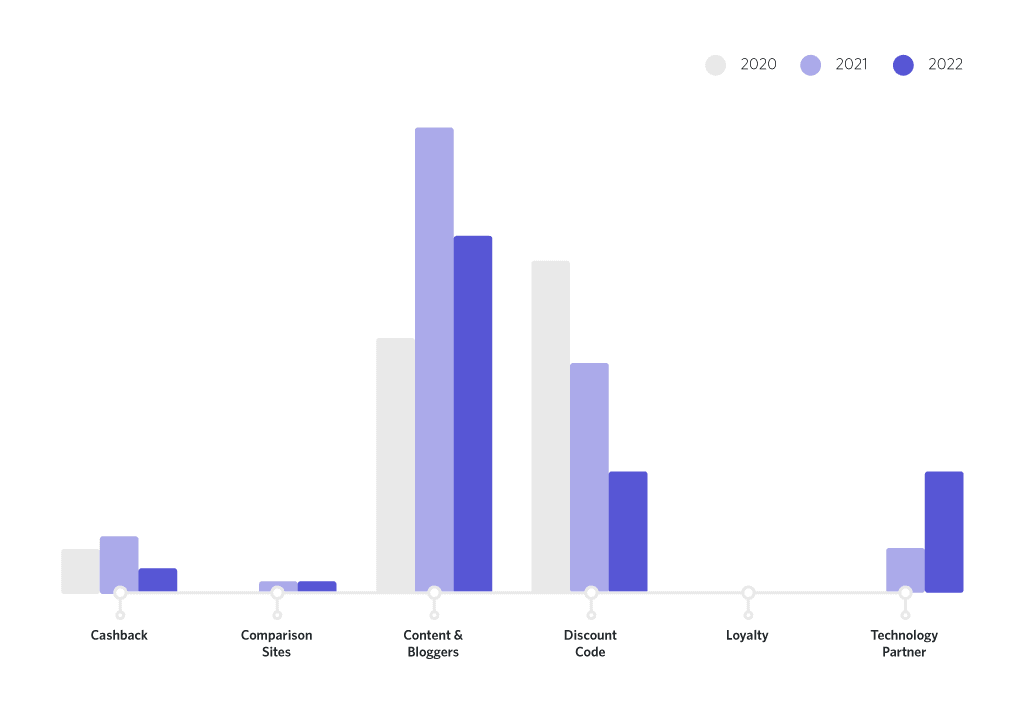

Delving into the affiliate types supporting the growth in online erotic sales performance, Awin data indicates Content & Blogger sites account for more than half (58%) of all online erotic sales. Discount Code affiliates account for 23%, and Cashback at 7%.

The dominant share of sales from Content & Blogger affiliates, including niche content sites, is testament to the digital adoption that these online erotic brands have taken. Customers are entrusting editorial sites when conducting product research, using blogger recommendations and reviews to inform their erotic purchase decision.

Top publisher performers

Content & Bloggers

Discount, Cashback & Loyalty

Technology Partners

For more information on DTC erotic market trends, please get in touch with a member of the Awin Client Partnerships team.

Sign up to The Pulse newsletter to keep updated with new sector trends and industry insights.