Content versus conversion: why we need to talk about voucher codes

Written by Matt Swan on 8 minute read

It is an age old debate within the affiliate channel – What value do voucher code sites add and should they be allowed to overwrite other types of affiliate? Before we address those points, it is important to understand the extent of cookie overwriting within the affiliate channel.

For a number of years we have published data that exposes the likelihood of an affiliate losing out to another affiliate because they aren’t the last referrer in a transaction. While this overwriting obviously occurs sometimes, people are often surprised that typically 80-90% of affiliate channel sales only have one affiliate interaction.

Furthermore, when we analyse those customer journeys that have multiple affiliate interactions, typically the touch points are within the same promotional type. When a voucher code is the last referring affiliate type, for example, it is more often than not another voucher code site that was the preceding touch point.

A further point of reference is that often overwriting research is done in isolation without considering other digital touchpoints, across additional channels such as paid search and email. A true understanding of how consumers are transacting online should be done with the inclusion of this data.

Earlier this year we launched a white paper, ‘Are you receiving honest rewards for honest sales?’, which investigated the key reasons behind advertisers declining transactions. One of the largest factors that contributed to sales being rejected was the use of an unauthorised code, typically a code that was exclusive to one affiliate that was then used via another affiliate interaction, or a code that was not released to the affiliate channel.

Using this data, this article considers the cross over between voucher code sites and how content publishers have been impacted by discounting.

Interaction between voucher code affiliates

As mentioned above, when a voucher code site converts a multi touch point sale it is typically another voucher code site that is ‘overwritten’. Looking at the data for a large advertiser on the network it has been possible to see the cross over.

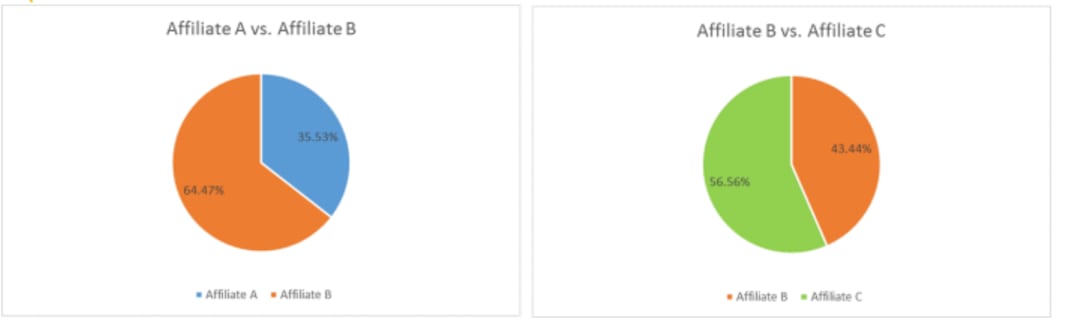

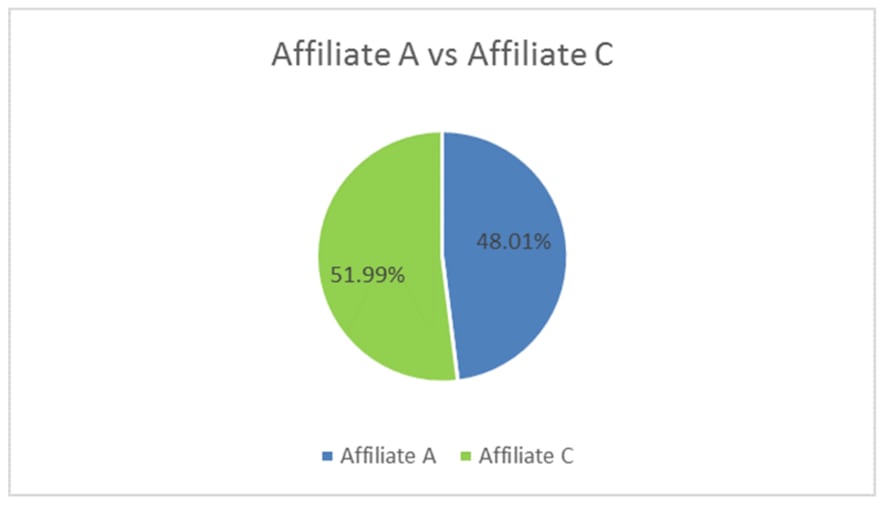

The following charts consider the interactions between three voucher code affiliates where they have been involved in multi interaction sales.

