Five reasons why you should start app tracking in 2023

Written by Juanfran González Paz on 11 minute read

Find out why affiliate marketing is perfectly positioned to capitalise on 2023’s expected €146 billion in consumer app spend.

Implementing affiliate tracking within your e-commerce app can significantly boost your affiliate performance. Without it, affiliate sales that complete in the app go unrecognised, unrewarded and unreported. Another important aspect is the user experience. It should be in every advertiser's interest to provide their customers with a seamless customer journey that not only creates less frustration, but also increases conversion rates.

Like previous years, 2022 was a big year for app tracking. If we look at the available data, it becomes undeniable that the time has come to start app tracking in the affiliate channel.

Reason 1: It’s (still) the right time

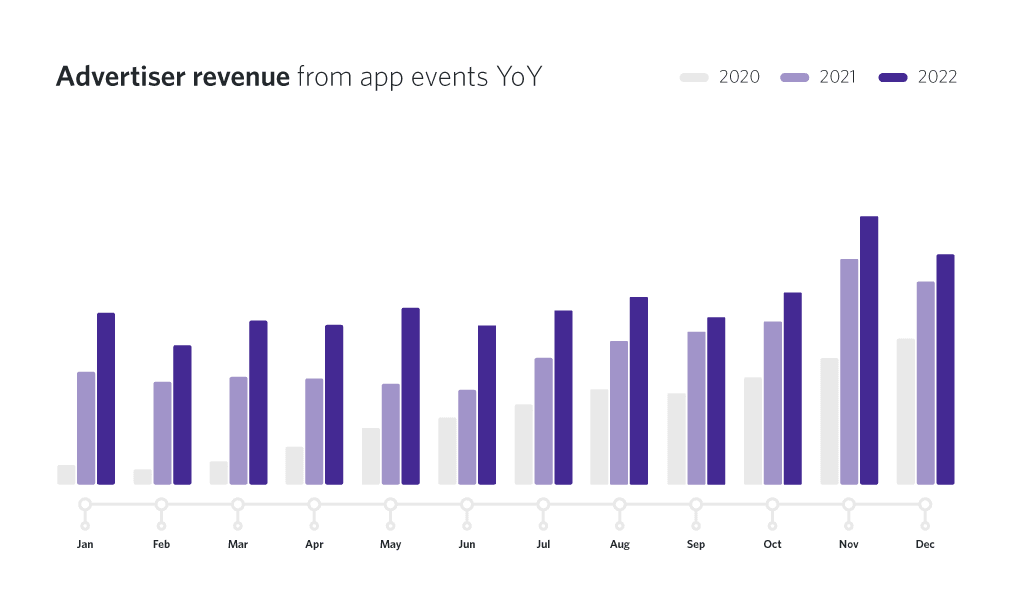

With the ever-present threat to tracking due to privacy laws, the digital landscape faces increasing difficulty and caution surrounding investment decisions. Closing 2022 with over 14,000,000 (+19% YoY) in-app sales for our clients, and €31 million in commission for our publishers (+55% YoY), it's clear that app tracking was a valuable endeavour for publishers and advertisers alike. Despite obstacles like reduced workforces, decreased budgets and the increasingly prevalent topic of consumer privacy, a fervour for heightened conversion metrics, reliable tracking, publisher fairness and data dependability prevailed. Awin was able to more than double the number of advertiser programmes tracking in-app events on the platform, reaching 256 live programmes.

This seemingly humble group of advertisers (when compared to Awin’s whole portfolio of advertisers) have collectively achieved +20% in app-based revenue on the platform when comparing 2022 performance to that of 2021.

As we move in to 2023, App Tracking shows no sign of slowing down and can no longer be considered an optional add-on but rather a fundamental part of successful affiliate programmes.

Reason 2: App Tracking does add incremental value

An exciting trend that Awin has seen with its tracked app events is the wave of performance coming from Brazilian advertisers. When looking at app tracking launches in 2021, Brazilian advertisers accounted for over 50% of all performance. By 2022 they were the top region for app tracking on Awin’s global platform.

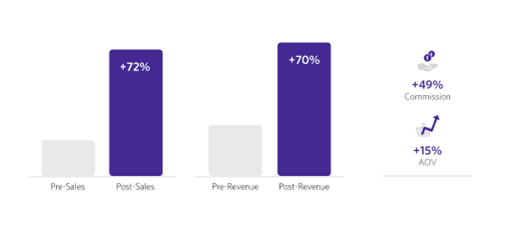

When looking at app tracking launches in 2022, Brazilian advertisers account for over 30% of all performance. One advertiser implemented app tracking in H1 2021 and a mere two months after the launch, had seen huge increases across all their KPIs, with sales and revenue exceeding a 70% uplift. It’s worth emphasising that their non-app performance did not see a dip, it grew alongside the addition of tracked app events. Another advertiser on the platform saw their number of sales increase by over 150% the month following the app tracking launch with almost 50% coming from app sales alone.

