Euro 2020: Four key customer trends brands can learn from

Written by Francis Kim on 6 minute read

We share key digital shopping trends seen across Awin’s data during the UEFA European Championship 2020 (Euros).

After a year of lockdowns and social restrictions across Europe, this year’s Euros were eagerly anticipated by die-hard football fans and the general public alike, who came together to rally behind their national team. Team merchandise, particularly replica kits, were in high demand this year as a result of the football fever that swept throughout Europe. Although retail stores in the UK had reopened their doors to customers, it’s clear from Awin data that digital sales still played an integral part in meeting consumer demand.

Having analysed network data throughout the course of the Euros, we’ve pulled together four trends covering shopping habits over the course of the tournament and how they changed throughout the month. We’ll delve deeper into customer behaviour from first click to sale, which publishers they were interacting with and how factors outside the channel (in this case, match results) affected the affiliate landscape.

Three Lions on a shirt

Football shirts saw unprecedented demand this year, both in the leadup to the Euros and throughout the tournament. Looking at sales for home nation kits only, the demand for England and Scotland shirts was already high at the beginning of June and was increasing steadily by 12% every day leading up to the opening fixture on the 11th. England kits saw the most dramatic uplift on 6th June, with sales increasing by 113% day-on-day, though this dipped by 22% after the following day. Similarly, Scotland shirts sales began to increase on the 6th at a somewhat steadier rate compared to England’s. All in all, week-on-week uplift from the first week of June to the second averaged 96% for all three nations’ shirts.

Naturally, the day of England’s first fixture against Croatia on the 13th tracked a massive number of sales, ending up as the biggest sales day over the entire tournament. Although sales increased 66% compared to the day before, this still paled in comparison to the 113% uplift mentioned above.

After the opening fixture, there was a sharp decline in demand. This might not be surprising given many customers had already purchased shirts pre-tournament or in its very early stages. However, the extent to which sales plummeted went completely against expected behaviour, especially after an England win where we would expect sales to spike up not down. As reported by ITV and Daily Mail, this drastic decrease can be attributed to widespread stock issues for football shirts across many advertisers and not any change in customer behaviour.

Match day uplift

Although shirt sales peaked in advance of the Euros, fixture days saw a strong increase in sales and proved to be massive sales drivers, especially as the tournament progressed. With online delivery times and stock shortages to factor in, you’d expect shoppers to be purchasing in advance of matches, rather than after. Initially, this appeared to be the case as half of total England, Scotland and Wales shirt sales tracked in the first 12 days of June, before any of the nations’ first games.

The majority of the remaining half were stacked in favour of match days, most obviously for England’s games against Croatia and Germany but also Wales’ fixture on the 16th vs. Turkey as well as Scotland’s on the 18th vs England. This raises the question – on these match days, are customers pre-emptively purchasing before kick-off or as a direct reaction to a favourable result?

