Trends from the travel industry, and the future of international travel

Written by Lee Metters on 7 minute read

With the announcement of quarantine free travel for the fully vaccinated, a third of us have booked a getaway to celebrate getting our Covid-19 vaccination.

But what trends have we seen in H1 2021 within the sector, and what does the future hold?

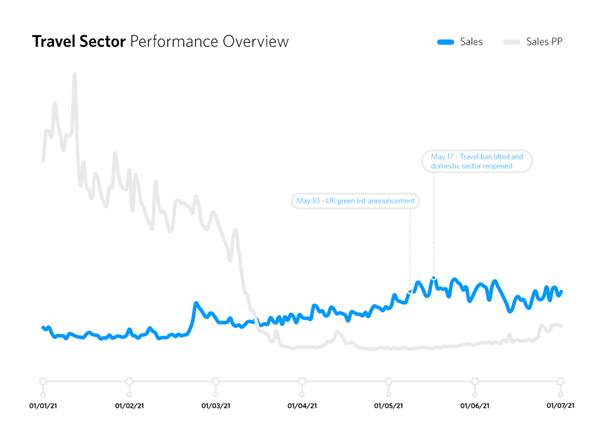

The last 18 months has been disruptive and impactful to businesses across a magnitude of sectors, but none more so than travel. The sight of grounded planes, hotel quarantine centers and ghostly cruise ships in the English channel have become all too familiar. However, finally there is cause for optimism. Year to date bookings within the UK travel sector peaked on 17th May, the date that international travel restrictions were lifted and the domestic accommodation sector re-opened. This increase in demand also coincides with the first green list announcement from the week prior, which included popular mass market holiday destination, Portugal. Much was made of the travel ban lifting, with many expecting an immediate surge in international travel bookings. Instead, what we saw was quite underwhelming, with demand seemingly flatlining.

The number of bookings year to date are still someway short of pre-pandemic demand with Awin reporting a -44% compared to 2020. However, 57% of total bookings last year came within the first three months, before the first UK lockdown on 23th March. There was also a small window of opportunity at the end of summer where some destinations, including the Greek islands, were accessible to UK travelers through government approved air bridges.

Domestic travel dominates 2021 travel bookings

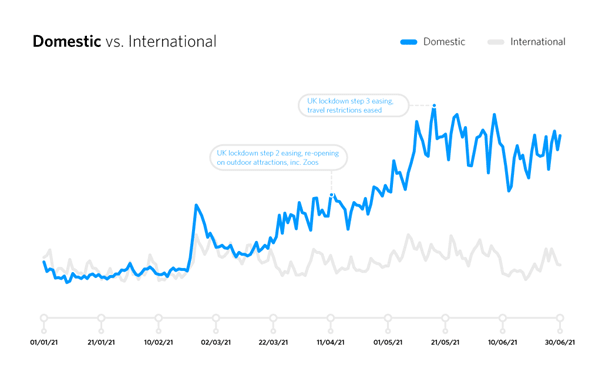

With a small spike in travel bookings, will we be jumping on a plane and heading to our favourite foreign beach destination this summer? Not quite. At least not immediately, with 69% of all travel bookings made in the first half of this year being categorised as domestic travel bookings.

The first evident peak for domestic bookings came on 12th April, the date that the UK moved to step two of the governments roadmap out of lockdown, and notably, the re-opening of outdoor attractions. Leisure attractions, including zoos, theme parks and areas of natural beauty, accounted for 44% of all domestic sales on that particular day.

The second peak in domestic bookings coincides with 17th May, another noteworthy date in the government’s roadmap out of lockdown as the UK moves to step three. Not only did this see the lifting of the international travel ban, but it also saw the re-opening of the domestic accommodation sector, including hotels, hostels and B&Bs. Domestic bookings since that date have fluctuated, largely due to bank holidays and half-terms, but demand has remained largely consistent and far above where it was previously.

