First and foremost, our findings show ITP is not focused on affiliate links. However, this statement comes with a disclaimer. ITP is an “intelligent” system; just because there does not appear to be a current impact on affiliate links doesn’t mean there won’t be in the future. Because of this, we plan to regularly test links on all Apple devices to stay up-to-date on any new developments.

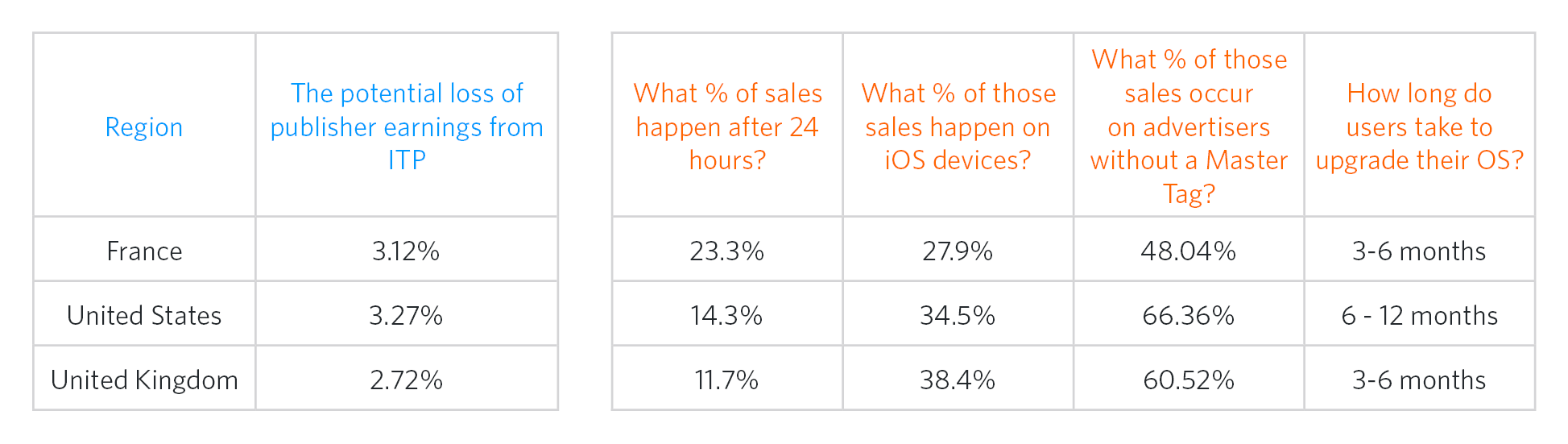

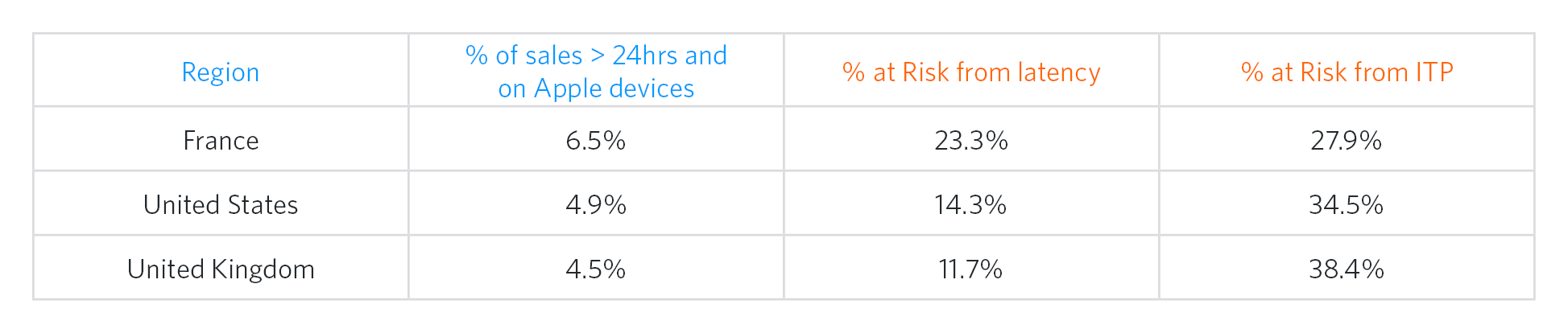

It is appropriate to explore the worst-case scenario should ITP begin to impact affiliate links. For Awin, the potential impact is actually quite small, with approximately three percent of all Awin sales made on Apple devices and using Safari browsers, with a latency period of more than 24 hours and with advertisers who rely entirely on third-party cookies for their tracking.

