See the first five trends we released in part one of this series here and watch the webinar based on this trends here.

6. Store closures see bricks and mortar retailer’s online orders soar

We have recently witnessed the closure of physical stores that do not sell ‘essential items’. However on the weekend prior to the announcement we saw some well-known department stores, clothing and beauty brands take matters in to their own hands to protect their staff and general public and shut earlier than enforced. For those retailers it looks like their decision paid off and consumers continued to support these brands online.

Friday 20th through to Monday 23rd Awin UK saw the general online traffic for department stores, clothing and beauty down 6% versus the same weekend in 2019. However looking at a handful of those high street stores that decided to close early, Awin saw traffic to these sites up 12% vs same period the previous year.

7. Desktop gains traffic share

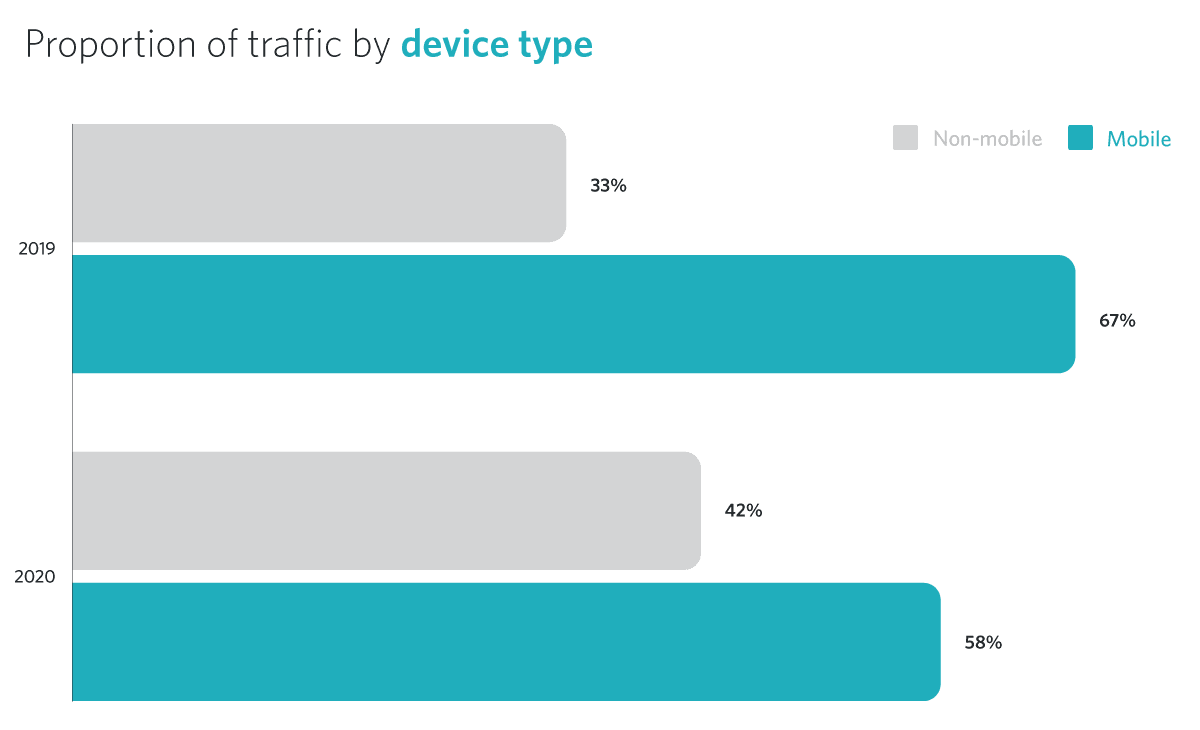

With people staying indoors the proportion of traffic from mobile devices is beginning to shift to traditional non-mobile devices. From Monday 16th March 2020 to Monday 23rd March we saw the proportion of online traffic for non-mobile devices increase to 42% comparative to only 33% in the same week the previous year.

