Insight of the Month: Tech Partner Adoption Shows No Signs of Slowing

Written by Alfie Staples on 6 minute read

We investigate how tech partner adoption has grown and why CMOs see them as the biggest reason to invest in affiliate marketing.

The growth in popularity of technology partners could be one of the most important developments in affiliate marketing in recent years. They’ve transformed the scope and standing of the channel in many marketers’ eyes. Expanding the perception of the value they can bring to more than just qualified traffic.

From conversion-driving overlays to intelligent email remarketing solutions, these partners are solving a range of different ecommerce challenges, putting affiliate in places it barely occupied some 10 years ago.

The common story arc for tech partners is to save advertisers countless hours in creating new solutions - usually for their websites - before winning them over with their performances. Such is the extent of their current impact, research conducted by Forrester and Awin revealed ‘gaining access to innovative new technologies’ as the number one attraction of affiliate marketing in the eyes of Chief Marketing Officers.

The rapid growth of technology partners on Awin’s platform

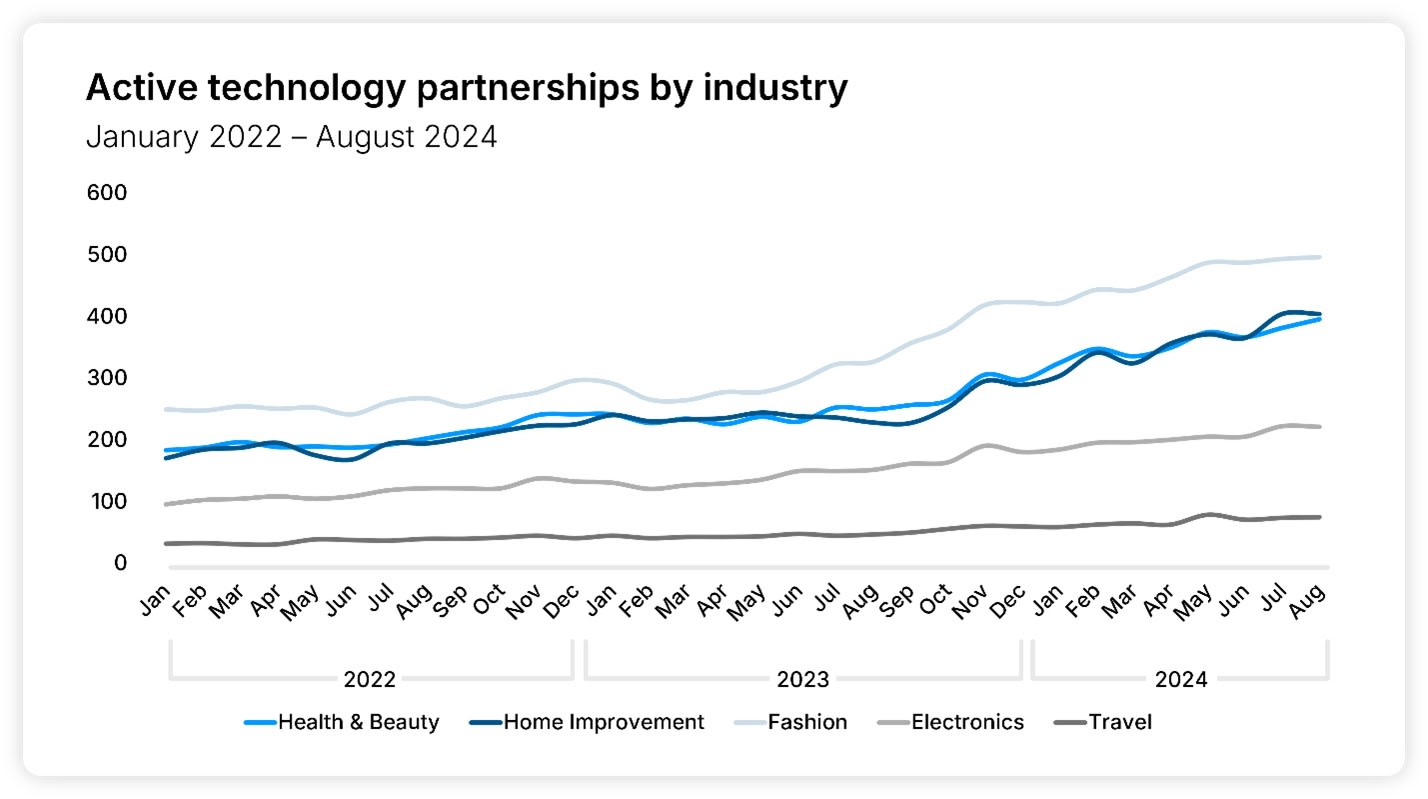

Therefore, it’s no surprise that tech partner activations on the Awin platform are currently up 44% year on year. They’re 64% higher than in 2022 after climbing over the 2,500 mark in August 2024.

Fashion has the most activations at nearly 500. Interestingly, tech partner adoption across the sector increased by 52% in 2023, a year in which retailers were constantly reminded to be tactful with their use of promotions rather than discounting their way out of industry-wide struggles. It’s logical that Fashion advertisers would turn to something like an Exit Intent or Remarketing partner to generate uplift in targeted ways.

Home Improvement (405) and Health & Beauty (396) also have steadily increasing levels of tech partner activations, but adoption has been much slower across Electronics (222) and Travel (75), with no signs of an immediate change.

Which types of tech partner are most popular?