Affiliate B converts 64.5% of sales where Affiliate A is also involved, while when there is cross over with Affiliate C, their share of conversion drops to 43.5%.

Interestingly when the two voucher code affiliates that are involved in the sale are A and C, the splits of the converting affiliate are fairly even.

There are certain aspects that will influence which affiliate is more likely to convert a customer where there is cross over between voucher code sites. For example their positioning in the search results as well as how influential additional traffic sources like email are will have an impact upon customer journeys.

The most important aspect of course will generally be strength of offer, and if one affiliate has an exclusive offer over another, the chances of converting a sale increases.

Impact of voucher code activity on content sites

With price conscious consumers and the rise of discounting, it is no surprise to see there is overlap between incentivised traffic sources. With consumers searching for the best deal they are keen to check the offering across multiple voucher code sites before making a purchase.

What is more concerning for the channel is the impact of discounting upon so called content sites.

While advertisers are always looking to increase their base of content sites, they have also contributed to the rise in overwriting that is so prevalent within the channel. They have been influential in shaping consumer behaviour to search for codes. By presenting visitors with an option to apply a discount code, it is often said that consumers are encouraged to search for a code. Voucher sites that have strong search listings are more likely to overwrite other affiliate types such as content as a result.

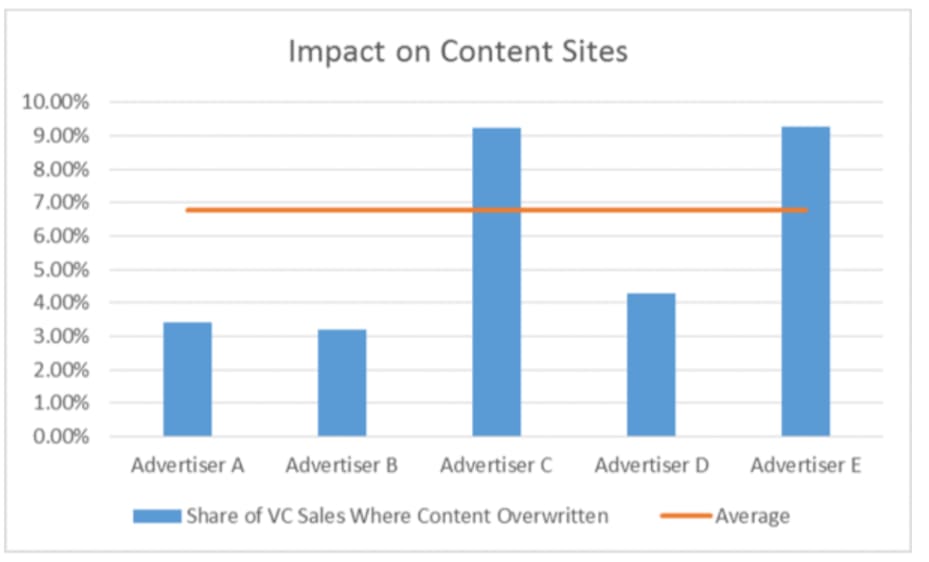

The following charts consider the impact of voucher code sites on content affiliates. Looking at five advertisers, content sites are overwritten to a varying degree. Each advertiser’s voucher code strategy and the volume of codes they issue will have a significant impact on this.

Advertiser C and Advertiser E see around 9% of the voucher code sales they convert have the preceding click from a content site. However, this number drops to 3% of sales for Advertisers B.

Taking the average across the five advertisers, 7% of all sales attributed to a voucher code site had a content affiliate touch point prior to the conversion.

It’s important to stress that while we can clearly see a trend of overwriting between voucher code sites and content sites, the volume of sales involved is small.