The reason ITP has become such a talking point (it’s not every day an operating system update generates 5,000+ comments on reddit) is it has the intentional aim of preventing tracking after an initial 24-hour period. This is hugely at odds with affiliate marketing standards, where sales are traditionally attributed after the 30-day cookie window. The legitimacy of this is an entire discussion in its own right, but it’s safe to say many purchases are considerably more complex than the final 24 hours preceding the purchase decision.

It is no surprise that the US Advertising Bureau and US Association of National Advertisers – as well as the UK’s IAB – have written an open letter in AdWeek, stating their discontent with Apple potentially limiting tracking activity. You can read more about that letter, and Apple’s response here.

Changes to ITP are anticipated by Awin, and as the first performance marketing network to develop fingerprinting and cross-device tracking, work has already been done to mitigate the impact of this on the affiliate community.

There are three critical factors when considering the impact of ITP to affiliate link tracking:

- The volume of sales occurring after the 24-hour cut off period

- The usage of Safari-enabled devices on this subset of transactions

- The method of tracking an advertiser uses

Volume of sales occurring after the 24-hour cut off period

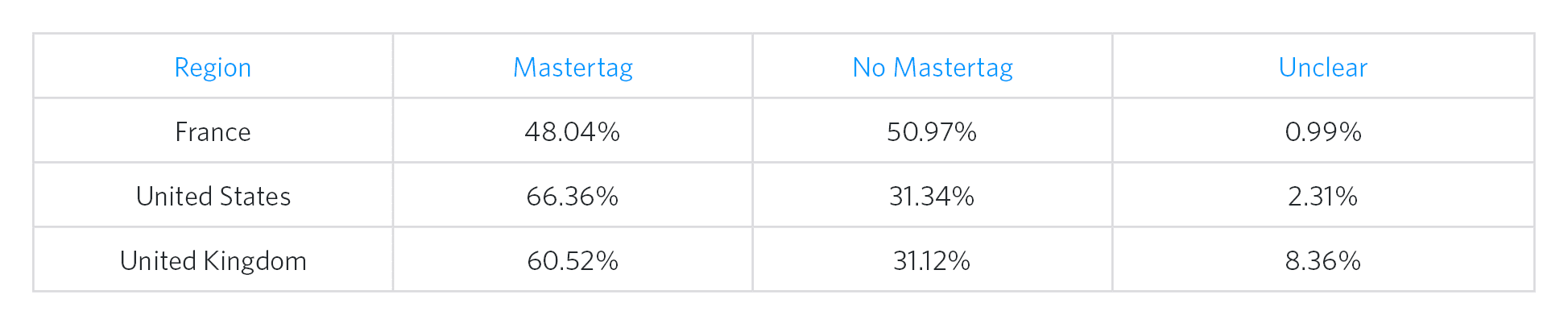

Using data at Awin’s disposal, we honed in on three of our 15 territories, as they represent three different affiliate markets and can give a good pulse of how the industry could be impacted: France, the US and the UK. First, we examined what percentage of sales in these three regions occur more than 24 hours after the last affiliate click.