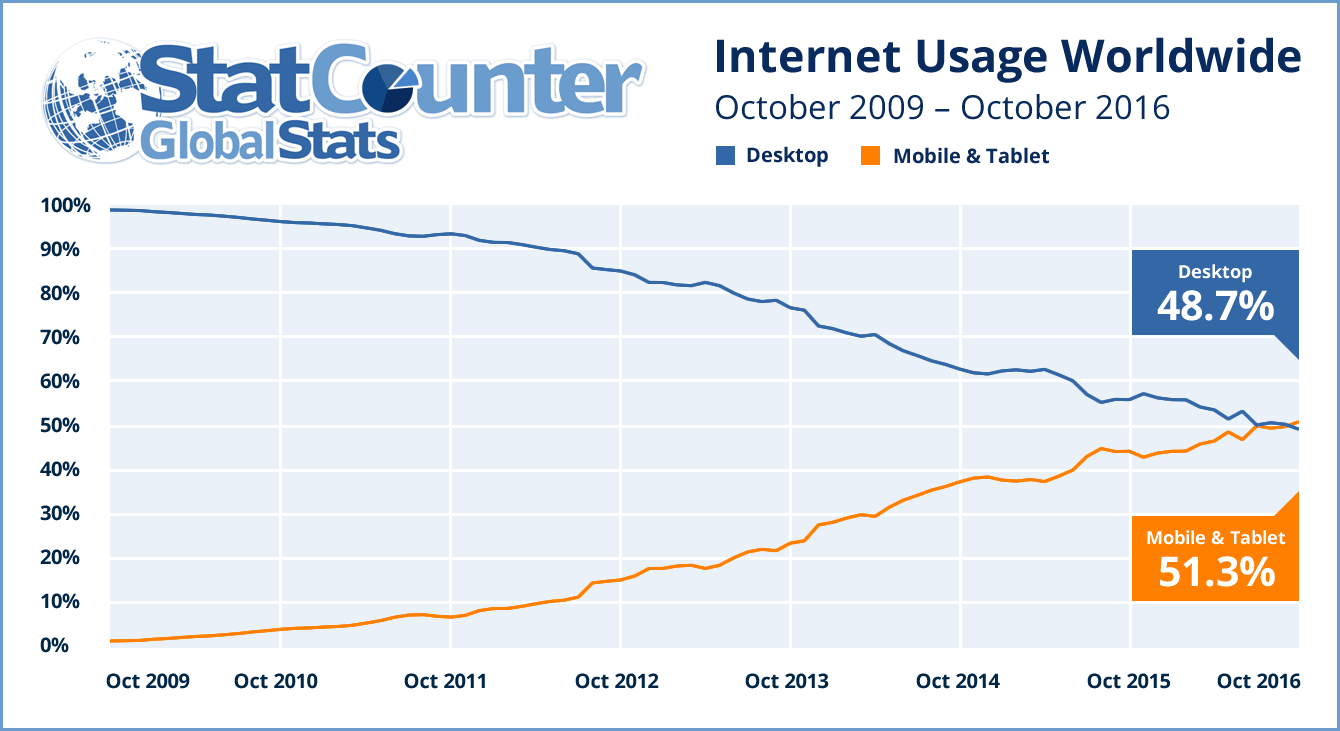

According to StatCounter mobile and tablet internet usage overtook that of desktop back in October 2016 and has been continuing to steal share from desktop and non-mobile devices until Covid-19. Many brands have spent the last several years focusing on mobile-first websites and marketing strategies, including Google who started ‘mobile first’ indexing from July 2019. Will we see a shift back to the desktop consumer during this stay at home cycle?

