Awin Black Friday 2024 trends and predictions

Written by Alfie Staples on 13 minute read

Alfie Staples, Senior Global Insight Manager at Awin, shares ten top predictions for 2024’s Golden Quarter.

As the busiest shopping period of 2024 approaches this year, several key trends are poised to shape the retail landscape. 2023 was plagued against the backdrop of quickly rising inflation, threatening margins and marketing budget. But as we enter Q4, global pressures have eased.

The question remains: has consumer confidence increased enough to save the big day?

Awin’s global experts have put together their top 10 predictions to this year’s peak shopping period.

1. Will interest rate cuts boost consumer confidence this Q4?

With the Fed’s first interest rate cut in four years announced in September, and inflation cooling from its peak in 2022, it appears the central bank will look to continue to cut rates in the near term.

Those decreases in the cost of borrowing may take some time to trickle through the economy and stimulate shopper’s wallets, but the symbolic importance of that first rate cut may be the boost to US shopper confidence needed to prompt many to take advantage of Black Friday’s alluring offers.

Across the pond consumers (and marketers) will be anxious to hear the Bank of England’s verdict regarding interest rates in early November. After a positive reduction in August from a 16 year high of 5.25% to 5% its impact for more than half a million homeowners could be substantial, providing a few extra pounds in the pocket for consumers on variable tracker mortgages across the festive period.

Meanwhile, the EU jumped first and the European Central Bank (ECB) announced a cut in its main interest rate from 4% to 3.75% in June with another cut to 3.5% announced last month which could also bolster European spending over Cyber.

2. Late Black Friday brings Christmas closer and may shift buying motives

It’s been noted before how, despite Black Friday’s proximity to Christmas, the event has maintained a strong strand of ‘self-gifting’ from shoppers, as they buy personal items they’ve shortlisted for some time with the aim of getting a better deal.

That characteristic may alter this year as Black Friday’s late scheduling brings it that much closer to the Christmas run-up. With gifts for friends and family more of an immediate priority will we potentially see less ‘self-gifting’ and more buying presents for others? Or will we see both, driving up sales and revenue volume as shoppers tick off their gift lists and personal shortlists over the Cyber Weekend?

In an attempt to prevent too much concentration of activity over the weekend many brands may consider stretching their promotional campaigns over a longer period. Commencing earlier in the month than they might normally go live in order to not have performance targets all riding on the last weekend of the month.

3. BNPL’s 2023 success to continue despite pay checks landing in time for Black Friday

Last year we noted the popularity of BNPL affiliates across the Awin platform. Sales revenue generated by these affiliates globally over the Cyber Weekend grew by more than 40% in 2023.

But will the success of these partners still continue in 2024?

The fact that Black Friday falls later this year may be a factor. Falling later in the month means most workers will have received their pay checks in time for the big sales date as opposed to last year when many shoppers may have instead resorted to using BNPL methods to pay for their items. Despite this, one of Awin’s top BNPL partners, Zilch, is still optimistic. James Cartlidge, Sales & Partnerships Director expects consumers to “continue looking for seamless shopping methods and smarter ways to pay, that's why we’re predicting sales across Black Friday Week to climb by 80% compared to last year.”

From an affiliate perspective it’s worth bearing in mind that much of the affiliate activity we track from these partners is related more to their reward and offer pages than it is to their core credit offerings. With some BNPL partners increasingly valued as shopping ‘super-apps’ for consumers and a go-to destination for deals, performance from these affiliates may continue to thrive.

4. Tech partners to accelerate the death of site-wide discounts

In Black Friday’s early days it wasn’t uncommon to see a retailer or brand website draped with ‘30% off everything!’ messaging everywhere. The perceived need to draw in customers with a compelling offer led many advertisers to resort to blunt sales tactics that often hurt margins but ensured revenue generation and new customer acquisition.