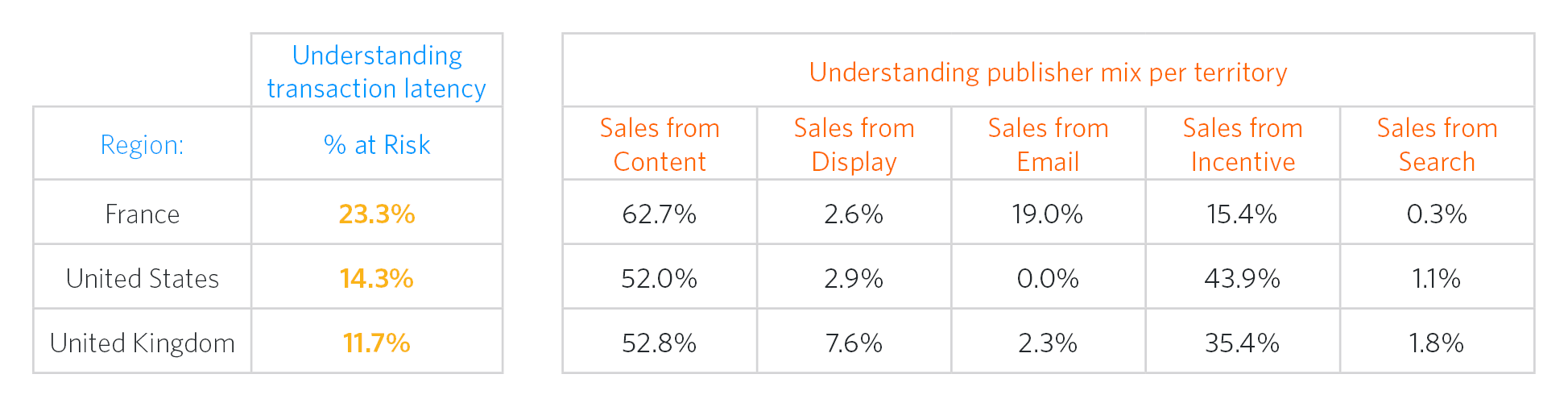

Differences in sales occurring outside of the 24-hour ITP cookie period vary based on the type of publishers prevalent in each specific region. The more varied the publisher mix and the lower the share of content publishers, the less impactful ITP would be, should it start to block affiliate tracking.

Sales from Apple devices

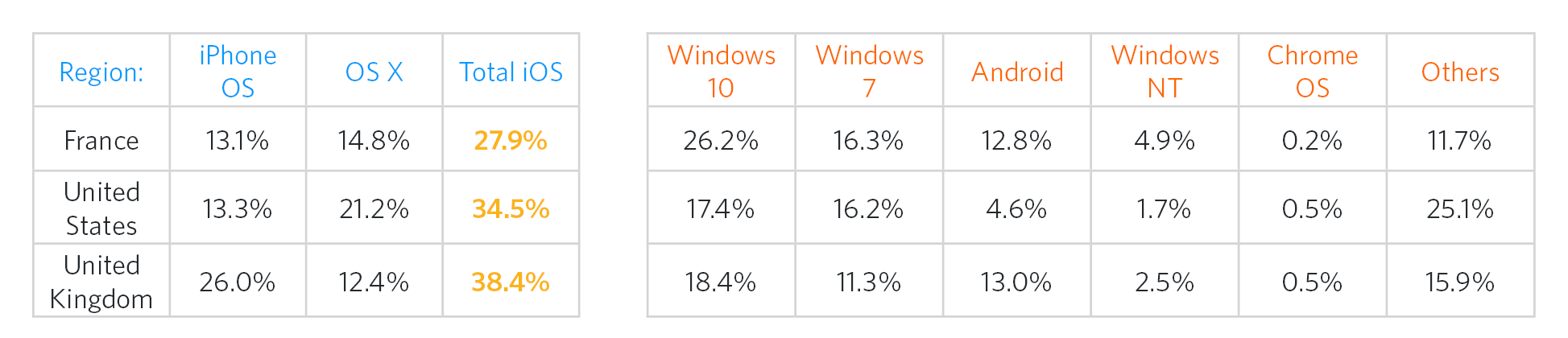

The next factor to consider is which operating systems are used for transactions that occur outside of the initial 24-hour cookie window.

When we examine specific transactions occurring 24 hours after the initial click, the presence of Apple operating systems varies quite noticeably between France, the US/UK. By combining these two territories, we start to build a much better picture of how much risk publishers in each territory face.