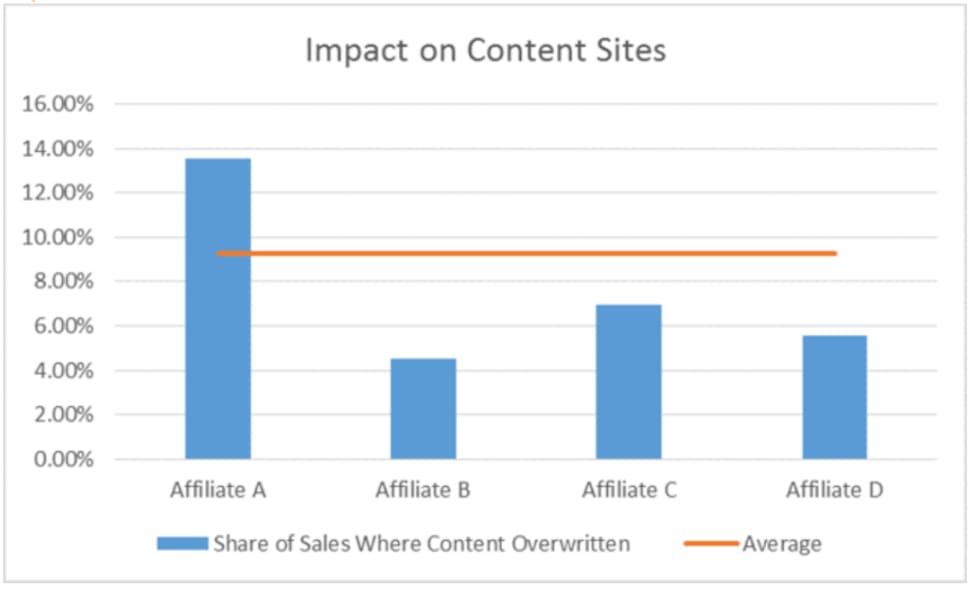

Looking at Advertiser C in more depth, this also varies significantly by affiliate. Affiliate A has overwritten a content site in almost 14% of their sales while for Affiliate B this is just over 4%. Again, the voucher code site’s strategy, traffic sources and positioning within the search engine results has a significant impact upon this.

Consideration of latency when determining influence

A key metric when considering the influence an interaction had upon the sale is the latency time between a click and a conversion. For example, where there is an interaction with a content site prior to a voucher code site converting the visitor, if there is a minimal lag time between that click and the transaction it is likely the voucher code site had a limited influence upon it.

Again this goes back to the behaviour that is encouraged by advertisers asking visitors if they have a voucher code right at the point of purchase.

Where the voucher code had minimal involvement in converting the customer, is it right for the content site to lose out on the commission they would have earned?

Rewarding content sites for influence

Advertisers are always keen to engage content sites yet often the last click model is counter intuitive. By the nature of content sites they are more likely to drive early funnel, influencing traffic and with the rise of

Advertisers are always keen to engage content sites yet often the last click model is counter intuitive. By the nature of content sites they are more likely to drive early funnel, influencing traffic and with the rise of mobile a significant proportion of their clicks will be through smartphones.

On a last click basis, their involvement can go largely unrewarded. It is important for advertisers to understand their role as influencers and reward them accordingly. It is only a small step but the launch of Awin’s payment on influence model goes some way to rewarding content sites further for their involvement in the path to purchase. A lot more work needs to be done in this area, especially when there will be a number of occasions where they have been overwritten by an incentivised traffic source.

Assessing the value of voucher code sites

While we can question the value that voucher code sites offer when overwriting a content click, there is no denying they are extremely valuable partners.

There will always be an element of overwriting within the channel but the majority of transactions have only a single touch point. With multiple routes to market including newsletters and mobile apps, it is evident that these sites are often the first port of call rather than merely an afterthought.

Additionally it is increasingly important for advertisers to analyse post conversion customer data to truly understand the value of customers referred by their top affiliates. Voucher code sites more often than not are driving highly profitable customers.

You can read more about assessing the value of voucher code affiliates in our white paper from last year.

The debate around the value of voucher code sites is one that is likely to rumble on. There is no denying they are able to add incremental value but they also have an impact on the content sites the channel is trying to protect.

We can certainly envisage a future where content is a separated from conversion where both are run in parallel. For the future success of the channel we need to recognise that traffic sources shouldn’t be competing, they should be complementary. While this may be some way off, in the meantime it is possible to implement some additional rules around cookie hierarchies.

Certain affiliate activity has so called ‘soft click’ technology in place that allows advertisers to define a cookie hierarchy which favours certain affiliate interactions over others based on the nature of the traffic. This was something that was introduced when remarketers and retargeters entered the affiliate space in order to protect the existing ecosystem on the proviso that such pre-qualified traffic could feasibly have been driven by other affiliates involved in the transaction.

This has never been in place for voucher code sites. Is it now time to have that conversation?