These are just a couple of examples of how app tracking has added incremental value for an affiliate programme, making it a vital component to boosting your digital marketing activity.

Reason 3: Changing tech and privacy make affiliates the best fit for app tracking

Whilst Awin hasn’t been unaffected by Apple’s App Tracking Transparency (ATT) framework, the effects have, thus far, been better than expected when looking at overall app tracking performance on the platform. Of course, multiple variables come into play here; some regions have seen bigger drops in performance than others just as certain advertisers have been more heavily impacted than others. This is based on several factors – the split of Android vs. iOS devices in any given region, the rate in which iOS users updated their OS, the consent rate of the users that have updated to iOS14.5+ and whether the advertiser is fully ATT compliant.

The effect experienced at Awin is not universal. Facebook, conversely, is providing fewer targeting campaigns and a declining reach for its clients. Unsurprisingly, Facebook attributes this to Apple’s ATT framework and the consequent difficulty in tracking and attribution.

So why does Awin stand out and continue to grow in this space where other advertising networks are suffering? The affiliate channel is data-light and, therefore not as intrusive as other channels might be. This fact, together with the different solutions that our SDK providers are putting in place, allow us to correctly attribute sales to publishers even though merchants may not have all the required information that they might need to validate their sales. Awin has redacted a Best Practice piece for ATT validation in order to help our clients continue to validate in a privacy-centric way.

Reason 4: You can forecast App Tracking sales

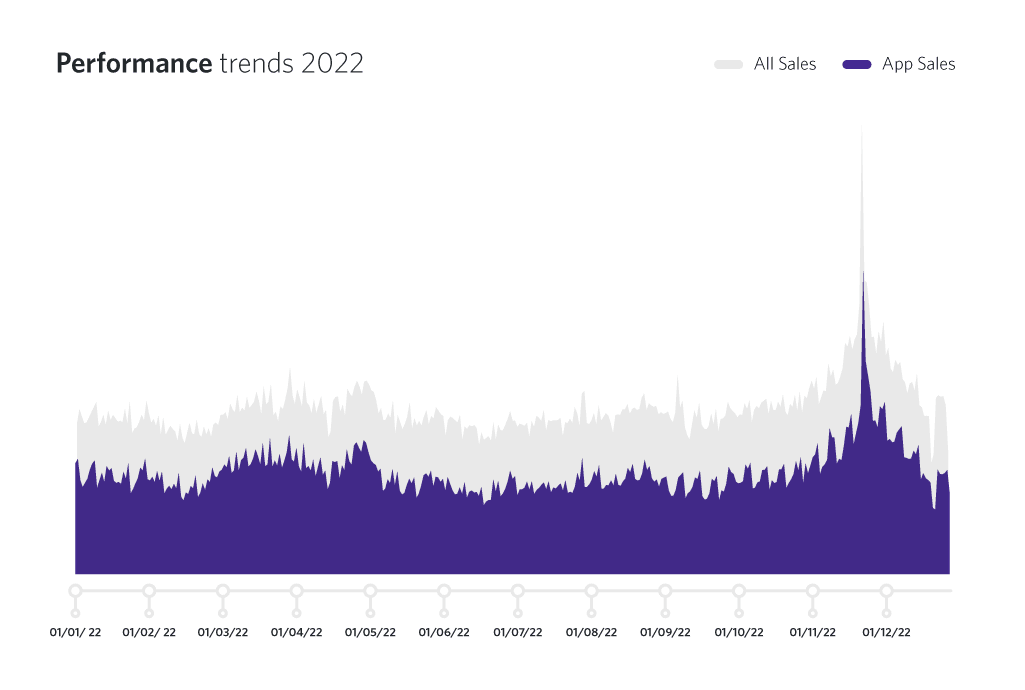

It will come as no surprise that Awin’s tracked in-app events saw a huge surge over the course of November, specifically over Black Friday and Cyber Monday.

As the graph above shows, tracked in-app events mirror the performance patterns of the entire platforms’s tracked performance. These patterns can be seen across all KPIs. The Awin platform saw the top three sub-industries as Health & Beauty, Department Stores and Clothing over the peak period – whilst the ordering changed slightly, these were also the top three sub-industries for in-app events for that period. The use of mobile is continuing to increase over time, now reaching over four hours a day and Awin’s total tracked clicks for the month of November reflect this:

With what we know about superior metrics in-app and the increased use of mobile, app tracking will continue to play a significant part in the make-up of successful affiliate programmes. As app tracking sales mirror those of the platform it becomes significantly easier to plan and forecast the impact of integrating affiliate app tracking, justifying any required tech work with the clear value add it brings.