These days things have become a lot more sophisticated, particularly when it comes to discounting. Partly that’s because of a maturing sense that Black Friday isn’t the sole day of shopping anymore. The peak has elongated across an entire month and there is an increasing sense from consumers that some of the deals may not always fit their personal needs.

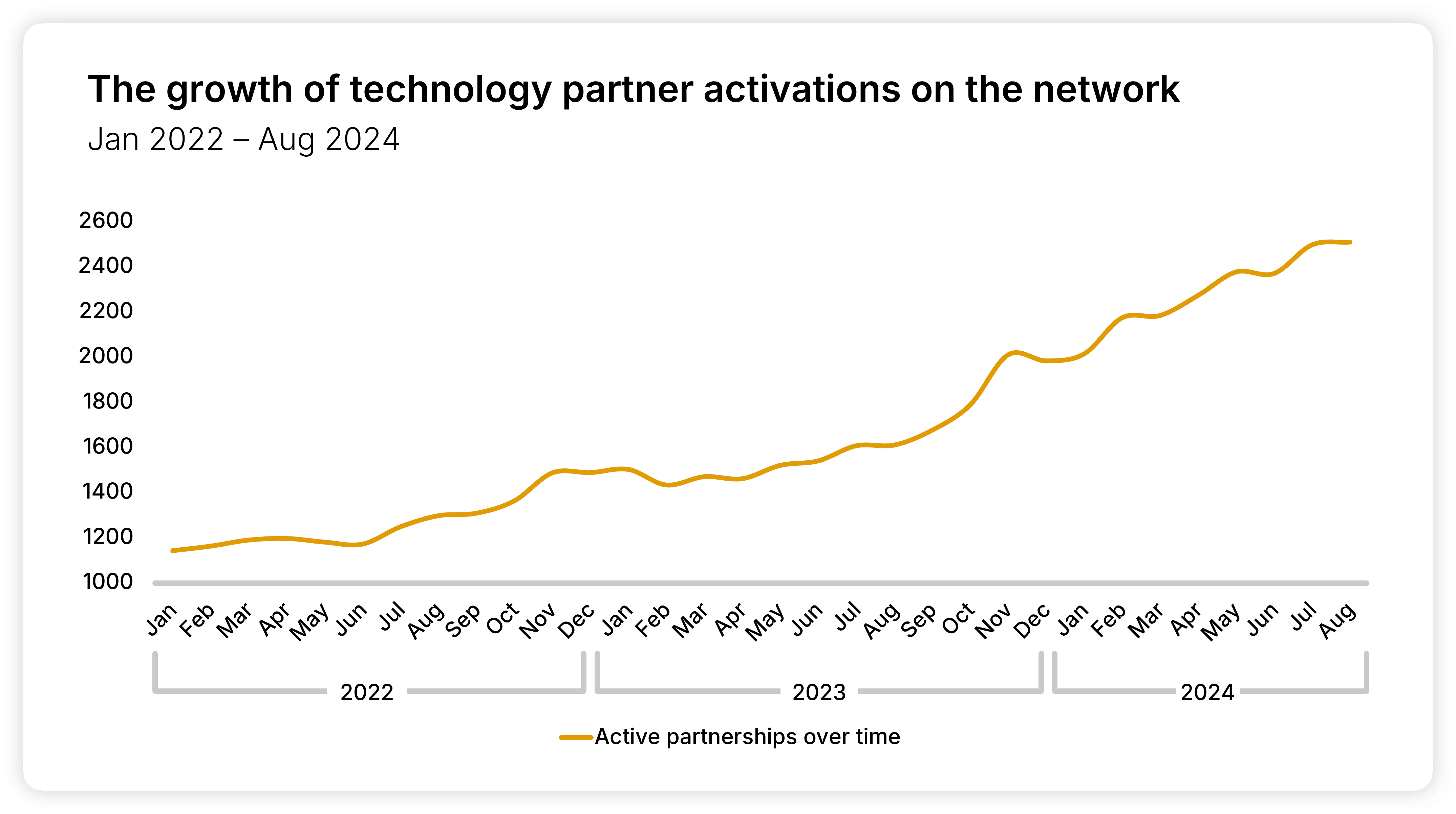

With that in mind, tech partners' ability to personalize offers, making them easier to execute on-site, is contributing to their own growth.