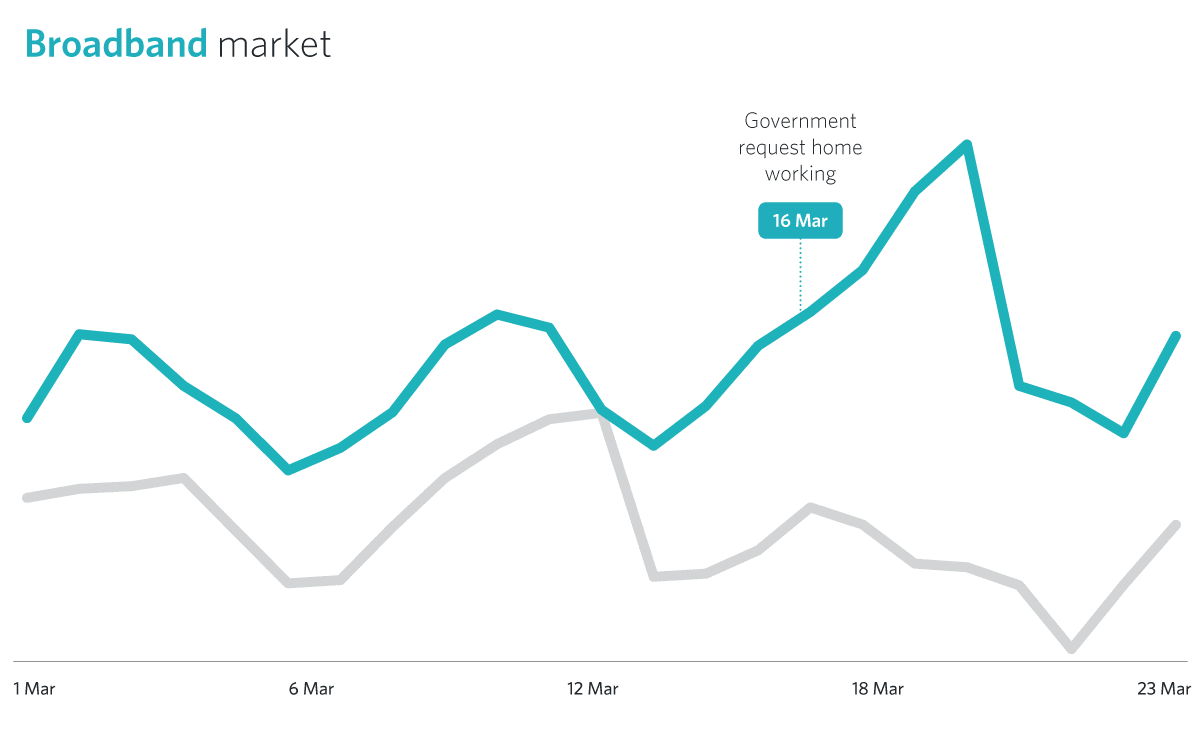

8. Broadband sales spiked with increased home working

March tends to a relatively slow month within the Home Broadband space. Following the Government’s request to stay at home, our data shows that this spurred many people to begin preparing their home for an increased reliance on the internet. The graph shows an instant increase in broadband sales, peaking on the 19th with over 4,000 switches, the biggest day in 2020 within the space.

However with a number of ISPs now looking at the impact on their operations teams and engineers, there now may be a bit of a slowdown and reduction in availability. Openreach, who power the infrastructure for most home connections in the UK announced on the 24th they may limit the amount of engineering work which may restrict any future switching. We may see more of a push to plug-and-play solutions such as mobile broadband in the future.

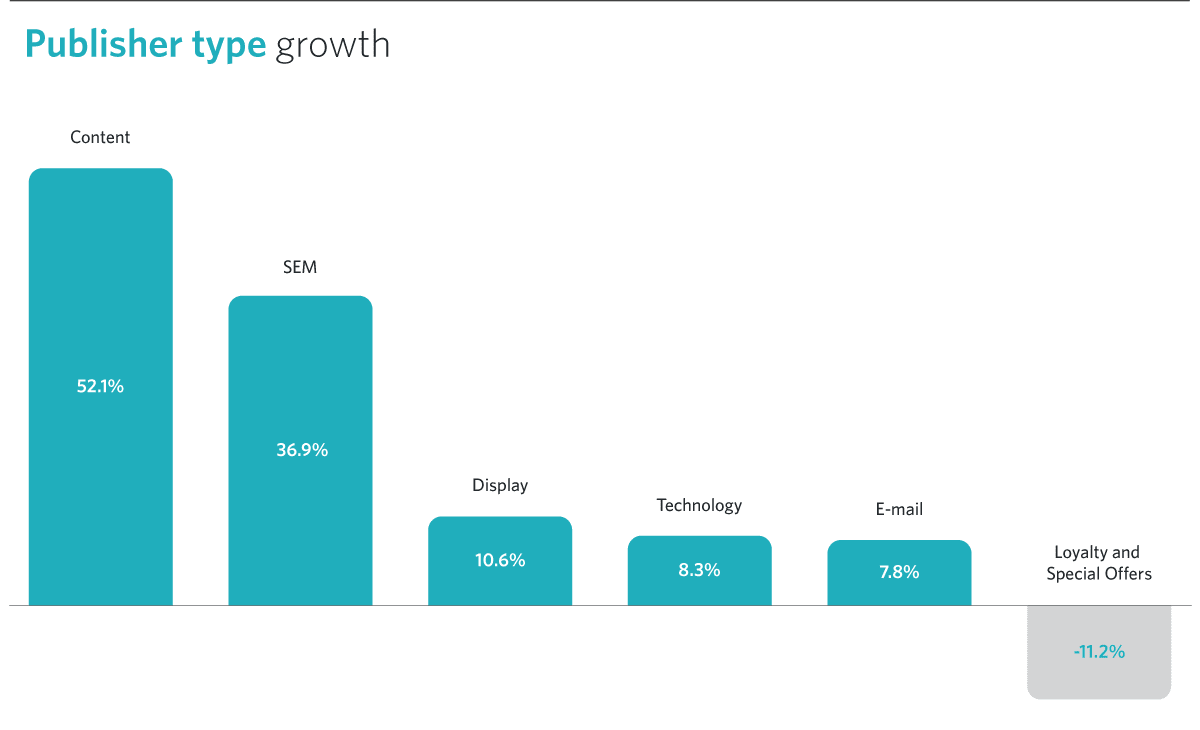

This spike was echoed within the publisher type data, which showed Content seeing the highest growth over the last week, which includes Comparison sites and specifically Broadband Comparison seeing very strong increases as customers searched for broadband deals.

