DTC baby care boom generated over £32 million for Awin retailers in 2021

Written by Johanita Dogbey on 4 minute read

The closure of many high street baby care stores led to a rise in DTC online shops and revenue for brands, including Mamas & Papas, Kids Pass and My 1st Years.

Introducing Awin’s new sub-sector series, a cross-section into emerging markets and consumer trends consolidated with Awin data and performance highlights. The pandemic resulted in new consumer shopping behaviours, as a result of increased screen time and the closure of high street stores. A plethora of brands entered the online space and have benefited from affiliate and partner marketing from baby care, pet care, food box subscriptions and coffee sales.

Key takeaways

- 65% increase in monthly baby product sales vs. pre-pandemic average.

- £32 million in retailer revenue generated by baby brands.

- £99 average order value for baby products.

- £17 return on investment for every £1 invested into affiliate activity.

- 7 million customer visits (clicks) with a 5% conversion rate.

- 27% of all baby products sales come from Content & Blogger affiliates.

We’re seeing another baby boom, but this time it is in ecommerce sale growth. The coronavirus pandemic has shifted consumer preferences, with parents (and parents-to-be) now searching for high-quality and specialised baby care products to support the growth of their toddlers. The closure of high-street stores since the first lockdown has forced many parents to research, review and shop online. This demand for online DTC baby care brands offering high quality and affordable products has resulted in a surge in sales.

According to Mintel, it is estimated that there were 681,560 births recorded in the UK alone throughout 2020, with a reported £676 million spent by consumers within the baby care sector, an increase of +2.8% year-on-year (YoY).

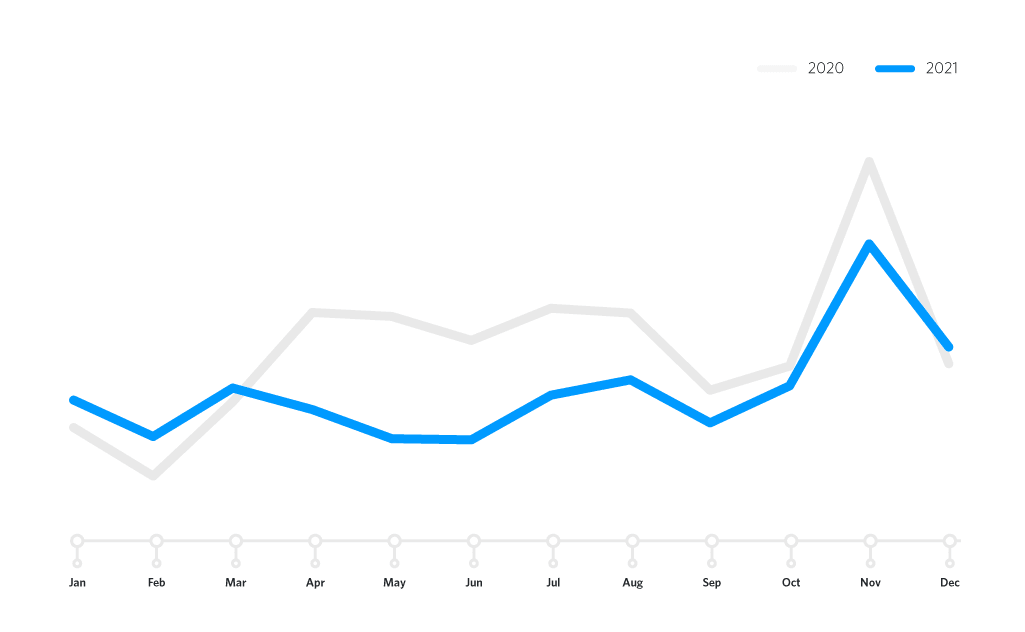

Product Sales Increase

Overall, data tracked on the Awin platform shows a YoY sales decline for 2021, which can be attributed to the re-opening of high street retailers and a subsequent shift in digital share. However, the average number of baby care product sales has increased +65% vs. the pre-pandemic levels, with over £32 million in consumer revenue generated. Looking back to April-2020, the first full month of UK lockdown, sales increased +47% month-on-month (MoM). Since then, performance has steadily trended above the pre-pandemic baseline, hitting peak numbers in November and across Cyber Weekend, typically generating the highest number of sales.