Affiliate solutions like intent.ly, UpSellit and SaleCycle are experts when it comes to personalizing offers to site visitors and can be deployed with a single click via Awin. And the steady growth of adoption of these technologies by Awin brands in the last couple of years is a clear indicator of their value to them.

5. AI developments and ‘Big Tech’ shake up the affiliate channel

AI has changed many aspects of affiliate marketing for advertisers and publishers alike. However, players outside of the channel and developments in the AI models themselves are likely to have a knock-on effect on affiliates in Q4.

Paul Stewart, Awin’s Group Strategic Partnerships Director predicts: “Google curating discounts as a refined list in search results via Gemini could in turn lead to lower volumes from seasonal SEO publishers that have URLs that do well this time of year.”

While this blanket approach from Google will have its own negative effects, the impact of AI within the affiliate domain will play an increasingly important role in brands' strategies, with a more refined, mature and customized approach.

As Paul comments: “More retailers will leverage AI to offer highly personalized shopping experiences. To be more specific, expect to see AI-tailored recommendations (ChatGPT or other LLMs being used as starting point for gathering discounts from across the web). On-site dynamic discounting powered by AI as well as more chatbots assisting with customer questions in real time will also be more prevalent.”

Tech partners offering personalization solutions (mentioned in the previous trend) alongside the likes of Envolve Tech, who offer an AI-driven shopping assistant, are likely to be core pillars in brand strategies.

Also, expect AI to play a larger role in interpreting customer behavior and tailoring shopping experiences based on those learnings. Companies like Qubit provide a machine learning model that creates custom user journeys using real time and historic customer data.

6. The rise of influencers as ‘promo players’

The influx of influencers within the affiliate channel is not new news. However, our analysis of this affiliate segment earlier in the year did reveal some detail about these partners which may come to bear during this year’s peak period.