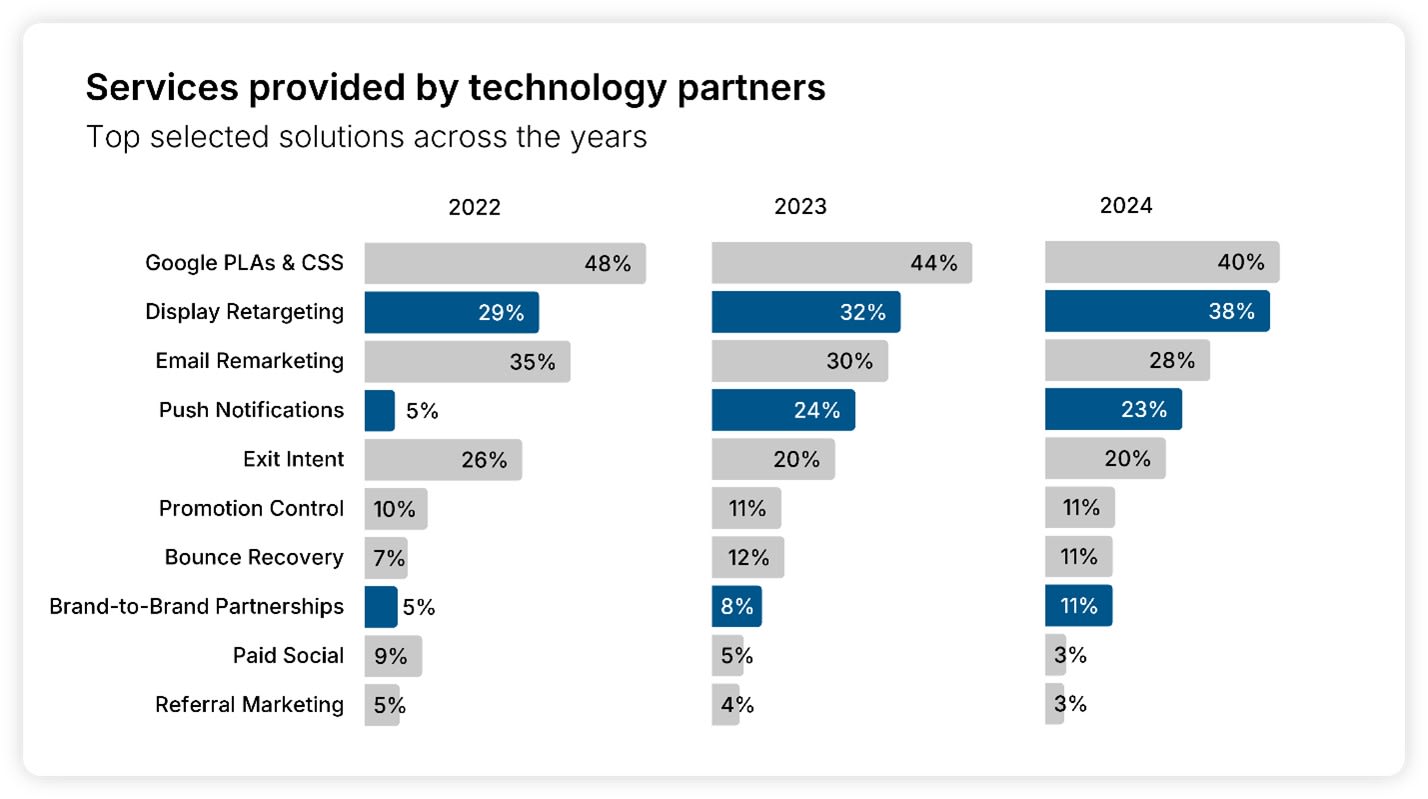

You can find a tech partner for every stage in the purchase funnel. However, there’s a particularly strong pool of options for Google Product Listing Ads (PLAs) and Comparison Shopping Services (CSS). This service might have declined by eight percentage points compared to 2022 (48% vs 40%). However, with the demand for Google Shopping expertise and solutions currently elevating CSS revenue contributions across many sectors, it’s feasible that other service options are levelling the playing field by growing faster.

For example, Display Retargeting is now offered by 38% of tech partners having grown by 31% since 2022. Push Notifications and Brand-to-Brand Partnerships are also high-growth areas, having seen increases of 360% and 120% respectively over the same period.

Don’t be alarmed by the groundswell for a service option you don’t recognise. Tech partner availability and demand vary by region, as shown by the virtual non-existence of Google PLA partners in the US (2%), where Google is safe from the EU rulings that enable advertisers to bid on exposure in its Shopping service.

Email Retargeting (76%), Exit Intent (67%), and Push Notifications (46%) are more commonly available services for US advertisers, who are spoilt with options for engaging customers at the right moments.

Awin’s case study library is packed with stories of tech partners delivering considerable performance uplifts. A prime example is the collaboration between Vodafone and SaleCycle, which currently drives 2,000 extra sales per month from a mix of intelligent remarketing tactics.

In our recent Awin-Win Marketing Podcast episode, Tanita Dickson, Vodafone’s Ecommerce Specialist, explained how the brand’s trust in SaleCycle’s recommendation of SMS targeting was repaid to great effect.

How does tech partner performance stack up against other affiliate types?