“Interest in UK holiday destinations is booming.” That was the view of Colin Carter, Director at Weather2Travel.com, who I spoke to about trends they had seen within the travel sector. Whilst foreign travel is still complicated by changing government guidance and travel advice, customers have sought to book staycations, short breaks and days out within the UK. A trend to emerge last year was the increased popularity of camping trips, and that looks set to be the case again for summer 2021 with camping getaways set to become an even bigger hit.

Traveler confidence will be key to the resurgence of international travel

While there is a positive trend towards staycations and camping trips, 73% of us would look to book an international holiday this year, with over half willing to spend more than they usually would. But whilst that gives cause for optimism, a third of those same UK travelers would only be willing to book when they felt it was safe to do so. The rebuilding of customer confidence, which has been so badly damaged as a result of the pandemic, will be key to any resurgence in international travel over the next 6-12 months.

But it isn’t just health and safety confidence that travel brands need to rebuild. Customer trust has also been damaged as a result of the pandemic with 6 in 10 travelers having had a holiday cancelled as a result of Covid-19, and many still battling travel brands for refunds. One fallout of the lack of trust is that 37% of travelers now want zero cancellation fees on any future bookings. But whilst that may instill trust it presents a threat of its own with an increased number of ‘ghost’ bookings as travelers book multiple holidays, domestic and international, to beat any changing government legislation and guidance.

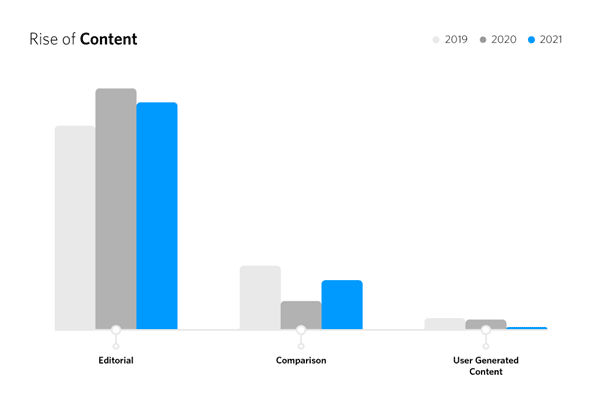

Within the affiliate channel we’ve seen that the demand from customers to have better clarity on booking details has resulted in an increase in the number of sales from content publishers. Content accounts for 24% of all 2021 bookings made, with the biggest growth coming from Editorial sites. Pre-pandemic, editorial accounted for 73% of all content bookings, with the remainder made up from comparison and user generated content publishers. Since the pandemic, that number has increased to 82% for sales made in the first half of this year.