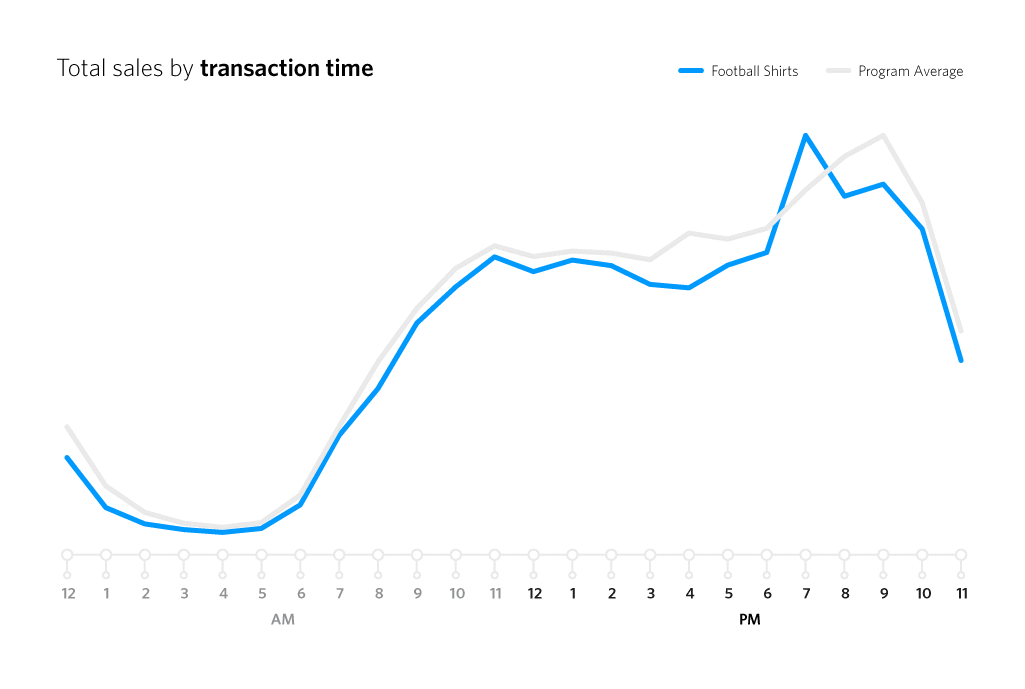

Awin network transaction time analysis showed resounding sales spikes from 7pm onwards on these fixture days. With the majority of post group stage games kicking off at either 5pm or 8pm, it appears football fans were driving the surge in football shirt purchases during or immediately after games. Whether these sales were off the back of a post-win high or not, impulsive buying seems to be in play given the timing and the sudden 40% hour-on-hour increase in orders.

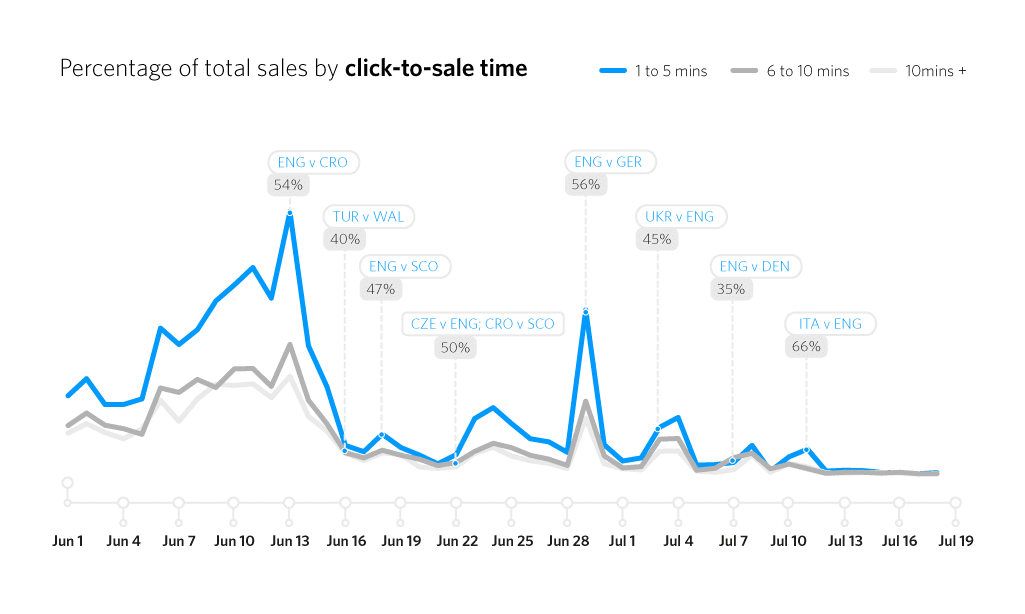

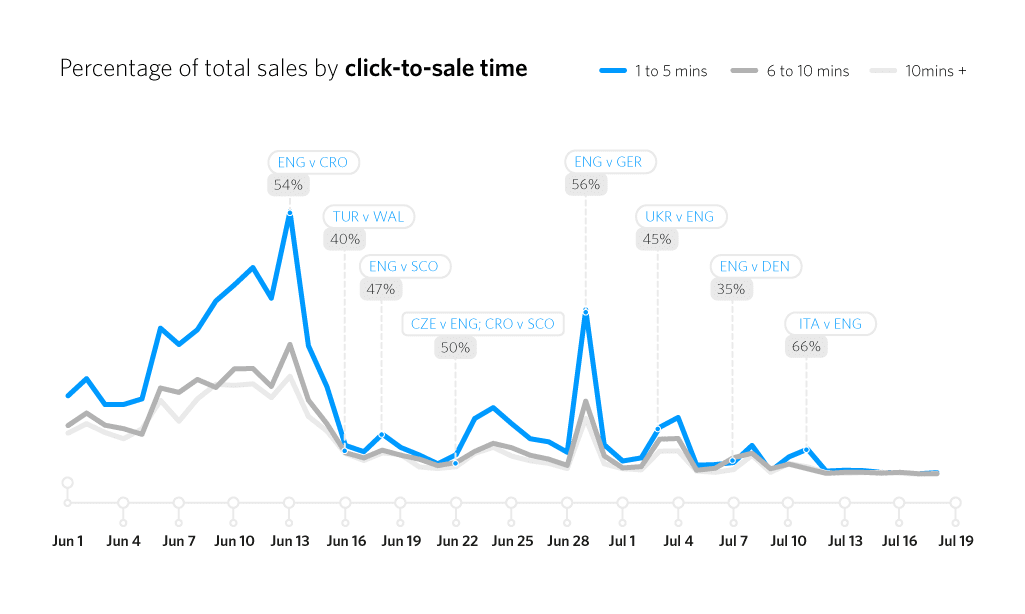

Quick off the ball

Click-to-sale insights also underscore the emotive power of the beautiful game. Looking at England’s fixtures against Croatia and Germany, there were notable spikes in purchases taking less than five minutes to complete. On both days, sub-five-minute-sales accounted for over 50% of transactions, whilst only a third of sales had a click to conversion duration over 10 minutes. All of this suggests that many shirt sales were in-the-moment impulse buys, fuelled by anticipation and celebration.