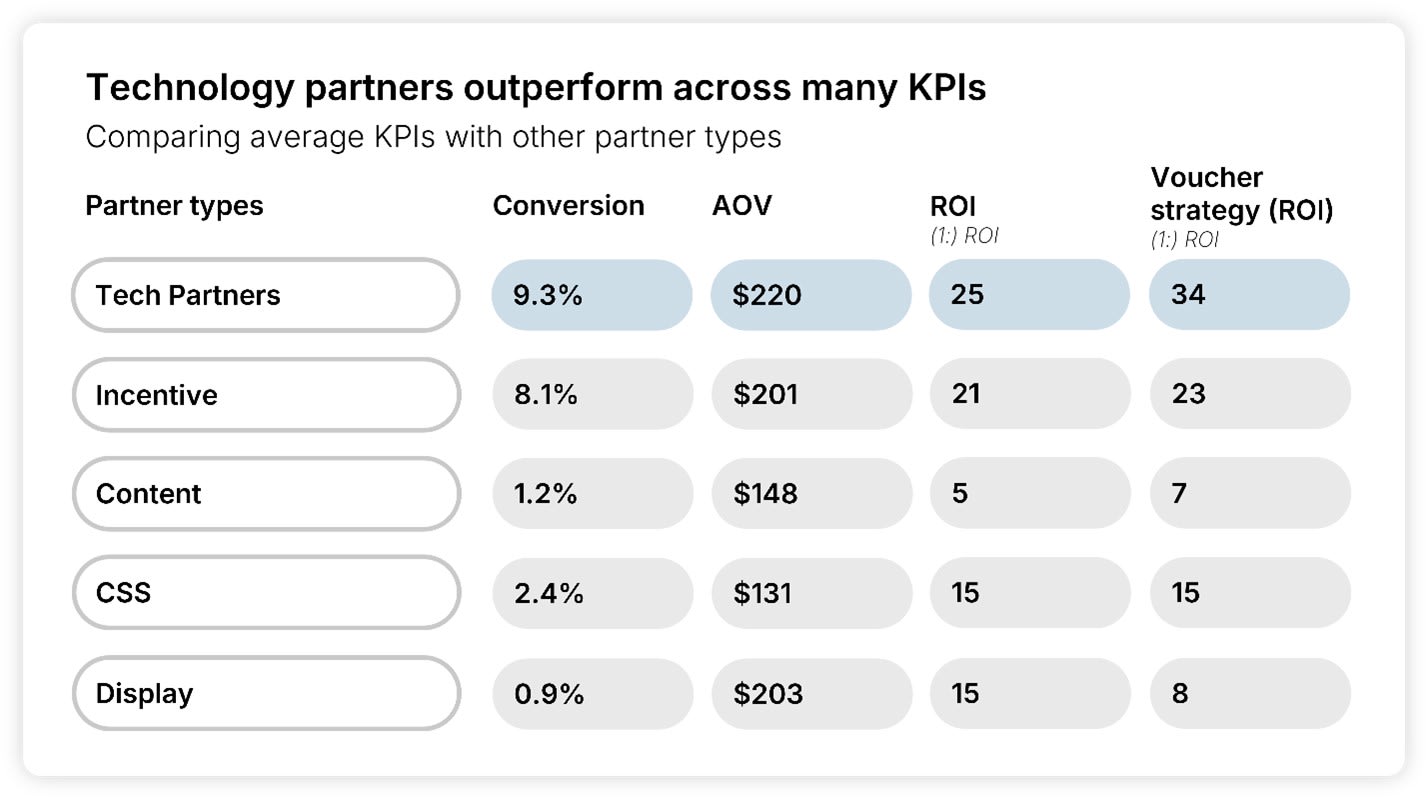

To measure the performances of tech partners against other publishers, we looked at two metrics often used to demonstrate their effectiveness: conversion rates (CVR) and average order values (AOV).

The average CVR for tech partners either specialising in reducing basket abandonment or boosting conversions is an impressive 9.3%. It comfortably exceeds the 8.1% for incentive publishers, 1.2% for content, and 2.4% for CSS. Tech partners also out-converted these publishers in every sector we analysed, from Fashion to Home Improvement.

It’s a similar story for AOV, where tech partners focused on upselling and increasing basket values deliver an average sale of £166.21. Incentive publishers once again come closest at £151.97, with content (£111.69) and CSS (£98.69) following behind.

Evidently, when tech partners position themselves as specialists in a certain area, they have the results to back it up.

Speeding towards success: how quickly can tech partners have an impact?