Reason 5: It has the support of Social

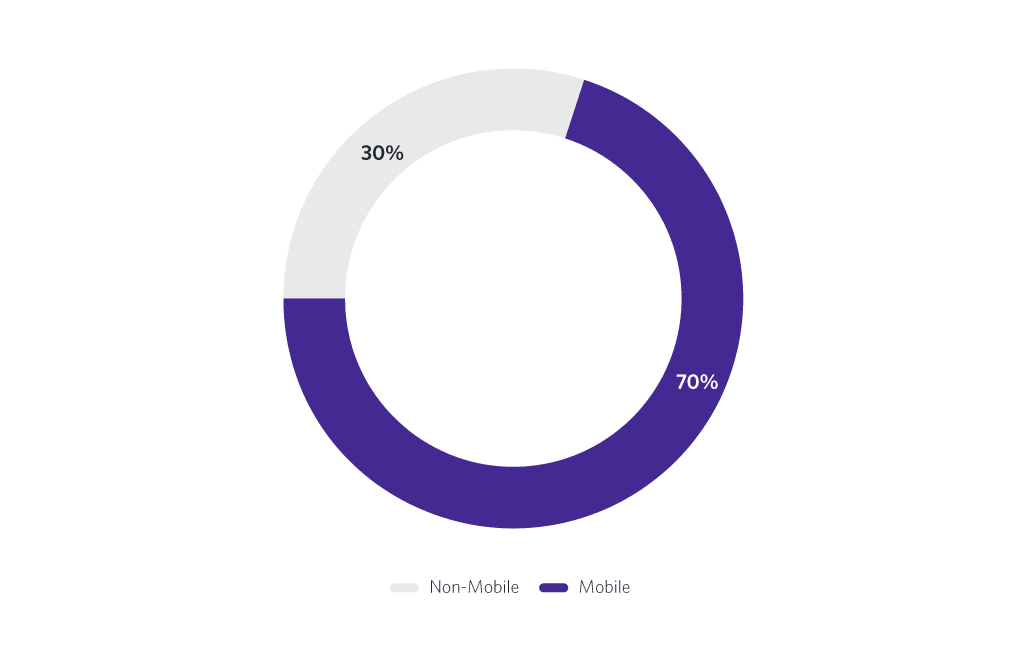

You’re probably already aware that Instagram made affiliate marketing accessible to all in 2021. It made sharing links in stories available to everyone so that the feature was no longer restricted to verified accounts or those with over 10,000 followers. Content publishers, of which ‘Social Platforms’ are a sub-vertical, are the second largest publisher vertical for app-based transactions. It is expected that Instagram’s announcement will drive an even higher proportion of app transactions for this publisher vertical. In 2022, Content made up 30% of all app sales through over four million transactions. While looking at US app sales specifically, almost 80% of all app sales were made through Content publishers.

Any user that clicks on an affiliate link from an Instagram story, and if they already have the app downloaded for that advertiser (and sometimes even if they don’t), will most likely be directed to the app. The issue with this journey is that unless the advertiser in question has launched app tracking on their affiliate programme, any conversions that occur in-app will not be tracked and thus the publisher will not be fairly rewarded for the sales generated.

Pushing users to complete the journey in-app makes sense for advertisers and publishers alike; with social media taking up an enormous proportion of peoples’ time spent on mobile, it makes sense to drive these users in-app where engagement rates, conversion rates and AOVs are knowingly higher than both desktop and mobile-sites.

With Instagram’s blessing, the case for app tracking is even stronger, showing that now is the time to get started with app tracking.

If you are still unsure if app tracking is right for you then consider the ever-growing use of mobile (which now has over 60% of the share worldwide when compared to desktop [37%] & tablet [2%] as per statcounter). Awin expects to see continued (if not enhanced) zeal and growth for app tracking well into 2023. With over four hours a day being spent on mobile, and conversion metrics proving to be superior in-app than on even mobile-optimised sites, it’s important to capitalise on this as the trend continues to grow.

Awin has strong partnerships with some of the largest Mobile Measurement Partners (MMPs) in the space like Branch, Adjust, Appsflyer, Kochava and Singular, as well as Button, and offers on hand support to advertisers throughout their journey to App Tracking – from picking the right Software Development Kit (SDK) provider to commissioning app events on our clients’ programmes, we’re here to help.

If you are ready to get started with App Tracking or have any questions, please get in touch with your dedicated Awin point of contact or fill in this form, and our App Specialist will get back to you.

To find out which Awin advertisers have app tracking enabled, make sure to use our newly launched app tracking filter.