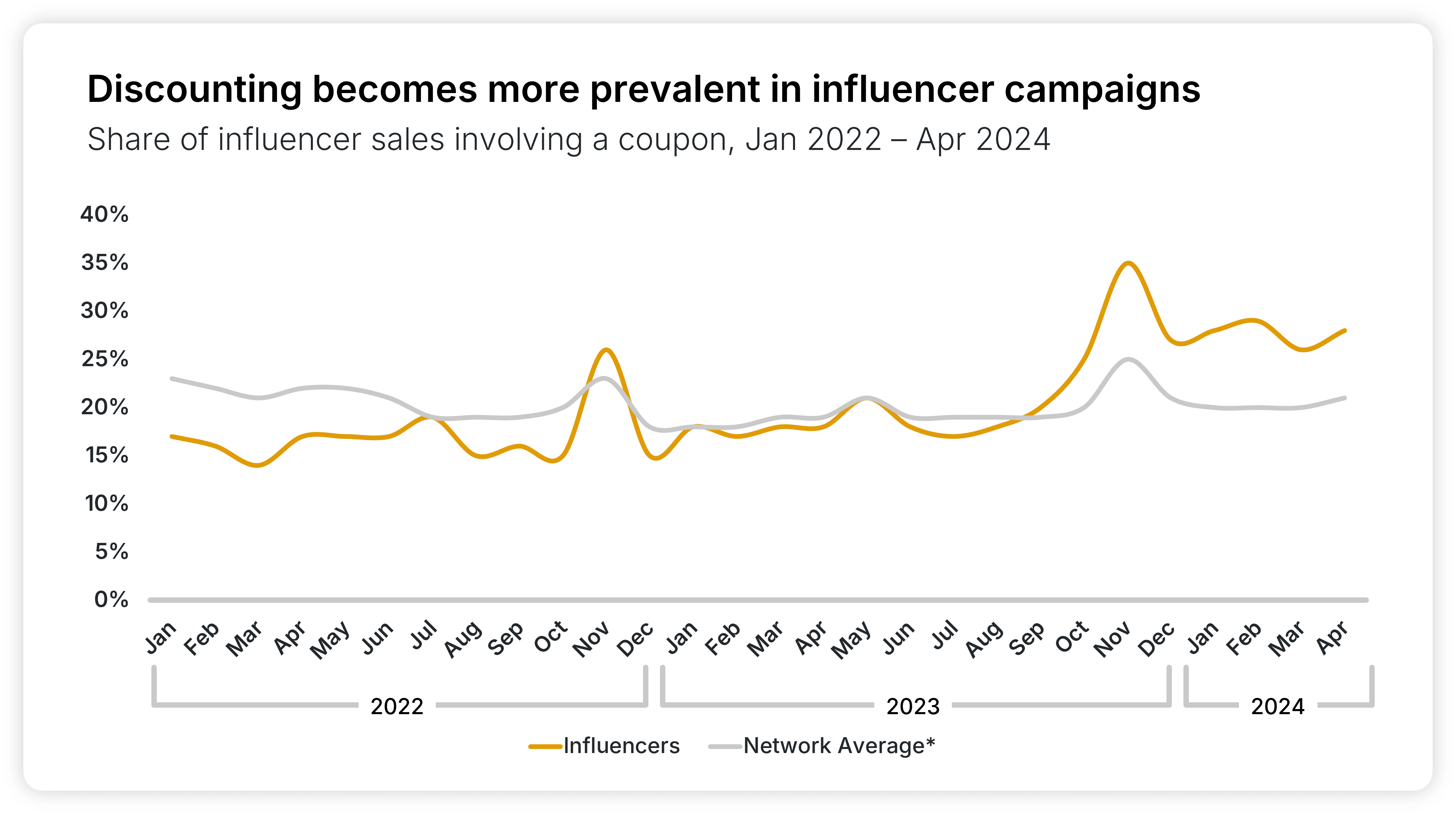

Notably, while the general characterization of influencers and creators is that they tend to operate in more of a brand-building phase of the purchase funnel, the reality is increasingly more nuanced than that. Specifically, it’s worth recognizing the fact that a growing number of sales attributed to influencers involve a coupon code of some sort. And, as the chart below illustrates, that trend is particularly pronounced around Q4 and November. In fact, influencers on Awin’s platform are now generating sales involving a coupon much more frequently than the platform average for other partner types.

What does this tell us? Well, for one, it’s yet another indicator that shoppers are increasingly comfortable with buying directly from influencer recommendations via social platforms. These spaces are becoming more and more a commerce-friendly environment, and shoppers clearly find the codes influencers are posting useful.

Secondly, with a dizzying array of offers available online over Q4, shoppers seeking guidance are happy to defer to these authorities. Smaller influencers in particular are of value here. Data from Magic Numbers suggests the ROI from those with a following of ~5k followers sits at £18:1 ($24:1). Yet this drops to just £6:1 ($8:1) for those with ~20k. Niche influencers with ardent followings are where your best bets lie over Q4.

7. Travel’s bounce back set to continue thanks to TikTok and Travel Tuesday

Travel Tuesday, a day for discounts on travel products following Thanksgiving, has been gaining steam since 2017. But it’s in the last couple of years with it being eagerly adopted on TikTok that the event has really started to establish itself as part of the Q4 peak.

The travel market has witnessed a resounding return to form this year following some tough years during and coming out the Covid lockdowns. Awin has seen the travel sector bounce back rapidly this year as we noted in our Insight of the Month piece back in March. With Travel Tuesday set to take place on Tuesday, December 3rd this year, we expect to see this strong trend continue.