Average Order Value on the rise

The growth in online baby care sales also coincides with an increase in average spend per transaction. Throughout 2020, the average order value (AOV) for baby care products was £96, increasing to an average of £99 by the end of 2021. Not only does this suggest that parents are opting to shop online more frequently than pre-pandemic, they are also spending more per transaction.

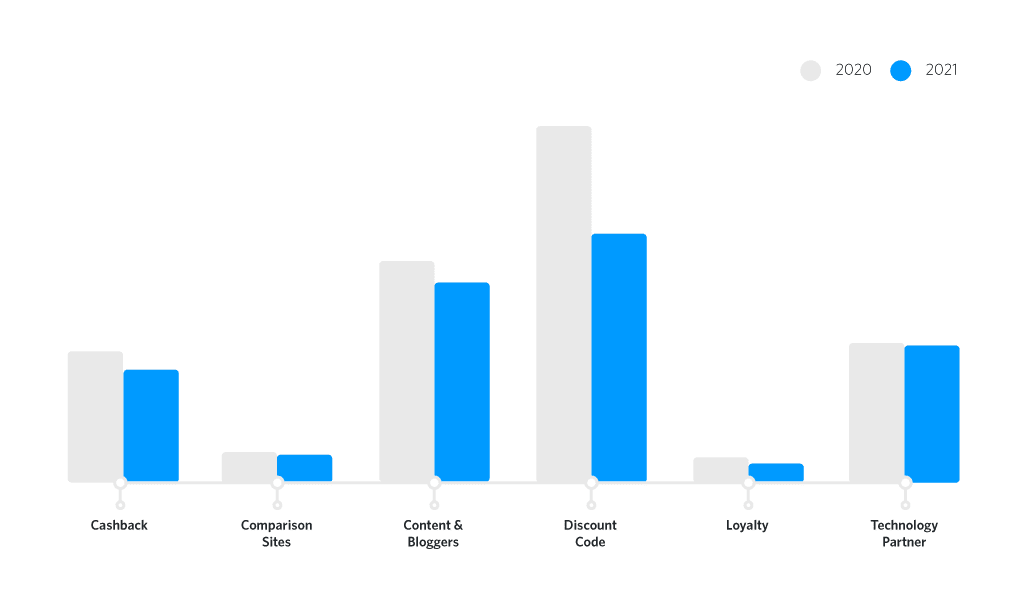

Discounts drive sales growth

The affiliate type supporting the upward trend in online performance for the baby care sector is Content & Bloggers, accounting for 27% of all product sales. Discount Code affiliates are driving the highest share of sales (33%), which is perhaps unsurprising, as retailers look to boost their online conversion in an increasing competitive market landscape. The remainder of the sales mix is made up from Cashback (15%), Loyalty (3%), Comparison Sites (4%) and Technology Partners (18%).

The sales share growth for Content & Bloggers (27%), which includes Editorial Sites, User Generated Content and Influencers, is testament to the digital adoption that we’ve seen from shoppers since the start of the pandemic. Customers are replacing immersive in-store experiences with relatable digital content reviews and influencer recommendations before making their final purchase. This is a consumer trend we expect to extend beyond the pandemic.

Top publishers

Content creators & influencers

Cashback & Loyalty

Technology partners

It may come as no surprise that the pandemic rise in baby care product sales coincides with an increase in erotica sales. Keep an eye out for our next sub-sector piece, to find out how performance has peaked for the DTC erotic brands.

For more information on baby care trends and how to maximise performance marketing with affiliate partners, please get in touch with a member of the Awin Client Partnerships team.

Sign up to The Pulse newsletter to keep updated with new sector trends and industry insights.