Searching for goals

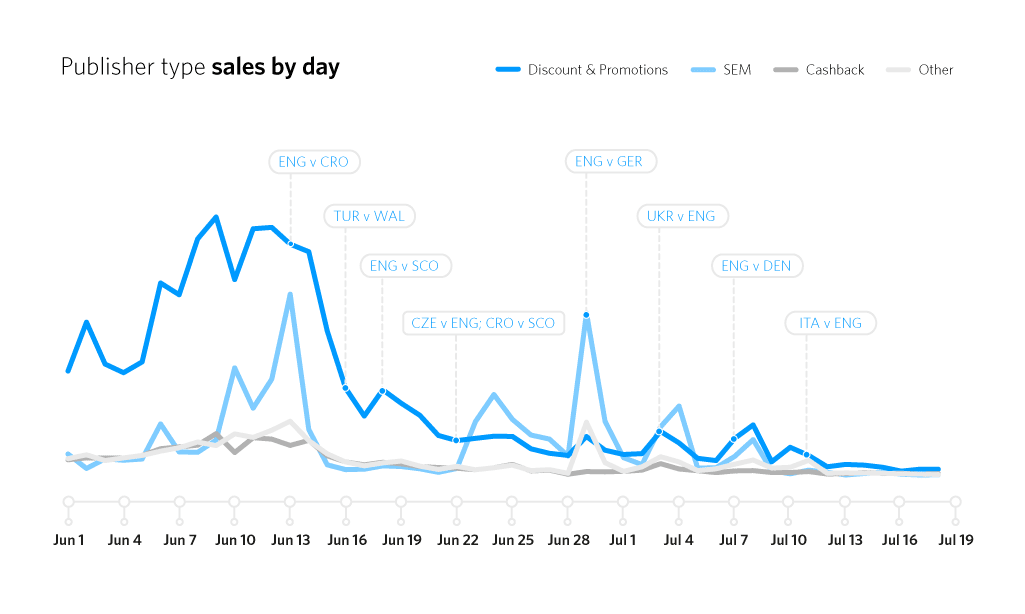

Discount code publishers were responsible for most shirt sales over the first three weeks of June with better-prepared fans taking time to research best-in-market offers and savings. Towards the end of the month however, the lion’s share of sales shifted more in-the-moment mediums like search engine marketing (SEM) and comparison shopping services (CSS) partners. Match days, or the days either side, attracted high number of CSS attributed sales and this becomes more significant heading into July as the share of discount code partner transactions drops dramatically.

Although not upper funnel by any means, the interaction with voucher code affiliates does show some level of consideration before conversion. The drop in voucher and increase in CSS activity instead illustrates growing time sensitivity and impulsiveness with customers looking for the quickest way to buy through a Google search or Shopping ad. Alongside the short click-to-sale times, this paints a picture of the increasingly reactive customer as tournament stakes heightened.

They think it’s all over

Whether you’re an avid football fan or not, the above analysis holds helpful learnings for businesses large and small. Although perhaps not on the scale of the European Football Championship, every business has its key event(s) in their trading calendar. For some it could be a music festival or new TV show. For others, an industry conference or event.

Identifying opportunity phases before, during and after these events is a crucial step in optimising your brand strategy. Especially in this day and age where mobile commerce is ubiquitous, customers are empowered to act almost immediately when they’re inspired to buy. With the prime purchase window often closing within hours or even minutes, ensuring your products are positioned to fully capitalise on this could give you that edge over your competitors.

However, not all customers are alike. Segmenting your audience and identifying what phase they’re most likely to react to will ensure you have a holistic plan in place to capture as many conversions as possible. Effective engagement of those savvy early buyers, through personalised AI offers and bundles for example, is equally as important as being top of the table in Google Shopping search.

As with England shirts earlier this summer, stock availability and logistics are expected to be key challenges for many businesses in the coming quarters (is it too early to mention Black Friday?). Whatever the time of year, providing clarity in stock counts could also help to drive faster click-to-conversion windows. Including accurate stock availability in product feeds will also help partners only promote items that are actually purchasable, making sure the customer journey is as seamless and uninterrupted as possible.

Just like the England football team, we hope you’ll takeaway some valuable lessons from this year’s Euros and make your next campaign a winner.