8. Gen Z and Millennial consumers will 'splurge' this Cyber

Gen Z and Millennial consumers are always a key demographic to target for marketers but this Cyber will see them be the key deciding factor regarding advertiser wins and losses. It is to be said that data from the US finds that all demographics are feeling more optimistic about economic conditions, the amount of people feeling “optimistic” about the economy rising from 33% in May to 41% in August 2024. However, while crucially this combines all demographics, segmenting down to Gen-Z, Millennial, Gen-X and finally Boomers tells a more nuanced picture.

Millennials and Gen-Z are most likely to “splurge” on key vertical items such as apparel, beauty, electronics and shoes. In fact, across the board Gen-Z and millennials saw a 13% and 18% increase on intent to splurge from Q2 to Q3 2024, while older demographics saw just 4% average growth. However, it must be noted that this data is excluding UK and Euro participants, nonetheless, with interest rates coming down gradually and inflation becoming more manageable across all regions, it's it likely these trends will persist in the UK and EU also.

This means that marketers should be focusing on more diverse creative avenues this Cyber to reach their target demographics. Gen-Z and Millennial consumers are least likely to research products traditionally through price comparison or discount websites with 22% saying they choose this option in comparison to 32% of boomers. Meanwhile, 44% of Gen-Z consumers utilize Social Media to research products compared to just 10% of boomers. However, despite their differences they do have commonalities. Retailers’ own websites remain a valuable source of product information during the search across all generations, so optimizing your customer experience on site will be key regardless of who’s visiting over peak.

9. Live shopping hits the West after years of popularity in China

Live shopping isn’t a new concept, having existed even before the start of affiliate marketing; however, in recent years, it has found its footing in the affiliate landscape.

Since 2016, its uptake has been rapid in China, evidenced by live shopping events accounting for around 20% of ecommerce on Singles' Day 2023. While it has seen a meteoric rise in the East, Western adoption has been slower by comparison, with technological costs and investment often cited as the primary reasons, followed closely by the challenge of quickly building a community between brand and consumer.

So, why will 2024 be a starting point for live shopping?

Over the last 12 months, technology partners such as Contester have become synonymous with innovation and efficiency, utilizing ready-made technologies and creators to ease the pain points that previously plagued the live shopping experience for marketers, making these partnerships more fulfilling for all parties involved.

In combination with this, interest in the medium has grown in 2024. 46% of US consumers currently express an active interest in live shopping events, especially among young shoppers (18-34), with 56% showing an interest in live streams when shopping, especially given its unique ability to entertain, inform, and allow consumers to interact with their favorite creators - a continually important trend we highlighted here.

According to Hadi Alavi, CEO of Contester consumers in 2024 are seeking “not just the cheapest option anymore, but demand authenticity throughout the entire consumer journey, from pre-purchase education, shopping and finally the post-purchase experience.” Live shopping addresses all of these points simultaneously, and with more global brands utilizing streams, it’s hard to imagine this trend fading anytime soon.

10. Retail media becomes a new source of revenue for brands via affiliate

Retail media is a hot topic within advertising. A recent report published by dentsu showed retail media increasing 32% year-on-year and EMARKETER projected its ad spend reaching $171bn by 2027.

Retail media is defined as “an advertisement strategically placed on a retailer's ecommerce site to positively influence customers precisely at the point of sale.” In the past, this form of advertising was primarily purchased by advertisers who were already selling products on the retailer’s site, in order to boost sales and awareness.

More recently, these placements are being acquired in order to target specific customer groups. According to Merkle, 63% of retailers have brands using their networks in this way. Brand partnerships at Awin function in a similar manner. Partnering with another complementary brand allows you to benefit from their first-party customer data, increasing your reach and potential customer base.