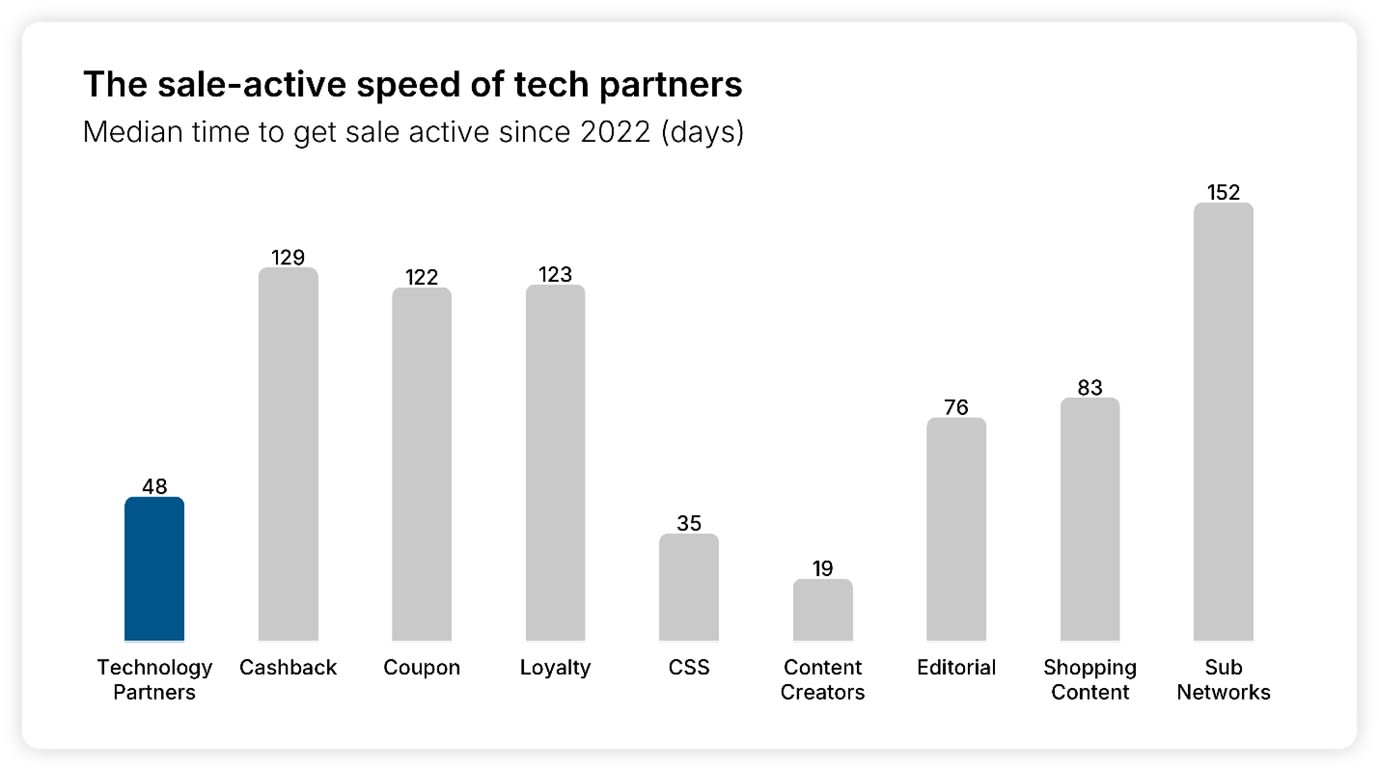

The conversion and AOV-driving acumen of tech partners is even more appealing when considering the ease at which their solutions can be implemented. Thanks to the Awin Mastertag, many of the publishers in our Tech Partner Directory can now be launched within a single click, but we wanted to see how quickly they could start producing results.

Judging by two years of activations, it takes just 48 days for tech partners to become sale active. By comparison, cashback, coupon, loyalty, and sub-networks all take over 100 days to reach the same status.

Considering the weeks or months it could take to plan and build an equivalent solution in-house, there is seemingly no false economy in deploying tech partners.

Nevertheless, if you need an even quicker contributor to your programme, give Content and CSS a try. Both partners can get sale active in under 30 days.

Resounding returns: The ROI of tech partners

We’ll wrap things up by looking at ROI. Most tech partners are free to launch and tend to operate on a cost-per-acquisition (CPA) basis. That cost-effective implementation, combined with their results, could explain why their return on investment sits at 25:1, above incentive publishers on 21:1, CSS on 15:1, and content on 5:1.

For Electronics advertisers, using a tech partner to sell high-value items seems like a no-brainer, delivering an average ROI of £81 for every £1 spent.

If you’d like to get started with a tech partner, you’ll find plenty of inspiration in Awin’s ‘Top 10’ lists. Our recently covered topics include a selection of conversion specialists and our most popular partners available via one-click activation.

And you can explore all of the various options available right now on our page dedicated to affiliate technology partners.