Now is the time for travel brands to be thinking about 2022 holidays

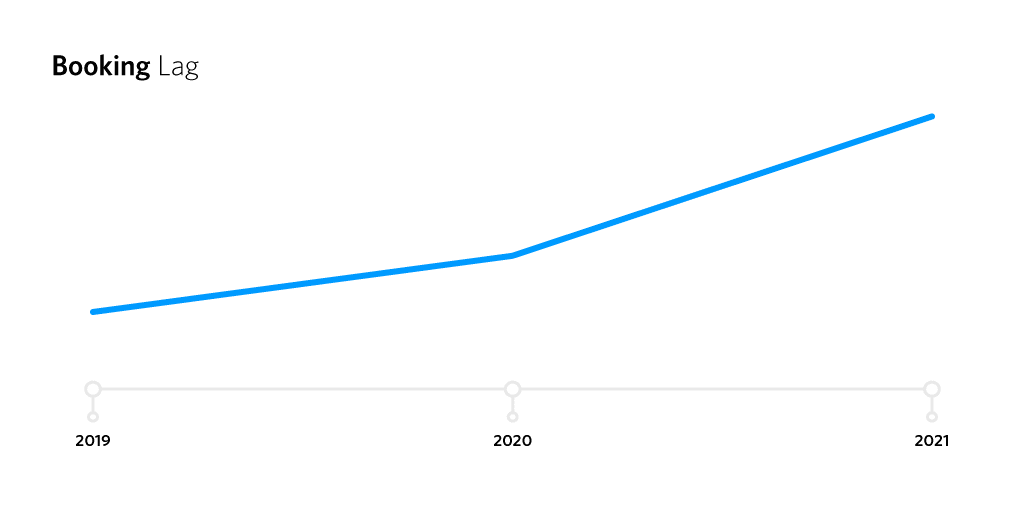

One consequence of the pandemic, and the continued uncertainty that surrounds international travel, is the extension in the days between the date of the booking and expected date of travel. Looking at one specific online travel agent (OTA) that passes additional conversion analytics data back to Awin, we can see that the average booking to travel time-lag for bookings made in the first half of this year is 243 days. That is an increase on the 154 days last year, and an even greater increase on the 118 days pre-pandemic.

Lower upfront deposits and fairer cancellation policies mean that customers can have confidence in the fact that any booked holiday can always been cancelled or moved. That was the view of Colin Carter, Director at Weather2Travel.com. Colin also echoed my prior insight that “many consumers are forgoing their summer 2021 holiday and booking well in advance”.

The UK traffic light system is confusing and is damaging customer confidence

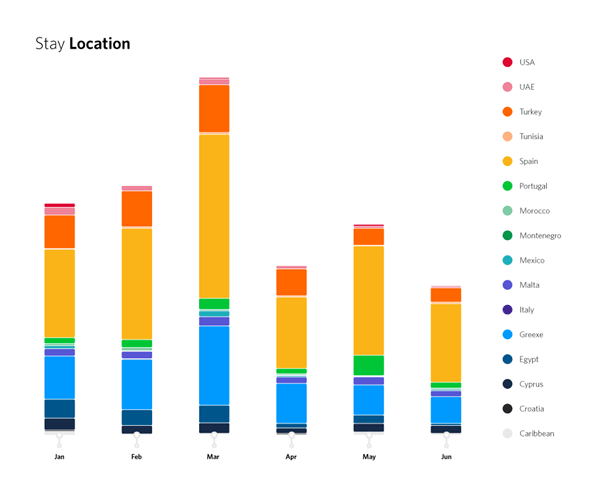

At a time where traveler confidence is so important, the UK traffic light system has already proved to be confusing and subject to change. Icelolly.com reported that the Algarve accounted for almost a third of their bookings when it was announced as the only mass market destination of the UK’s green list on 10th May. Looking at the data from an Awin client that passes stay location data as part of additional conversion analytics, we can see that mainland Spain and the Spanish Islands take the greatest share of bookings. Destinations such as Benidorm and Magaluf were all popular choices with UK travelers planning their 2022 holiday.

If you want to find out more about conversion analytics, and the benefits of passing additional data points to Awin then get in touch with your Awin account contact.

What’s next for the travel sector?

There is an increased cause for optimism. We’ve seen booking within domestic travel and leisure attractions increase as customers opt for staycations this summer. Within international travel our data shows that customers are willing to book, but are hesitant whilst travel restrictions and government guidance is changing. Those customers that are in market now are booking foreign travel further out and looking ahead to summer 2022.

The affiliate channel presents travel brands across with several opportunities to support the resurgence, with the performance model providing a risk free test bed to drive bookings:

- Content publishers can restore damaged customer confidence, making clear Covid-19 safety protocols and booking policies

- Supplier funding offers the opportunity to co-brand exposure pieces with your existing suppliers, leveraging the power of both brands to greater intensify the customer message

- Brand-to-brand affinity partnerships can reach new, and existing, customer audiences in a less crowded, but engaged marketplace

- Conversion analytics further strengthen campaigns, channel and publisher reporting capabilities, spotting and reacting to your own trends

- Agility ensures you keep pace with new demands as customer booking habits within the travel sector continue to change

For any questions on the Travel sector or trends reported in this article, please feel free to reach out directly.

Interested in hearing more insights from Awin's Client Partnerships Team? sign-up to our newsletter here.