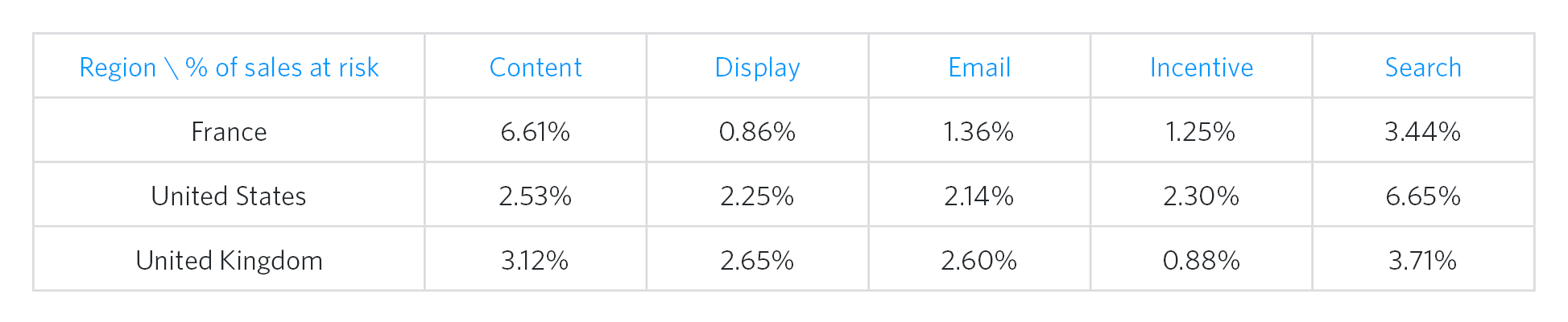

Types of tracking used

Most traditional networks use cookie-based tracking, albeit with additions like cross-device tracking, fingerprinting, etc. For cookie-tracked programs, the way they fire a network’s tracking pixel also impacts what effect ITP will have. Simply put, advertisers who allow network tags on their website unconditionally (i.e. for all their traffic) will be less impacted because the network can serve first-party cookies from the advertiser’s own domain. This is how Awin’s Mastertag solution works. It’s worth noting, advertisers that track using server-to-server are likely to entirely avoid the impact of ITP since it’s a cookie-less tracking solution.

With our three data sources explored, what is the worst-case scenario for the final impact of ITP? In truth, it varies a lot by publisher type and tracking method. Those most affected are search and content publishers, which aligns with where we would expect to see those publishers in the overall purchase funnel.

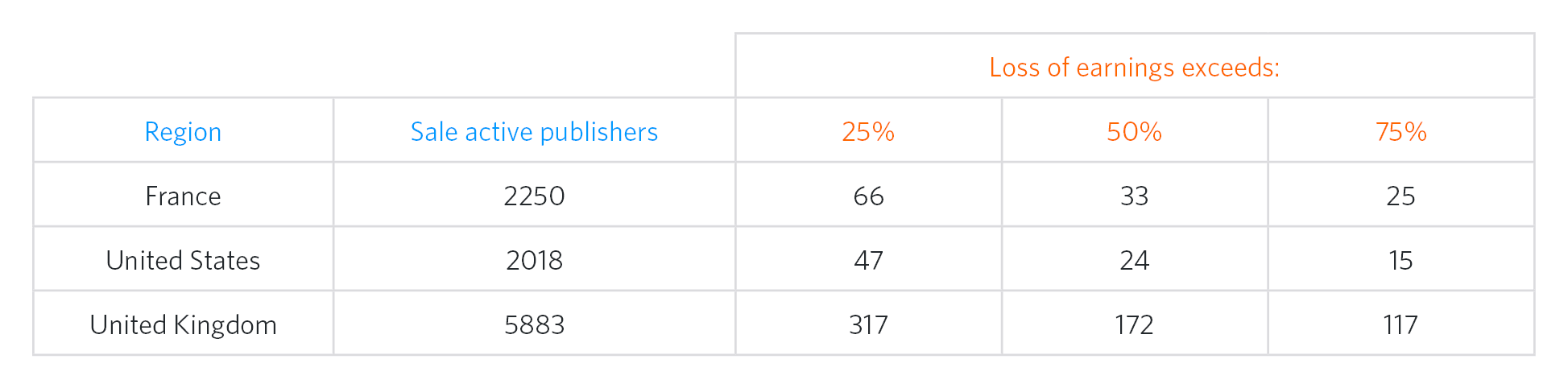

Stats grouping all publishers together don’t always tell the whole story. There are some publishers more affected than others. Below we can see the distribution of how impactful ITP could be across sales-active publisher bases in each of these countries.

In the UK, it’s sad to see almost one-in-10 publishers could face a 25% earnings loss from affiliate marketing if ITP decides affiliate tracking is cause for consumer concern. Thankfully, this has not happened. Our fundamental belief is affiliate marketing is in a strong position to remain unscathed as regulation changes and browsers start empowering consumers. Awin’s payment models and use of sales validation periods mean our channel must deliver value to consumers or it fails, shielding the industry from consumer ire often directed towards other, more-intrusive advertising methods.

Regardless of potential impact to affiliate tracking from ITP, what’s clear is the importance of continual investment in tracking, something Awin is passionate about and determined to improve in the coming months.