This data also shows a decline in Loyalty and Special offers despite some cashback sites topping up rates by up to 60% on retail brands for Premium members, and other discount sites hosting specific areas dedicated to NHS worker discounts promoting deals, such as Vodafone’s offer of no data fees for NHS staff online.

9. We are panic buying – and we all want food delivered

The issue of panic buying still persists. Supermarkets are opening with empty shelves as they can’t re-stock fast enough, grocery apps have been shut down, new customers can’t buy groceries online at all, and existing customers are forced to wait hours in virtual queues. Awin data shows that demand has so far not quite reached the peaks we see over the Christmas period, however school closures corresponded with the largest increase so far.

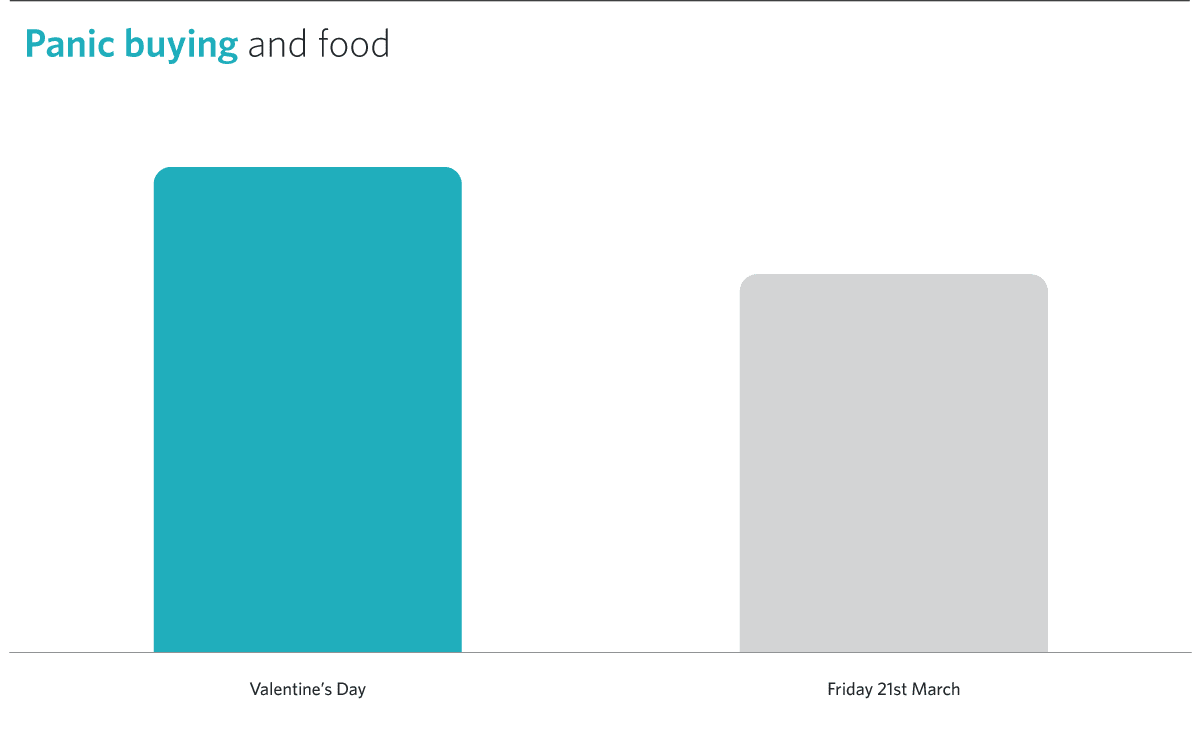

When looking at take away food delivery the data tells a similar story. Local restaurants are flocking to Deliveroo and Uber Eats, and others are using B2B platforms to provide a direct delivery service under their own brand. However looking at key delivery brand data, Awin hasn’t yet seen volumes over the past week to match the spike of Valentine’s Day last month. Friday 21st March has been the largest day so far, but was still 23% less than Friday 14th February.

10. We all need a stiff drink

Whilst we adapt to virtual socialising many of us are joining online social events such as concerts as well as partying with friends and family on the newly trending app ‘House Party.’ However the lack of face-to-face contact hasn’t dampened our spirits for a weekend alcoholic beverage. Looking at the week commencing 16th March 2020 we saw the wine, spirit and tobacco sub-sector up a huge 371% comparative to the same week in 2019.

As the nation was asked to stay home, paired with the shutting of all bars, pubs and restaurants on 20th, consumers begun to really stock up online. Friday 20th saw a 300% increase in orders of wine, spirits and cigarettes comparative to the previous week. One online pharmacy also saw a 159% increase in condom sales through Awin the day that the pub closures were announced.

Awin is committed to keeping you informed, engaged and supported through this time, and you can find further information and guidance on our Coronavirus news hub here.