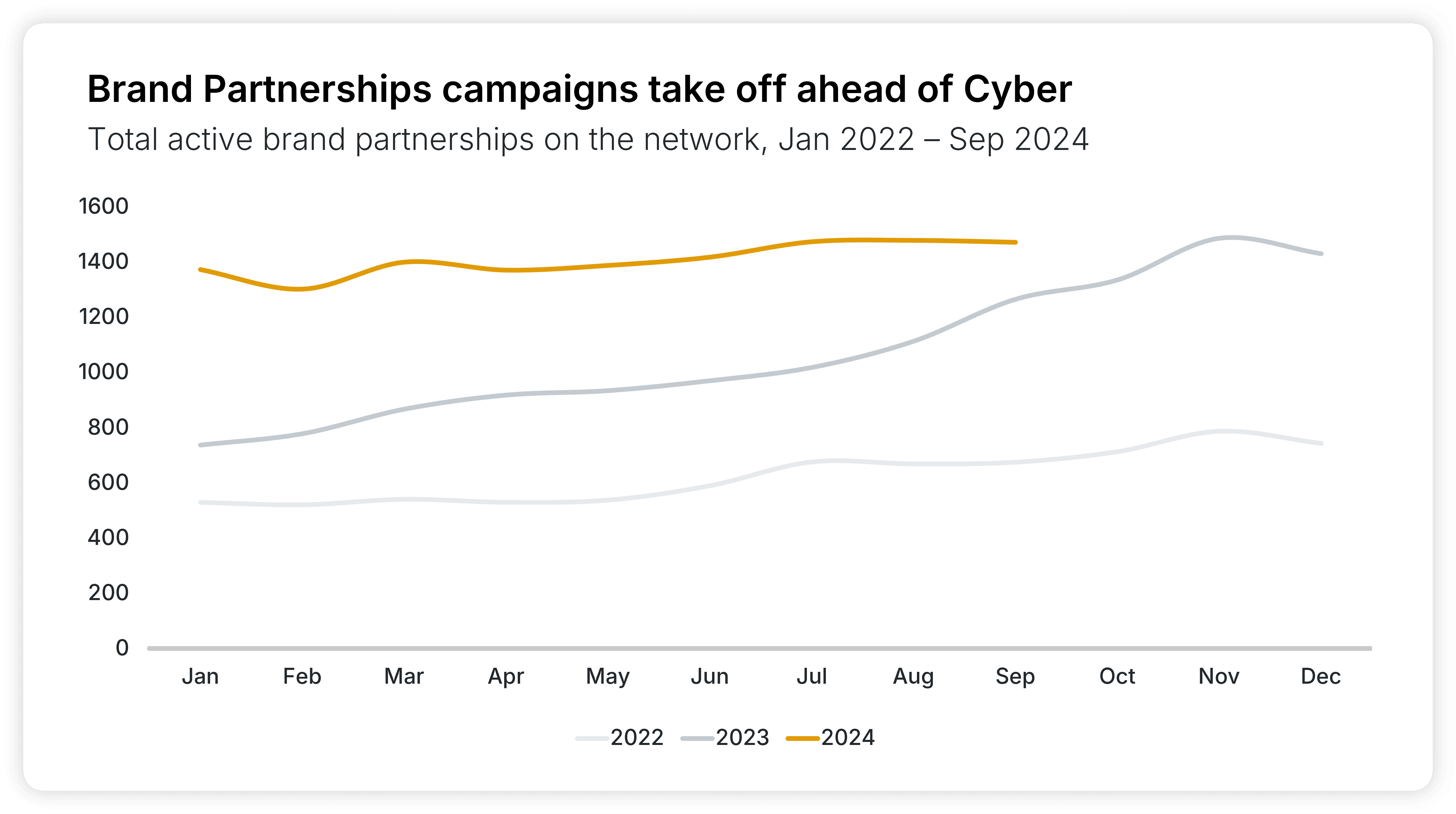

As pressure mounts on advertisers to find new revenue streams come Q4, we expect an uptick in brand partnership campaigns as advertisers search for like-minded brands to mutually benefit from. In the previous two years, we’ve seen active brand partnerships increase in Q4, with 2023 seeing a particularly strong increase. Alongside a much greater number of brand partnerships throughout the year, we expect to see a similar uptick in brand partnerships as Black Friday approaches.